Agreement Satisfaction With Judgment In New York

Description

Form popularity

FAQ

It's critical to remember that judgment lien laws vary state by state. States with more robust exemptions protect more of your property from judgment creditors. For instance, New York law grants you a motor vehicle exemption of $4,550. This means a creditor cannot touch that amount of your vehicle's equity.

Comments Section Satisfied judgments make it easier to get loans. They still hurt your credit score under the FICO formulas used for home loans, car loans, and credit card applications.

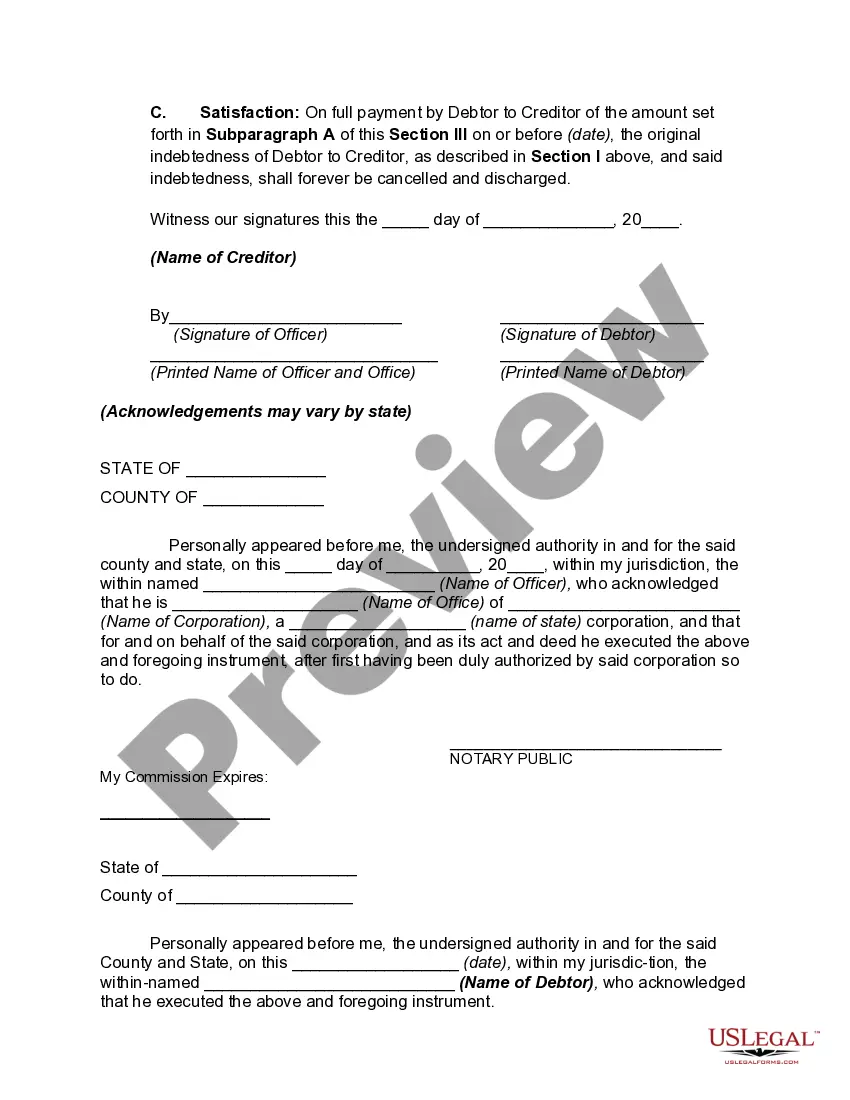

Step-by-Step Instructions Complete the Form. Instructions for completing an Acknowledgment of Satisfaction of Judgment (EJ-100) are available at the end of this Guide. Make Copies. Notarize Your Forms. Have your Acknowledgement Served. File the Acknowledgement in Court.

Communicate Openly: If appropriate, have a candid conversation about their judgment. Share your thoughts and feelings honestly but respectfully. Provide Context: Sometimes, judgments stem from misunderstandings. Offering more context about your actions or decisions can help clarify misconceptions.

Here are five tips you may consider following to improve your judgement abilities: Take your time. Allow yourself time to consider your options. Explore alternatives. Consider all of your options before making a decision. Create rules for yourself. Think logically. Talk to someone.

You should contact an enforcement officer in the county where the judgment debtor has property. If you do not know where the judgment debtor has property, then contact an enforcement officer in the county where the judgment debtor resides.

CCJ stands for county court judgement and you can only get one if the lender takes you to court.

How to Write a Letter of Customer Satisfaction? Step 1: Start with a Personalized Greeting. Step 2: Express Your Appreciation. Step 3: Explain the Purpose of the Letter. Step 4: Share Specific Details of the Customer's Experience. Step 5: Address Any Issues or Concerns. Step 6: Offer Solutions or Compensation.

Letter of Satisfaction means a letter signed by the Purchaser confirming that the Purchaser is satisfied with the condition of the Section, as contemplated in 5.2.6; Sample 1Sample 2.