Note With Balloons In Utah

Category:

State:

Multi-State

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

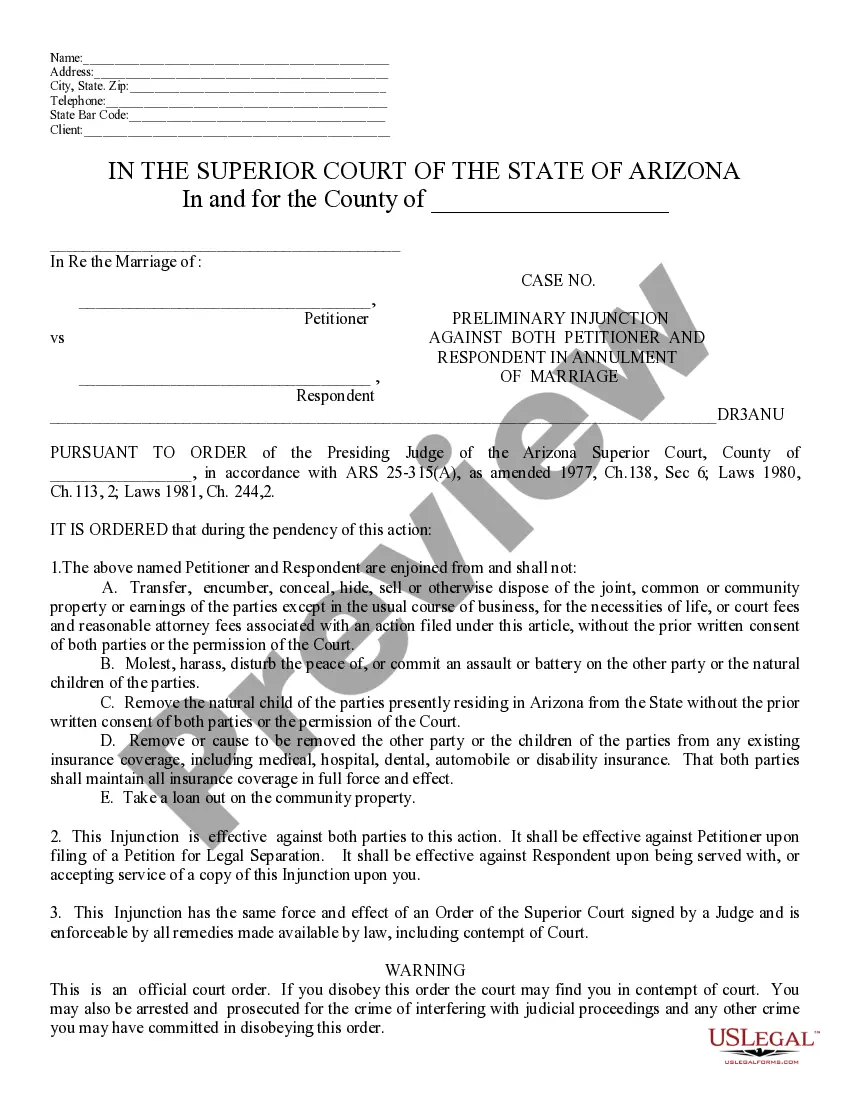

Description

The Promissory Note known as a Balloon Note in Utah is designed for borrowers to affirm their obligation to repay a specified loan amount to the lender. This form details essential loan terms, including the principal amount, interest rate, monthly installment amounts, and the final balloon payment due at the end of the loan term. It allows for prepayment of the principal with certain penalties in the first year, providing both flexibility and potential cost considerations for borrowers. The form also outlines the consequences of default, including potential legal fees and collection actions. For attorneys, partners, owners, associates, paralegals, and legal assistants, this form serves as a crucial tool for drafting loan agreements that comply with state laws. It requires careful attention to detail, particularly in filling out financial terms and the rights of parties involved. Understanding this document can help legal professionals guide clients in managing loan repayments effectively and ensure that all legal requirements are met, maintaining compliance with applicable usury laws. Additionally, the form supports various use cases, including personal loans, business loans, and real estate financing, thereby catering to a wide range of financial scenarios pertinent to their clients.

Free preview