Letter Settlement Estate Sample For Trust In Allegheny

Description

Form popularity

FAQ

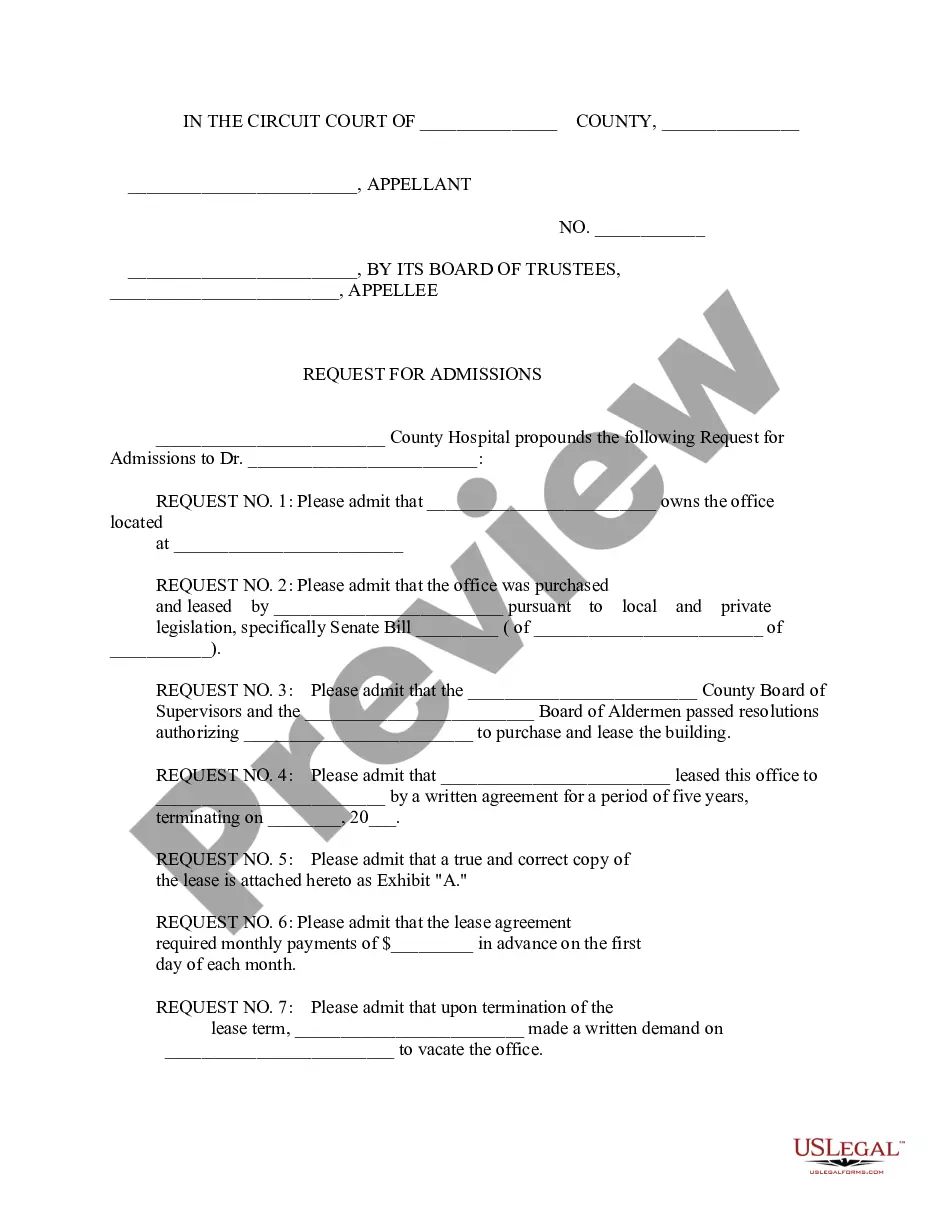

A creditor against an estate files a claim by providing the personal representative of the estate with written notice. This can be done by submitting a completed Notice of Claim form with the court register. The filing of a claim preserves the creditor's right to collect from the estate.

The Small Estates Petition must provide the Court with: (1) a list of all the decedent's personal property and the value of each item; (2) a list of all known debts of the decedent and the value of each claim; (3) the type and amount of any taxes due as a result of the decedent's death, including the Pennsylvania ...

How To Close or Settle An Estate in PA Finding The Decedent's Will. Arrange for Funeral And Burial. Filing a petition for probate with the county court. Appointment of an executor or administrator to oversee the estate. Inventorying and appraising assets, and paying off any outstanding debts or taxes.

Understanding the Deceased Estate 3-Year Rule The core premise of the 3-year rule is that if the deceased's estate is not claimed or administered within three years of their death, the state or governing body may step in and take control of the distribution and management of the assets.

Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

An estate attorney can provide advice, determine whether Administration will be required, and explain what procedures will be involved. If you choose to not consult an attorney to represent you through Estate Administration, you may file Pro Se (on one's own behalf) to be named personal representative.

Contents Make a last will. Think about a living trust. Make sure minor children are provided for. Make a living will. Make a power of attorney. Consider a life insurance policy. Make sure your beneficiary names are correct and up to date. Make sure you've addressed estate tax obligations.

Ask the County Clerk or search online for your county's probate forms. Fill out the forms with the requested details, such as the decedent's full name, address, date of birth, and date of death; their personal representatives' contact details; heirs; estate value; and more. Then return the forms to the County Clerk.

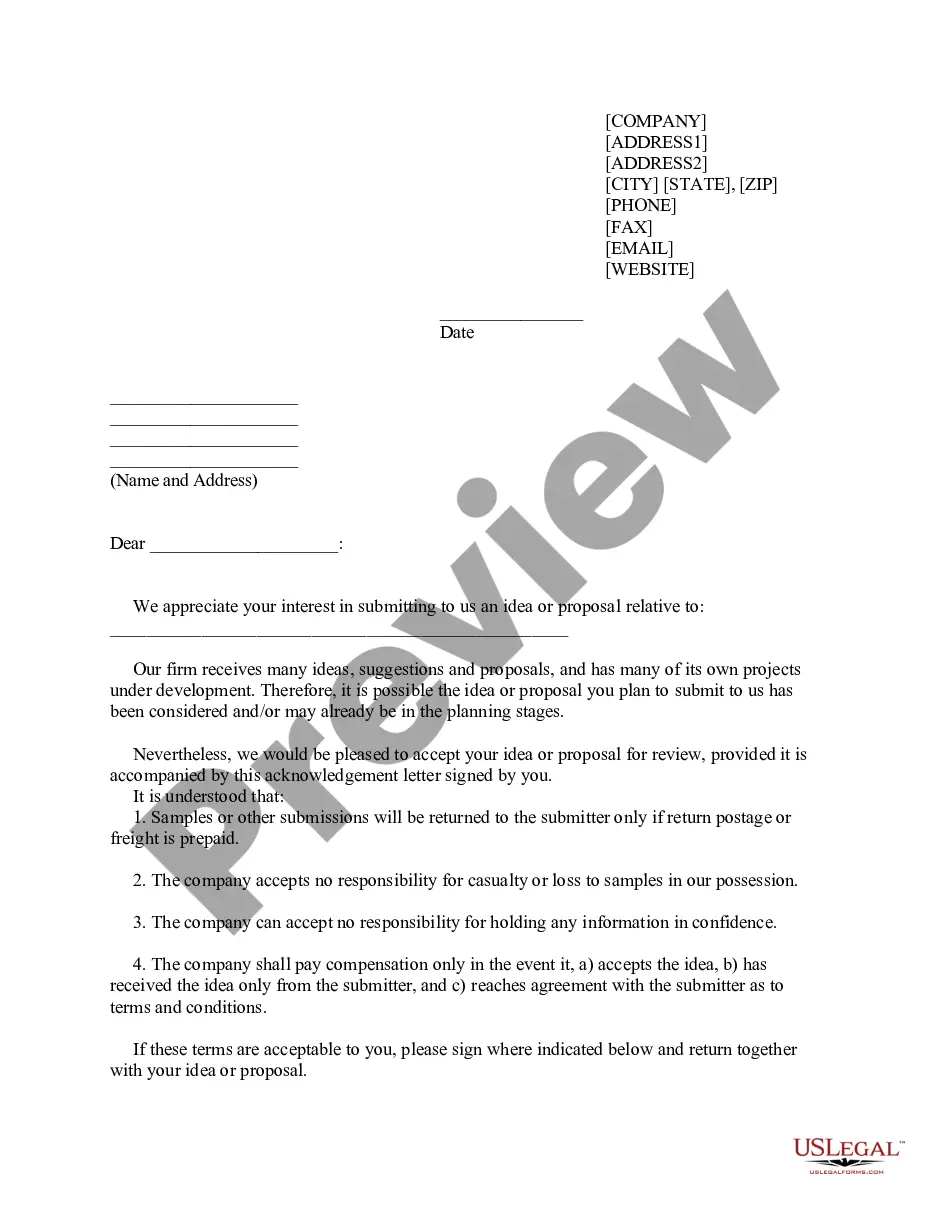

The letter includes the name of the deceased, the date of their death, and a list of assets and their respective beneficiaries. The letter also includes instructions for the distribution of assets, such as how and when the assets will be distributed to the beneficiaries.

Sample Estate Closing Letter to Beneficiaries I am writing to inform you of the finalization of Deceased's Name's estate, for which I have served as the executor. Asset Distribution: You will receive Description of Assets as part of your inheritance. These assets will be transferred to you by Transfer Date.