Claim Of Dependent In Collin

Description

Form popularity

FAQ

The child must be: (a) under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), (b) under age 24 at the end of the year, a full- time student, and younger than you (or your spouse, if filing jointly), or (c) any age if permanently and totally disabled.

Can I claim myself as a dependent? No. You can't claim yourself as a dependent on taxes. Tax dependency is applicable to your qualifying dependent children and relatives only.

As long as your child still relies on you for financial support, their employment status won't affect your ability to claim them as dependent.

Qualifying child Age: Be under age 19 or under 24 if a full-time student, or any age if permanently and totally disabled. Residency: Live with you for more than half the year, with some exceptions. Support: Get more than half their financial support from you.

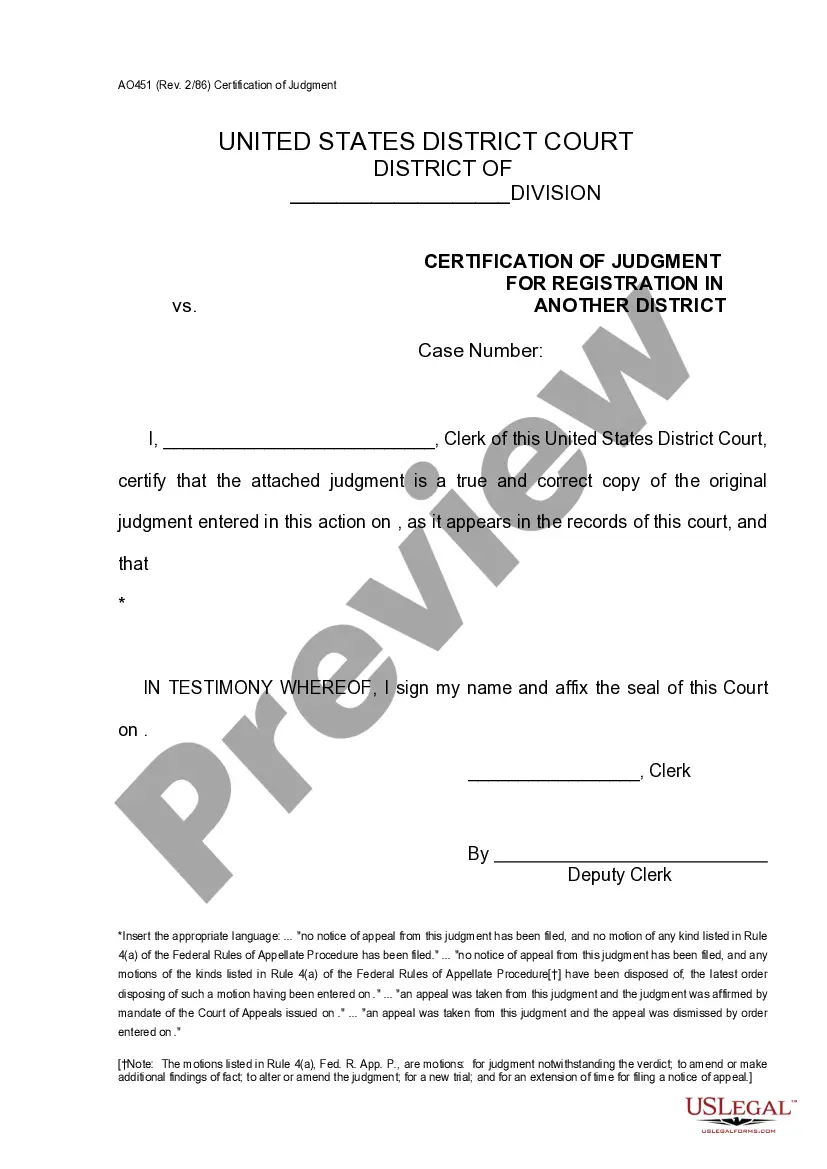

A person cannot be claimed as a dependent unless that person is a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico, for some part of the year. (There is an exception for certain adopted children.) A dependent must be either a qualifying child or qualifying relative.

