Balloon Note Example In Miami-Dade

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

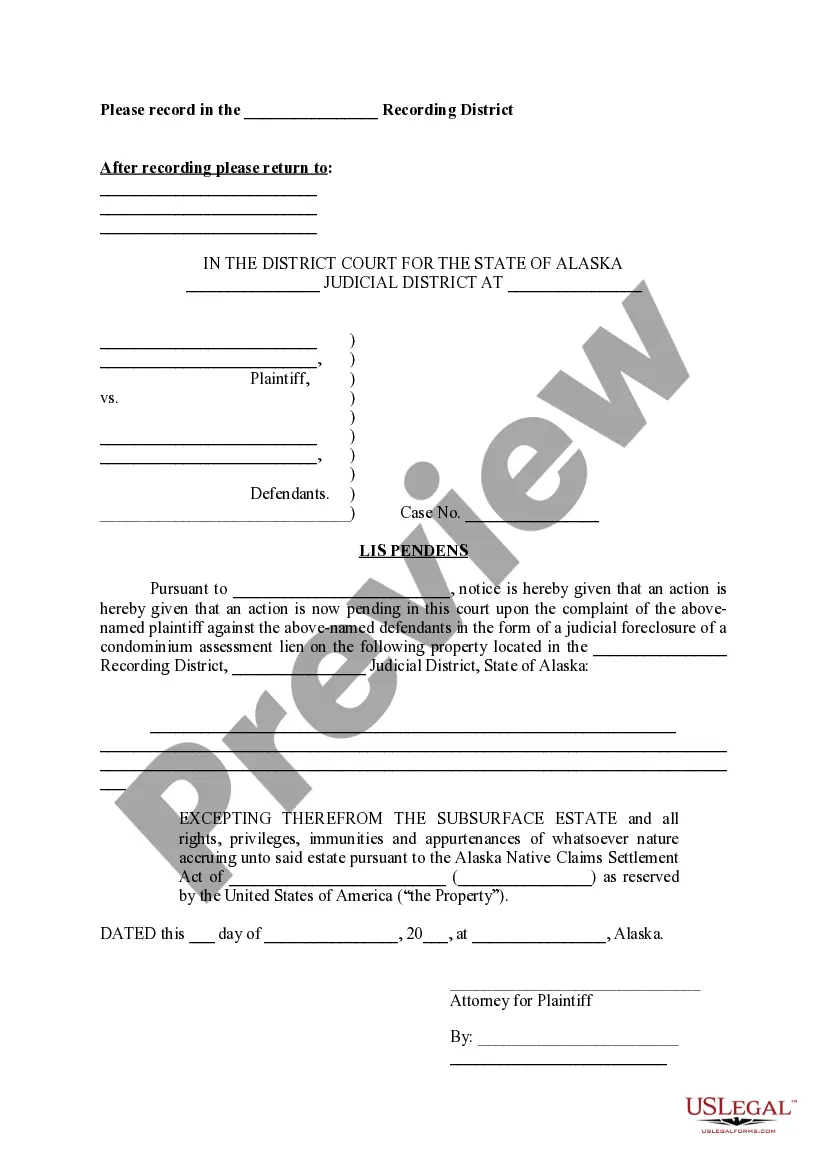

The Balloon Note example in Miami-Dade is a legal instrument that outlines a borrower's promise to repay a specific sum to a lender, with terms that include regular monthly installments followed by a larger final payment, known as a balloon payment. This document is designed to be clear and user-friendly, providing spaces for necessary details such as loan amount, interest rates, and payment schedules. Users should carefully fill in the blanks regarding personal and financial information, including any agreed-upon terms like prepayment penalties. The utility of this form is significant for a wide audience, including attorneys, partners, owners, associates, paralegals, and legal assistants, as it simplifies the process of securing loans while ensuring compliance with relevant laws. Each party involved must understand the potential implications of default and collection fees that could arise. Additionally, the Balloon Note also emphasizes the importance of adhering to usury laws, protecting both the lender and borrower. Efforts to complete and manage this form effectively contribute to smooth transactions and clear communication between all parties.

Free preview