Estate Against Without Income Proof In Dallas

Description

Form popularity

FAQ

There are several first-time homebuyer programs in Texas, including down payment assistance, tax credits and low-interest mortgages, to help Texans navigate the rising costs of purchasing their first home. To qualify, you generally need a credit score of 620 or better, and income restrictions may apply.

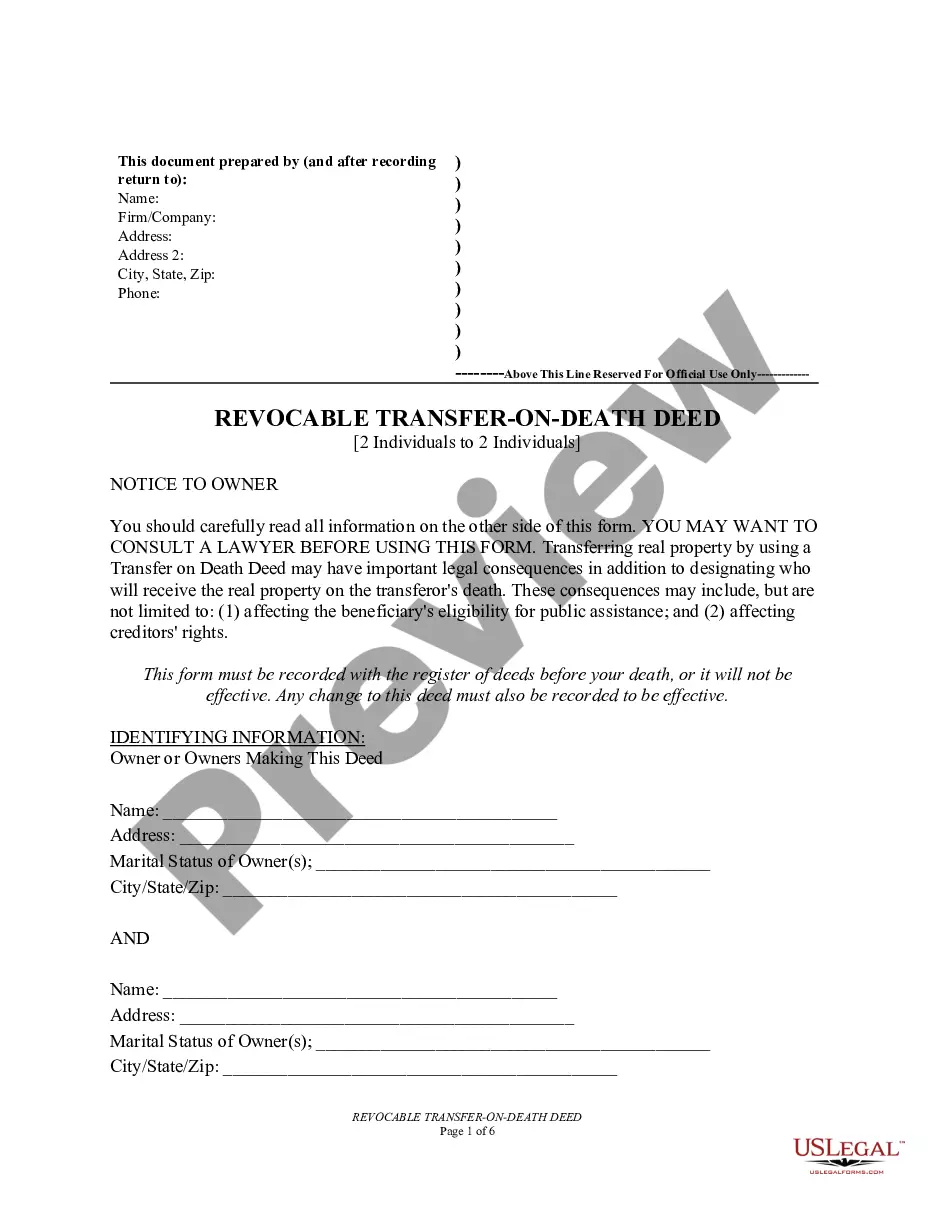

An estate may be exempt from the probate process in certain circumstances. Under Texas Estates Code, Title 2, Chapter 205, an estate need not pass through the probate process if there is no will and the total value of the estate (not counting any homestead real estate owned by the Decedent) is $75,000 or less.

Texas Probate Timeline If the estate is small or simple, the probate court can often conclude the process within six months. However, there are many cases where probate can last for a year or longer. This is especially true where the original will is contested or is missing.

The deceased person's property may sometimes pass without the need for a formal court proceeding. Not all estates need to go through probate.

No. You are not required to hire a lawyer to file a Small Estate Affidavit in Texas. Many probate courts offer downloadable forms and clear instructions for filing.

Executor's Role and Timeline for Asset Distribution. In Texas, an executor is given up to three years from their court appointment to distribute assets, excluding those allocated to creditors.

The person who wants to serve as an executor (or an administrator) must apply with the court for letters testamentary (or letters of administration). Even if the will nominates an executor, they must still apply and go through the approval process.

Probate Without an Attorney: The Muniment of Title Exception It is generally appropriate only in the simplest of small estates; for example, when the only property of an estate is a house that needs to be transferred to the sole beneficiary named in the will.

Proving Executor. The named Executor can firstly act as what is called a 'proving Executor' which means that they would take up their role as the Personal Representative, and actively deal with administering the estate of the individual who has passed away.