Dispute Claim Form For Equifax In Bexar

Description

Form popularity

FAQ

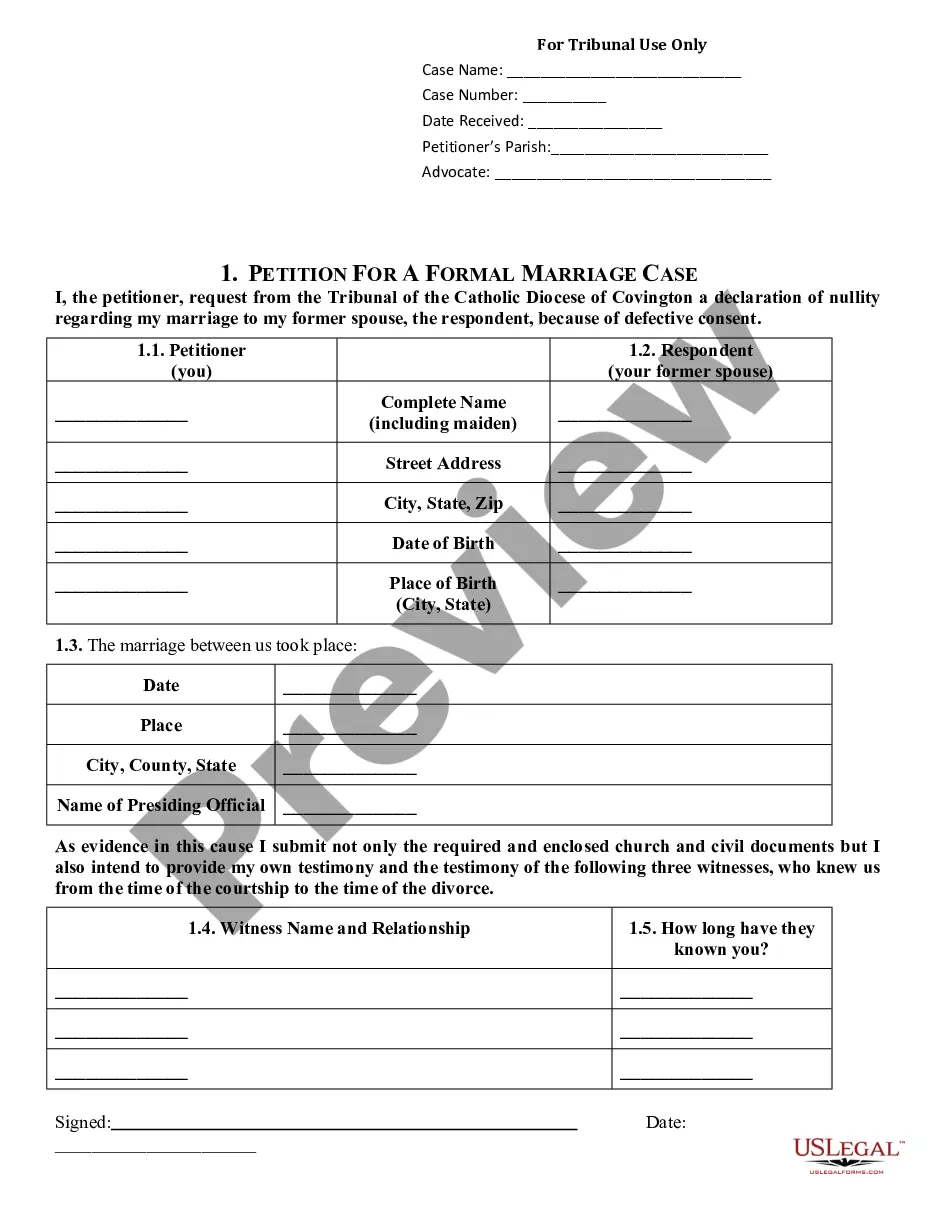

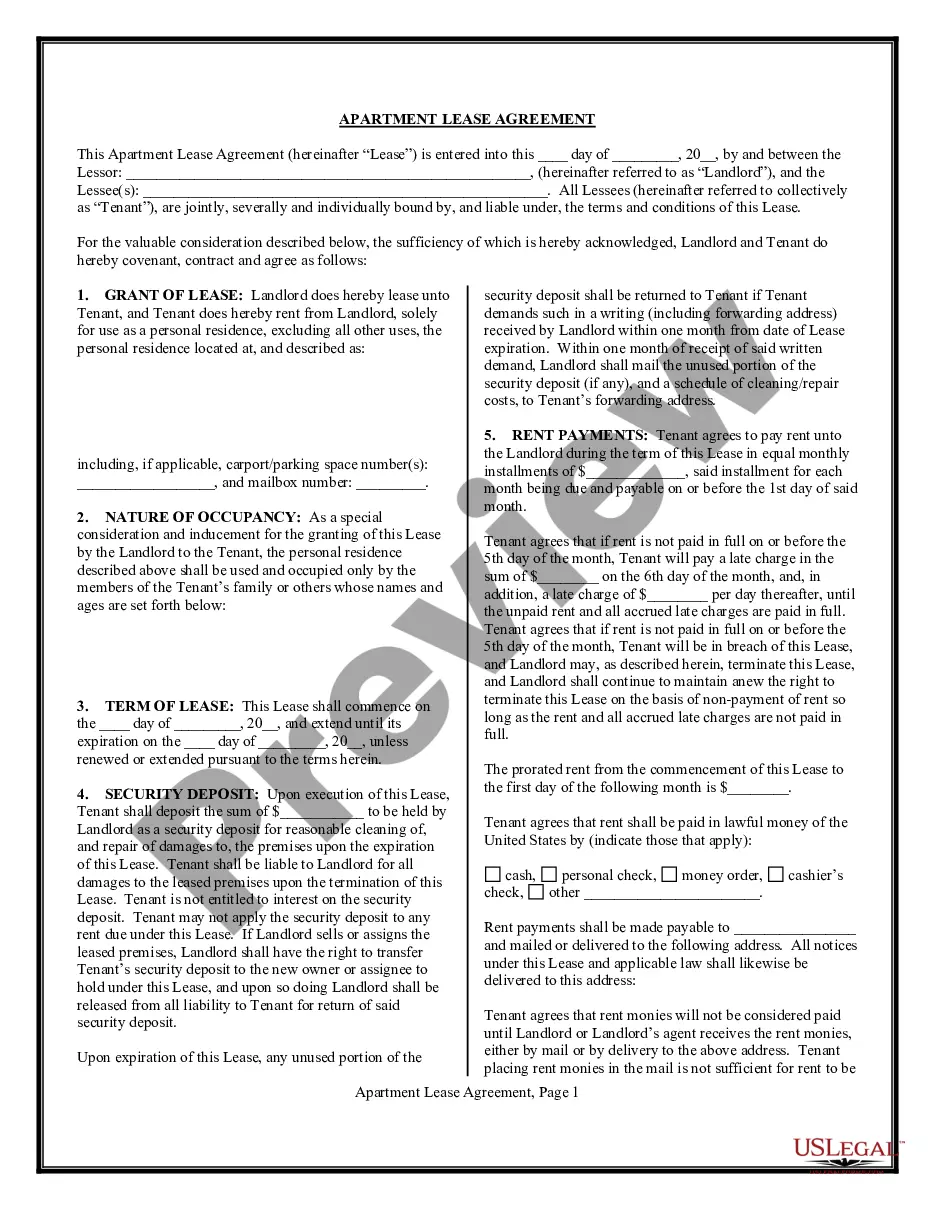

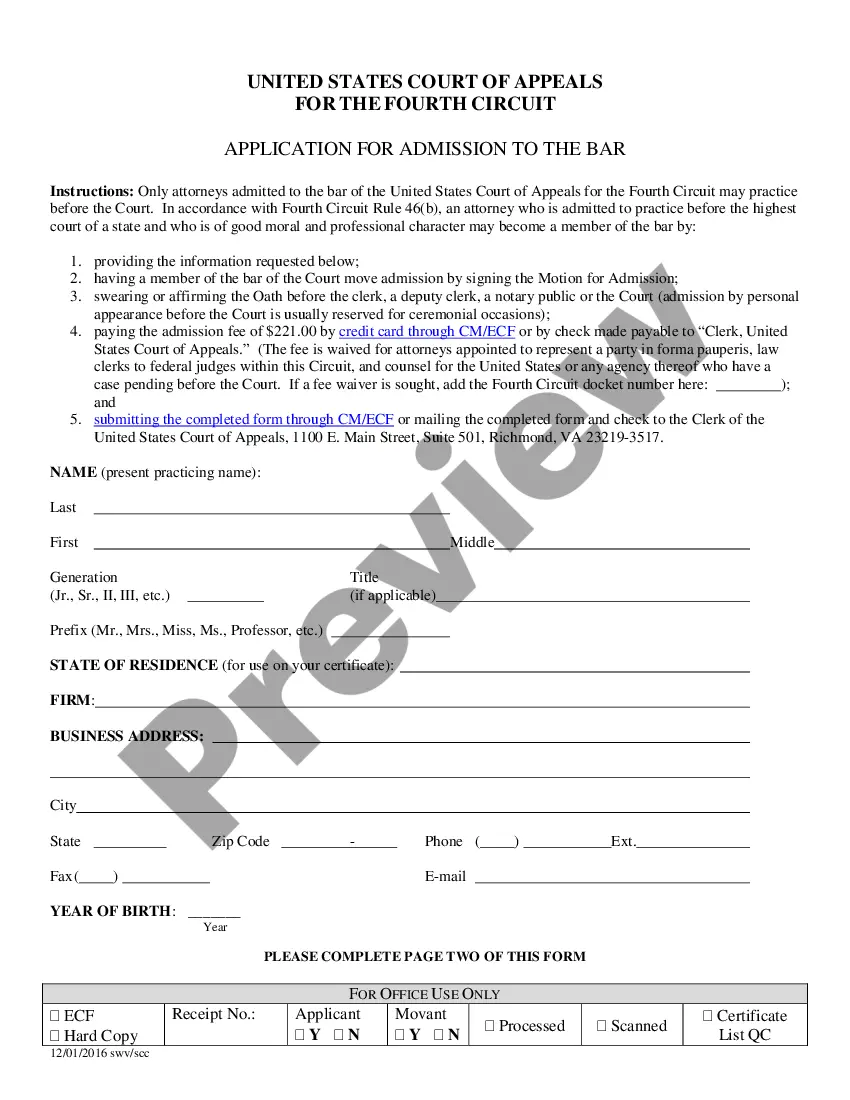

You have two options to submit your dispute documents. You can receive the form by email, complete it electronically and email all of your documentation to us. Or, you can print and mail in your completed dispute form and include copies of the required documents.

