Anthem Claim Dispute Form For Reimbursement In Middlesex

Description

Form popularity

FAQ

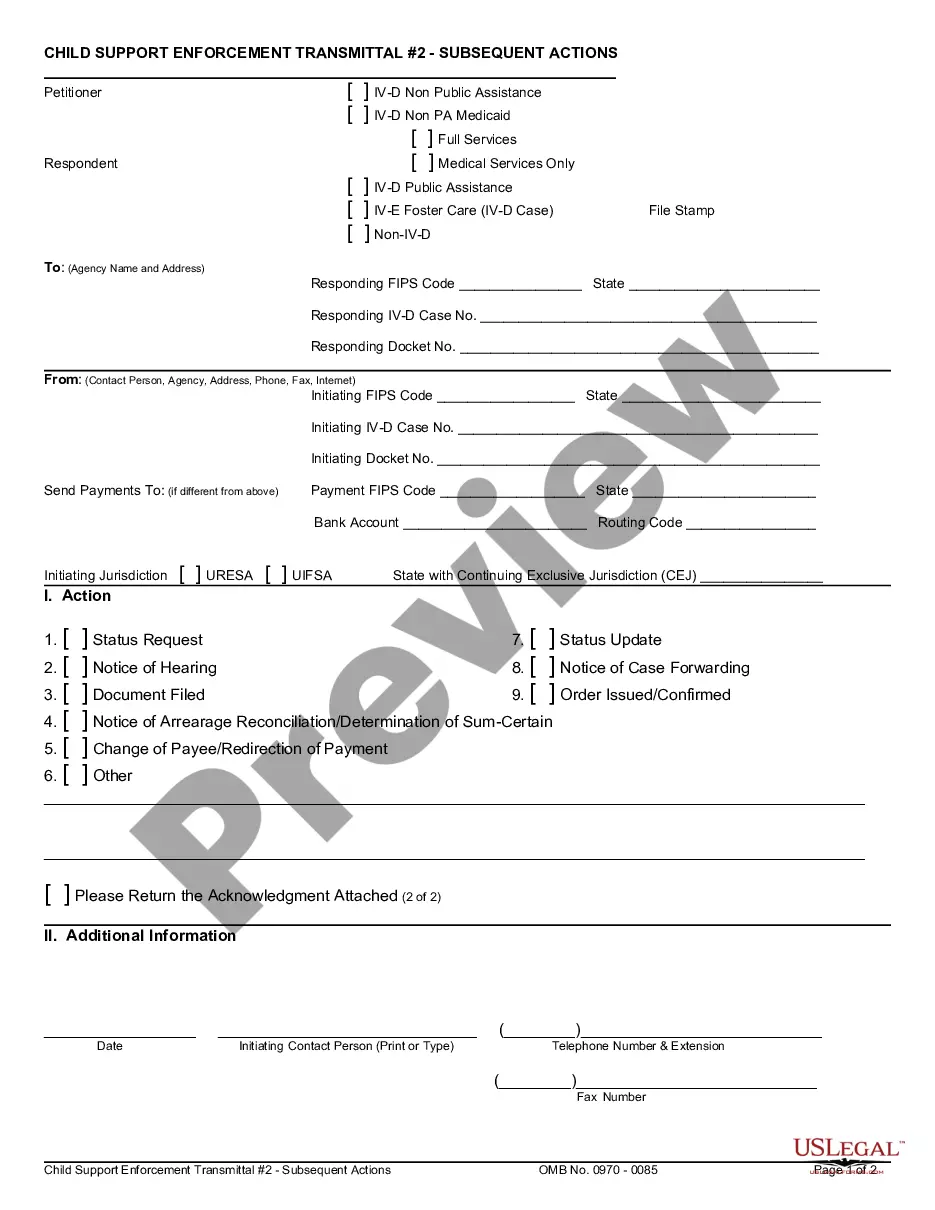

Submit a separate claim for each patient. Complete the form following the instructions on the back. (You can fill the form in electronically or complete it by hand.) Print and mail the form to your local Blue Cross and Blue Shield company by December 31 of the year following the year you received service.

Claims processing is the tracking, documenting, and paying of claims. It is an important part of the insurance process, though not all insurers offer claims processing services. In many cases, the insured party is responsible for the claims process.

How To Submit An Anthem Claim Yourself. Typically, your doctor or provider, especially if they're in your plan, will submit the claim for you. In some cases when you visit a doctor outside your plan, you may have to do this yourself. You can access claim forms in our Forms Library.

The corrected claim must be received within the timely filing limit due to the initial claim not being considered a clean claim. For participating and nonparticipating providers, Anthem follows the standard of 60 days from the date of payment (Explanation of Payment/Remittance Advice).

Services provided by Anthem HealthChoice HMO, Inc., and/or Anthem HealthChoice Assurance, Inc., Independent licensees of the Blue Cross Blue Shield Association, an association of independent Blue Cross and Blue Shield plans, serving residents and businesses in the 28 eastern and southeastern counties of New York State.

-Timely filing is within 180 days of the date of service or per the terms of the provider agreement. Out-of-state and emergency transportation providers have 365 days from the last date of service.

Anthem will consider reimbursement for the initial claim, when received and accepted within timely filing requirements, in compliance with federal, and/or state mandates. Anthem follows the standard of: • 90 days for participating providers and facilities. 15 months for nonparticipating providers and facilities.

Timely filing is when an insurance company put a time limit on claim submission. For example, if a insurance company has a 90-day timely filing limit that means you need to submit a claim within 90 days of the date of service.

180-day timely filing limit.

How to Find Timely Filing Limits With Insurance Insurance CompanyTimely Filing Limit (From the date of service) Anthem BCBS Ohio, Kentucky, Indiana, Wisconsin 90 Days Wellmark BCBS Iowa and South Dakota 180 Days BCBS Alabama 2 Years BCBS Arkansas 180 Days28 more rows