Basic Bill Of Sale For Rv In Arizona

Description

Form popularity

FAQ

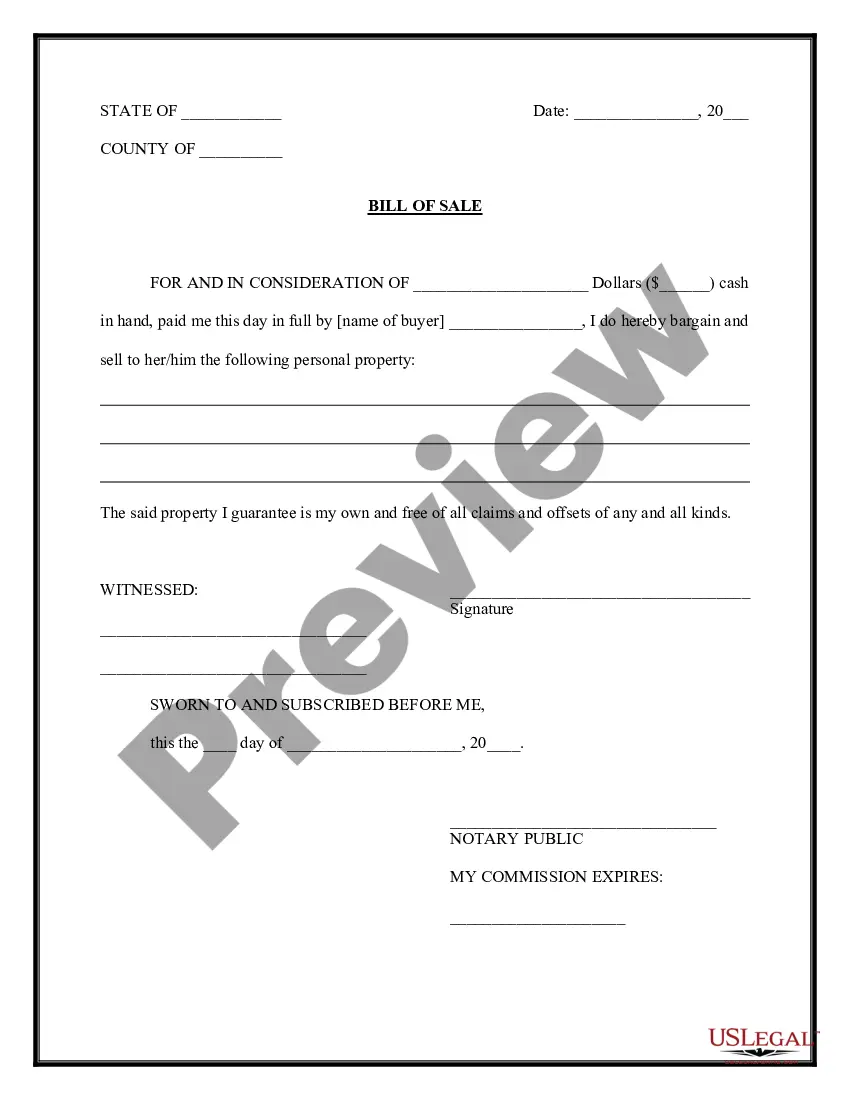

The bill of sale is crucial as it provides formal proof of the vehicle transaction, protects both parties against fraud, and ensures compliance with Arizona state regulations during the title transfer process.

Selling Your Vehicle complete a sold notice on AZ MVD Now. sign off the back of the title. remove the license plate from the vehicle and contact MVD to transfer it to another vehicle you own, or destroy it. give the title to the buyer with any lien release, if applicable. within 30 days request a registration credit.