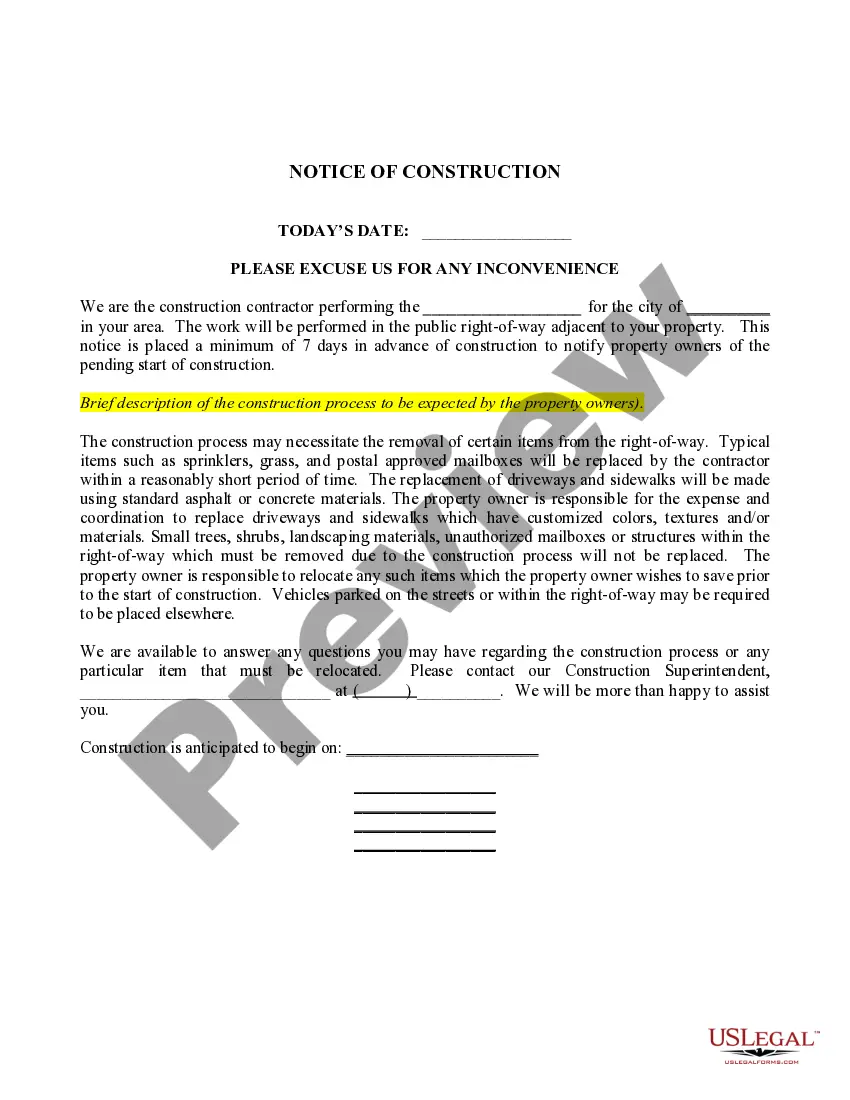

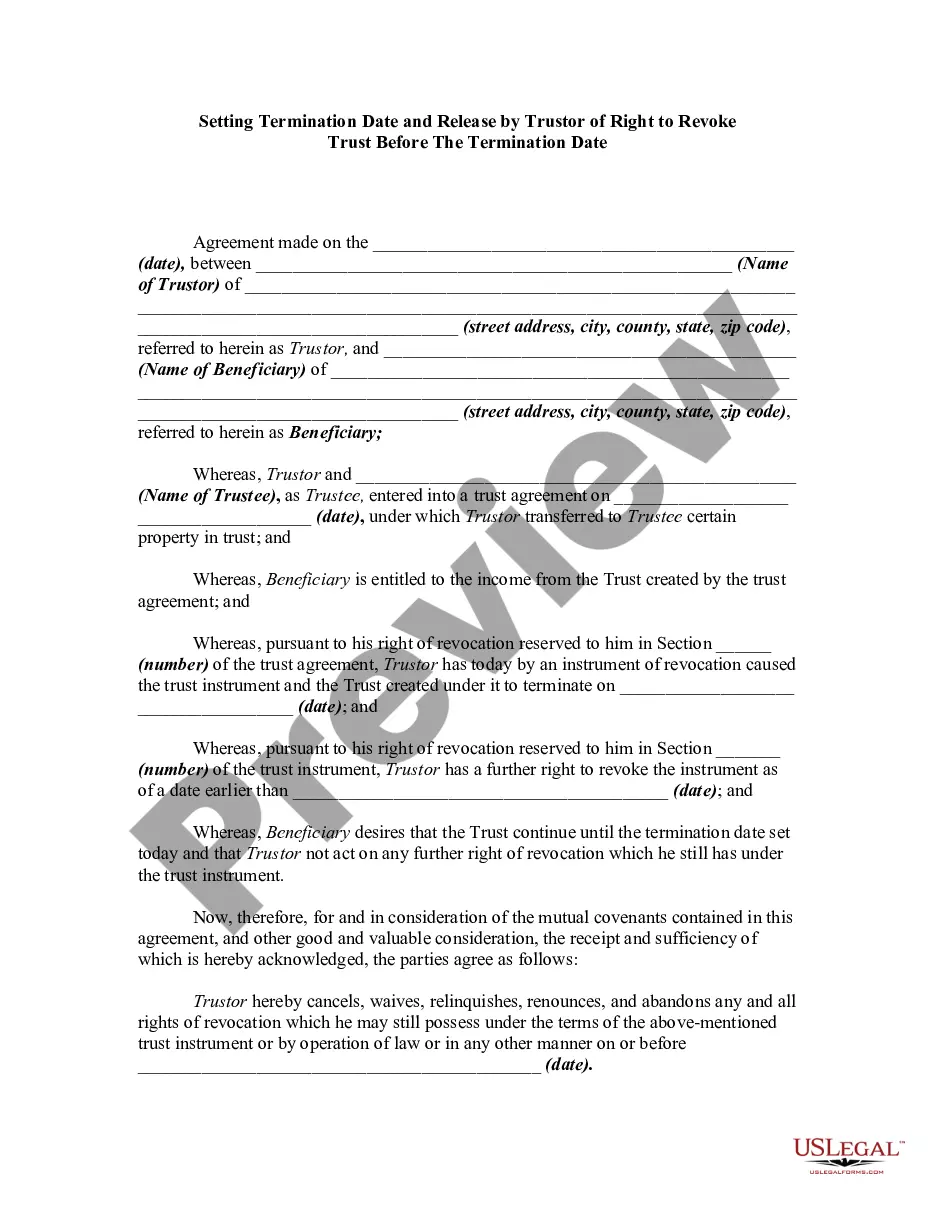

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

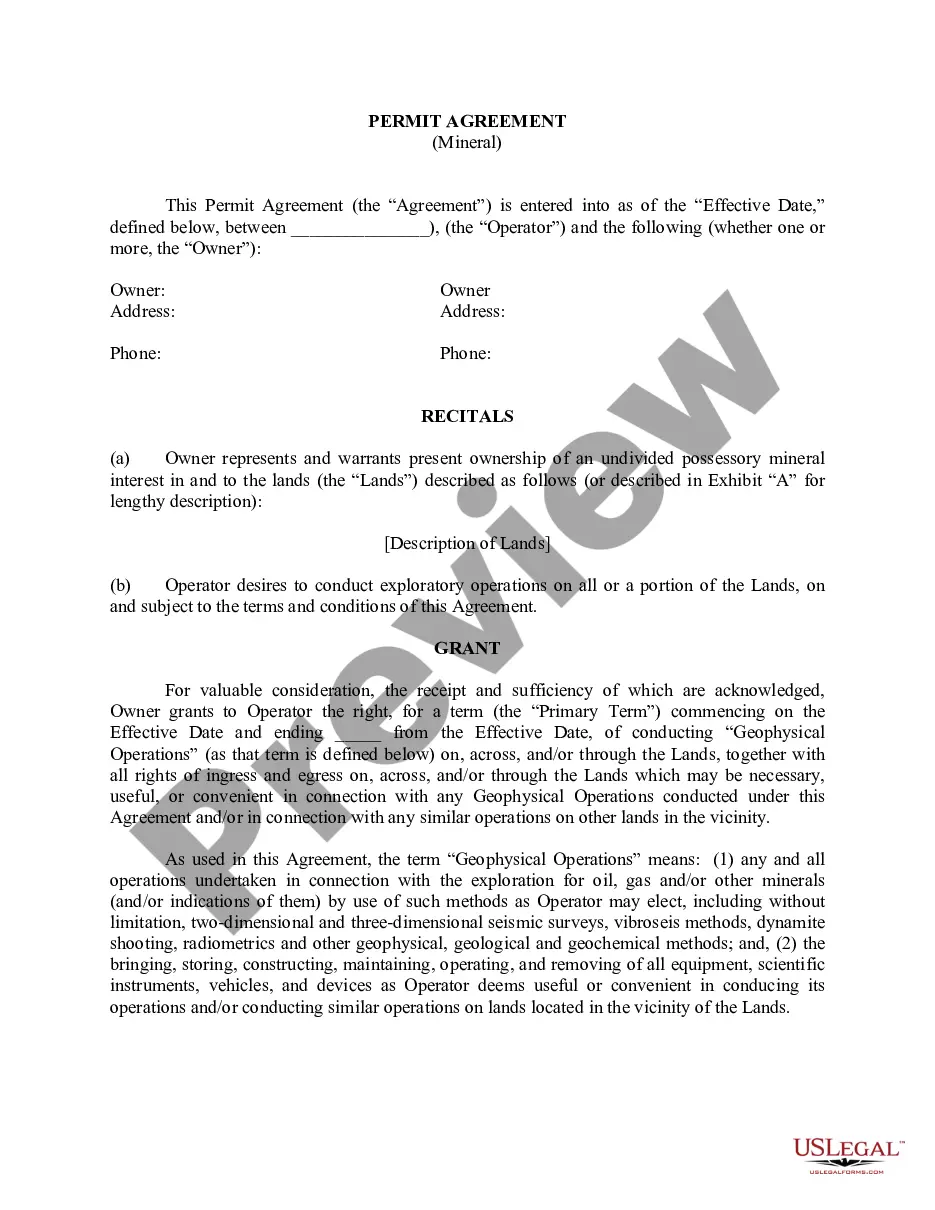

You can also call or write the credit bureaus. Most credit experts will recommend writing the bureaus directly, so you can tell your side of the story and provide documented evidence, especially if you have a unique issue or complicated case to plead.

Alternatively, you can write to us at Equifax Limited, PO Box 10036, Leicester, LE3 4FS. Please include your name, address, case number, and credit report reference number (if applicable). We ask that you don't send us original documents as they may not be returned.

If you discover errors on your credit report, gather any supporting documents and include them with a letter disputing the error. Then send it to: The credit reporting agency whose report you are disputing. The company that provided the incorrect information.

