State Tax On Estate In Hillsborough

Category:

State:

Multi-State

County:

Hillsborough

Control #:

US-0042LTR

Format:

Word;

Rich Text

Instant download

Description

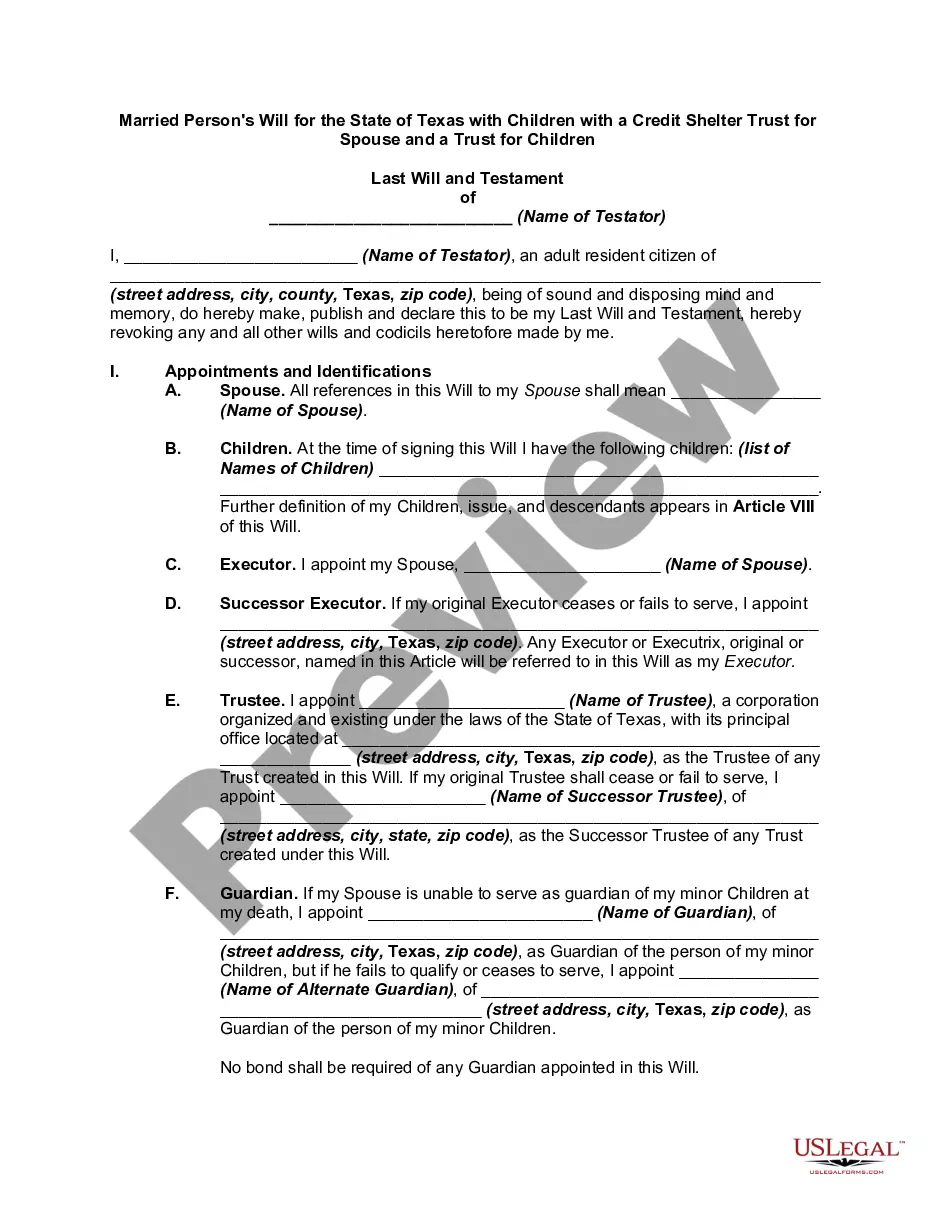

The document outlines a request for information regarding the state tax on estates in Hillsborough. It serves as a model letter for use by legal professionals such as attorneys, partners, and paralegals, aimed at obtaining vital information about the vehicles owned by a decedent. The letter requests copies of vehicle titles and a listing of any title transfers related to the decedent's name. It is designed to be adapted to fit specific facts and circumstances of each case. Key features include clarity in communication, formal request structure, and the inclusion of essential information such as VINs for the vehicles in question. The form emphasizes the importance of thorough documentation for the administrator of the estate to ensure all assets are accounted for in the process of settling the estate. It highlights the need for accuracy and completeness, making it a crucial tool for any legal professional handling estate matters for their clients. The instructions also recommend attaching relevant documents, such as the Letter of Administration, to provide context to the state tax commission. This form is particularly useful for legal assistants who compile information and for attorneys who represent estate administrators in Hillsborough.

Free preview