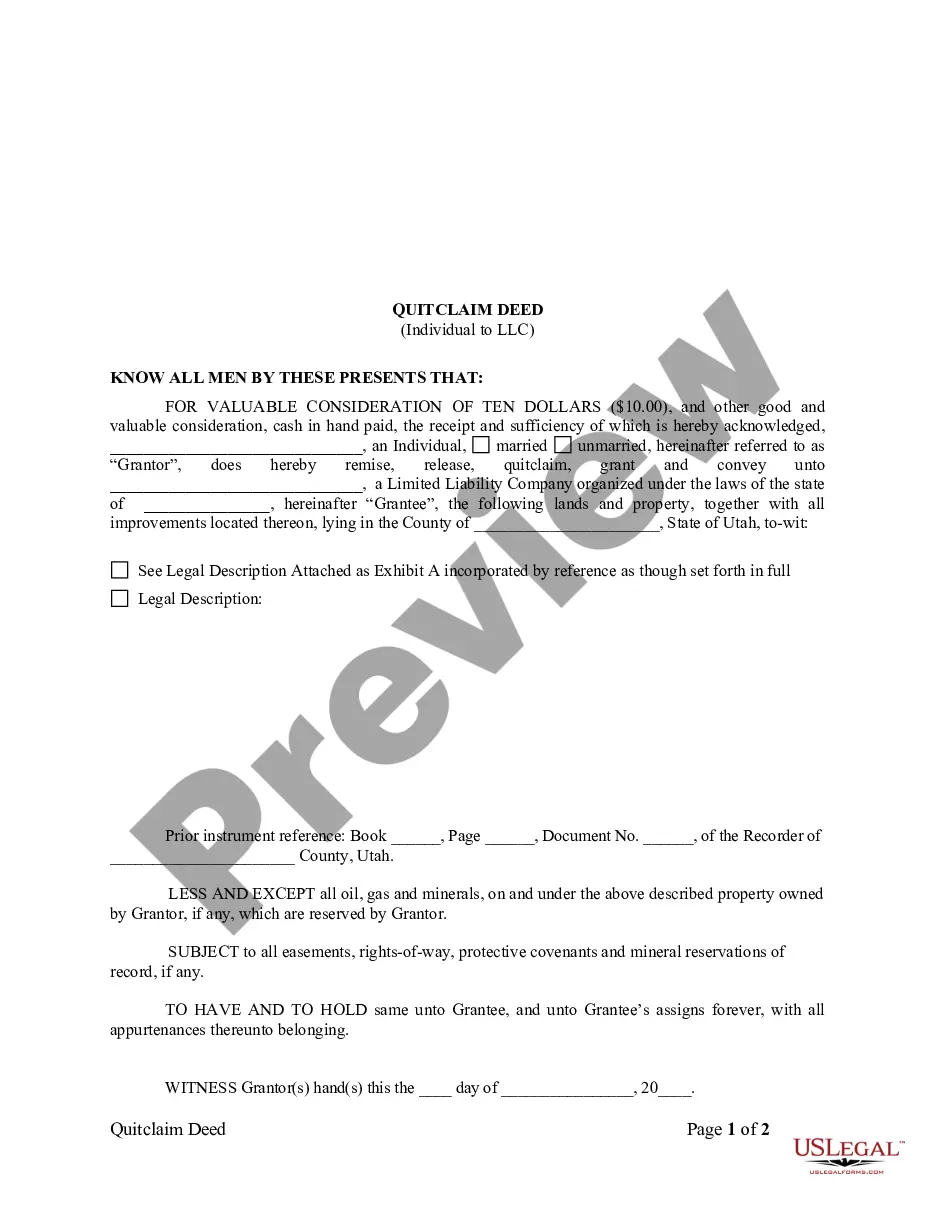

In most cases, a notary public isn't required for an Arizona bill of sale. However, for certain high-value transactions or when dealing with certain types of property, the presence of a notary might be prudent to ensure the protection of all parties.

Arizona sales tax overview The Arizona (AZ) state sales tax rate is currently 5.6%.

In summary, while a standard Arizona bill of sale for personal property does not require notarization, the title for a motor vehicle sale must be notarized by both parties. It's also a good practice to notarize the bill of sale for added legal protection, even if not strictly required by Arizona law.

Depending on what you are buying or selling, you might need to have your bill of sale notarized in Arizona. For example, notarization is required for a motor vehicle but not for a boat or gun bill of sale.

Every state commissions notaries; however, every state allows notaries to perform different functions. In Arizona, notaries can perform only acknowledgments, jurats, copy certifications, and oaths and affirmations.

In Arizona, the title no longer requires a notary or MVD Agent to witness the seller signature as of October 2022. However, If you are selling to an out-of-state buyer, we recommend you come in so we can notarize the title to prevent problems in a different state.