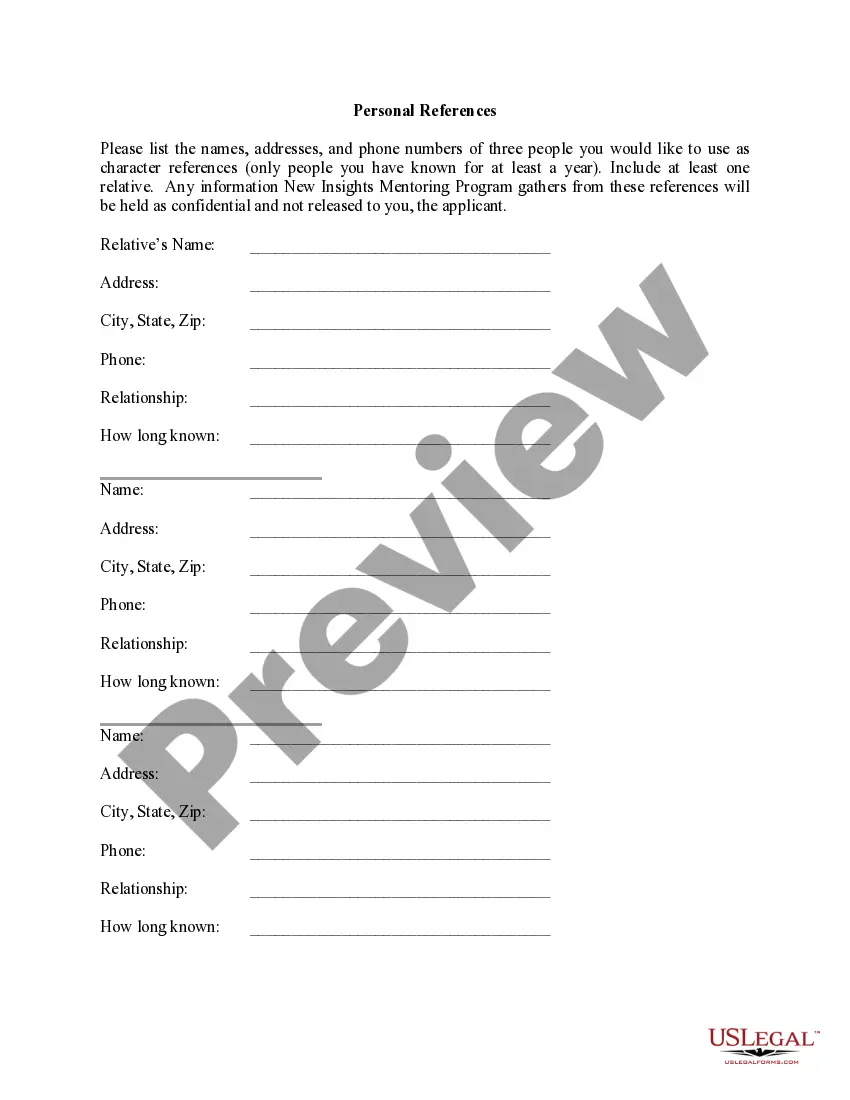

The dependent's birth certificate, and if needed, the birth and marriage certificates of any individuals, including yourself, that prove the dependent is related to you. For an adopted dependent, send an adoption decree or proof the child was lawfully placed with you or someone related to you for legal adoption.

The rule is that if someone ``can'' claim you as a dependent, you must check the box. It is not, did or will someone claim you as a dependent. There is nothing that requires your parents to claim you as a dependent if you qualify, they will just be giving up a $500 credit (potentially).

Students are expected to maintain satisfactory academic progress while enrolled at Collin College. Satisfactory Academic Progress (SAP) is defined as maintaining a 2.0 cumulative GPA. A grade of 'D' or better received at Collin or any other college is a passing grade and may not be repeated for benefits.

Transferring Collin College Credits to an Out-of-State College or University The student will need to contact the out-of-state college or university for approval. The out-of-state college or university may require a course description from the catalog year the student took the course in order to make their decision.

Changes of address affecting residency classification should be reported promptly to the Admissions Office, along with documentation of current address. Name and CollegeWide ID number (CWID) changes require photocopies of the student's Social Security card or Texas Driver's License.