Proof Of Residency Without Mail In Minnesota

Description

Form popularity

FAQ

The 183-day rule does not apply to military members or their spouses, unlike civilian nonresidents. Minnesota Residents. If you are a resident of Minnesota for the entire year and are required to file a federal income tax return, you must also file Minnesota Form M1, Individual Income Tax Return.

You spend at least 183 days in Minnesota during the year (any part of a day counts as a full day) You or your spouse rent, own, maintain, or occupy a residence in Minnesota suitable for year-round use and equipped with its own cooking and bathing facilities.

First-Time Minnesota ID Card Certified Birth Certificate. U.S. Passport. Foreign Passport with proof of legal entry (I-94, I-551) Permanent Resident Card. Employment Authorization Card. Certificate of Naturalization.

The first test is the 183-day rule. If you're present in Minnesota for more than 183 days over the course of a year and maintain a living place—an abode—which is a place with living quarters, sleeping quarters, and cooking facilities, you're going to be considered a Minnesota resident.

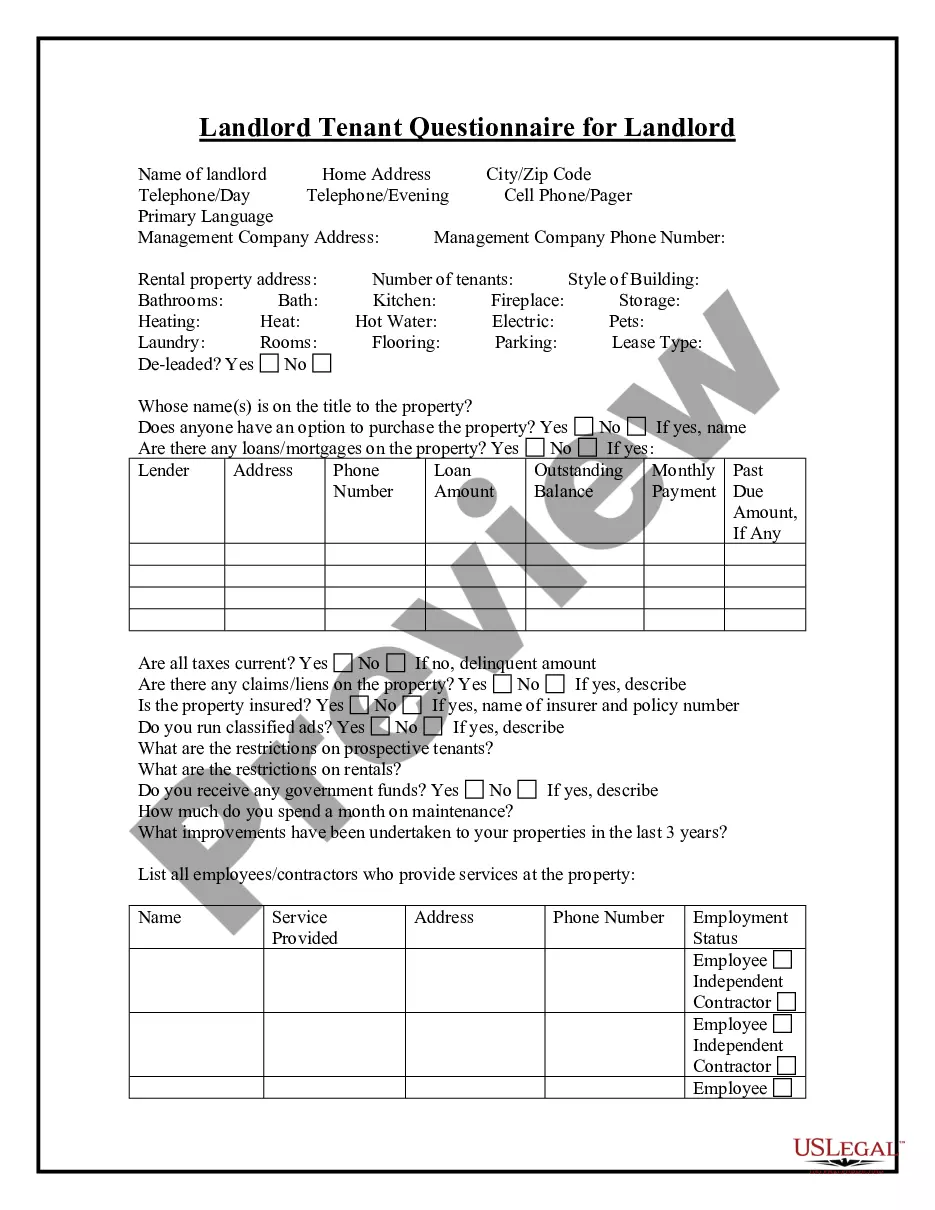

Proof of current residency in Minnesota: Proof of current residency in Minnesota: Must have owner's name and current address in Minnesota. • Valid, unexpired Minnesota driver's license or instruction permit. ( ... listed). • ... than 3 months from date of renewal). o Bank Account Statement. employer's name and address.

Minnesotans can now apply for a driver's license no matter their immigration status, thanks to a new law that went into effect on October 1, 2023. The Driver's Licenses for All law means that more than 80,000 Minnesotans can now apply for a license.

Subdivision 1. (c) An order under this subdivision is sufficient authority for the peace officer or probation officer to detain the person for no more than 72 hours, excluding Saturdays, Sundays, and holidays, pending a hearing before the court or the commissioner.

If you were present in the U.S. for 183 days or more in the current year, you automatically meet the test. You are a U.S. resident for U.S. income tax purposes. If you were present for more than 30 days but less than 183 days, you need to go to step 2 to determine whether you meet the test.

(33) The term “residence” means the place of general abode; the place of general abode of a person means his principal, actual dwelling place in fact, without regard to intent.

You spend at least 183 days in Minnesota during the year (any part of a day counts as a full day)