Anthem Claim Dispute Form With Two Points In Allegheny

Description

Form popularity

FAQ

Since Anthem licenses with Blue Cross Blue Shield, it only offers its own health insurance brands in certain states, including California, New York, and a dozen more. If you don't live in a state with Anthem health insurance, you may want to search for your own regional Blue Cross Blue Shield regional company.

The organization is now headquartered in Oakland, California, with over 4.8 million members. While focusing primarily on individuals, families and businesses within the state. Blue Shield is part of a broader network of Blue Cross Blue Shield (BCBS) companies operating nationwide.

Anthem and Blue Cross Blue Shield are related, but they are not the same company. While they are both top health insurance providers in the USA, the big difference is that Blue Cross Blue Shield is the umbrella that is made up of several independent companies, and one of these smaller companies is Anthem.

Blue Shield sold Care1st Arizona to WellCare in 2017. Care1st California was renamed Blue Shield of California Promise Health Plan in 2019.

Is Anthem the same as Blue Cross Blue Shield? Anthem is part of the Blue Cross Blue Shield group. Blue Cross Blue Shield is made up of independent companies. Anthem is one of these companies.

Yes! Blue Shield is a California-based national carrier with nationwide coverage for 100% of U.S. zip codes.

The appeal must be received by Anthem Blue Cross (Anthem) within 365 days from the date on the notice of the letter advising of the action.

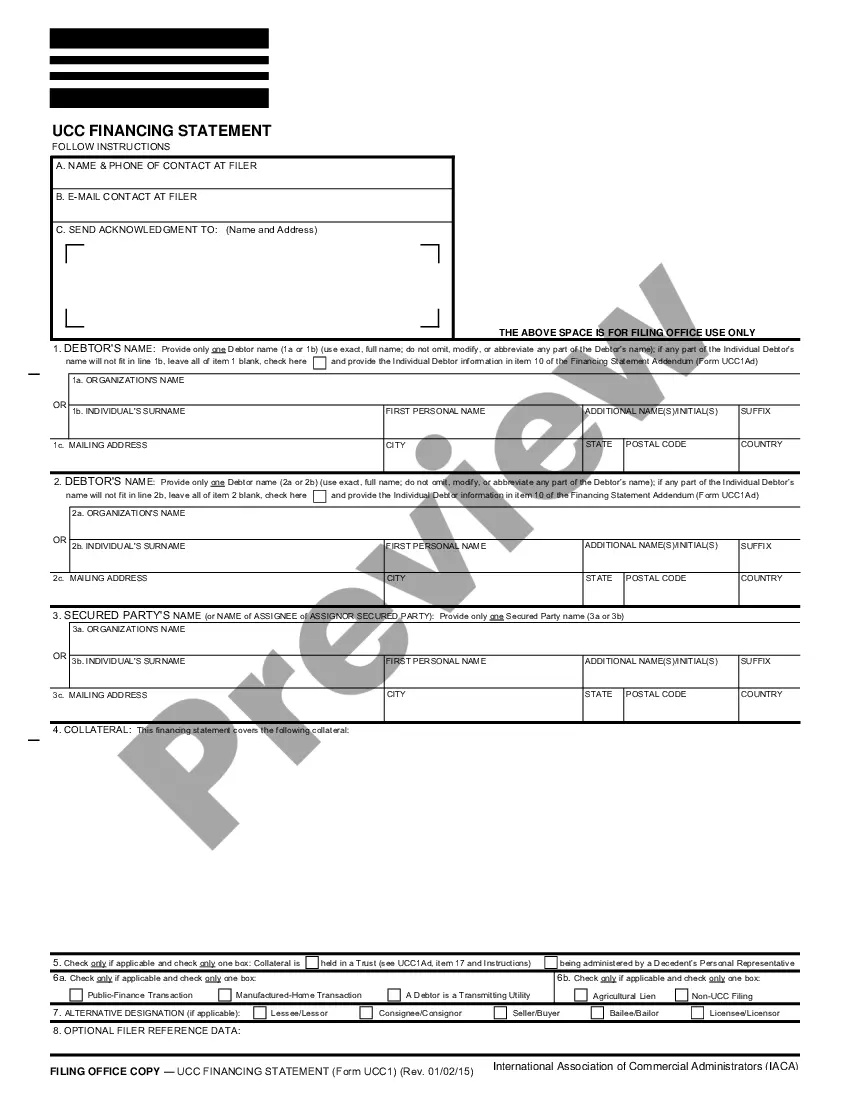

When complete, please mail to: Attn: Grievance and Appeals Department, Anthem Blue Cross, P.O. Box 60007, Los Angeles, CA 90060-0007. For claim disputes, please use the Provider Dispute Resolution form. This information is part of the permanent record. Write clearly and legibly.

To use the Appeals application, the Availity administrator must assign the Claim Status role for the user. The Disputes and Appeals functionality will support Appeals, Reconsiderations and Rework requests for providers. The Disputes and Appeals functionality is accessible from the Claim Status transaction.

Common Reasons Anthem Gives for Insurance Denials Reasons for Anthem insurance claims denials include: The filing deadline has expired. The insured mad a late payment to COBRA. The medical device or treatment sought is not medically necessary.