You have two options to submit your dispute documents. You can receive the form by email, complete it electronically and email all of your documentation to us. Or, you can print and mail in your completed dispute form and include copies of the required documents.

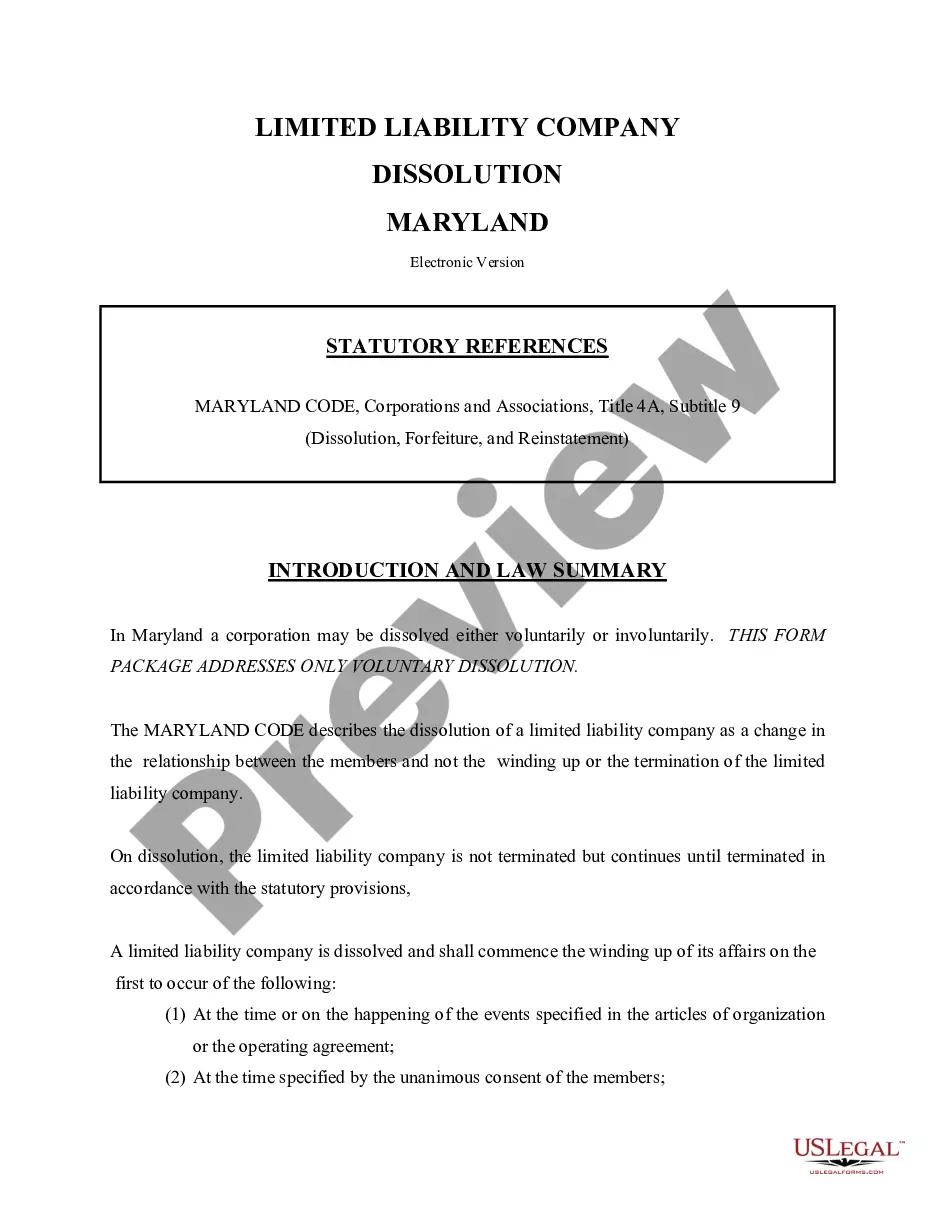

2) What is the 609 loophole? The “609 loophole” is a misconception. Section 609 of the Fair Credit Reporting Act (FCRA) allows consumers to request their credit file information. It does not guarantee the removal of negative items but requires credit bureaus to verify the accuracy of disputed information.

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, you have two options: Receive a dispute form by email and submit it online. Download and print a dispute form and mail it, with copies of all required documents, to this address:

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.