Promissory Note Procedure In Harris

Category:

State:

Multi-State

County:

Harris

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

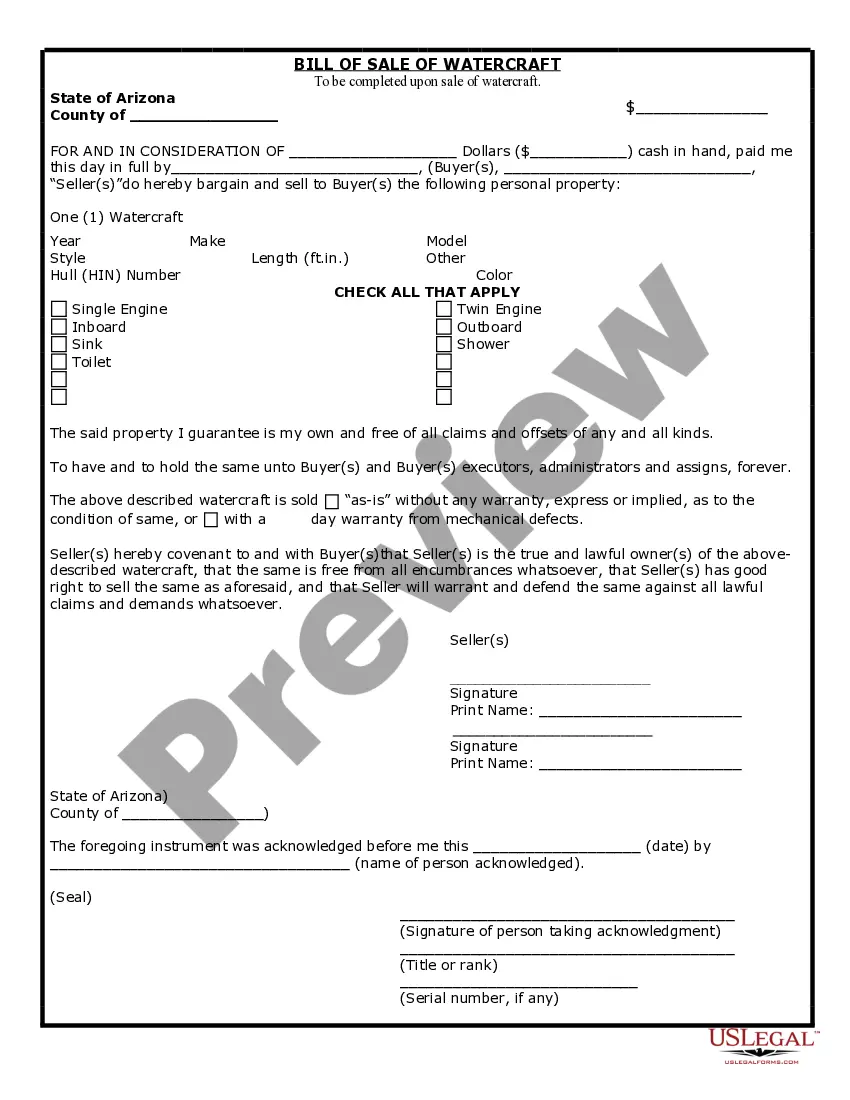

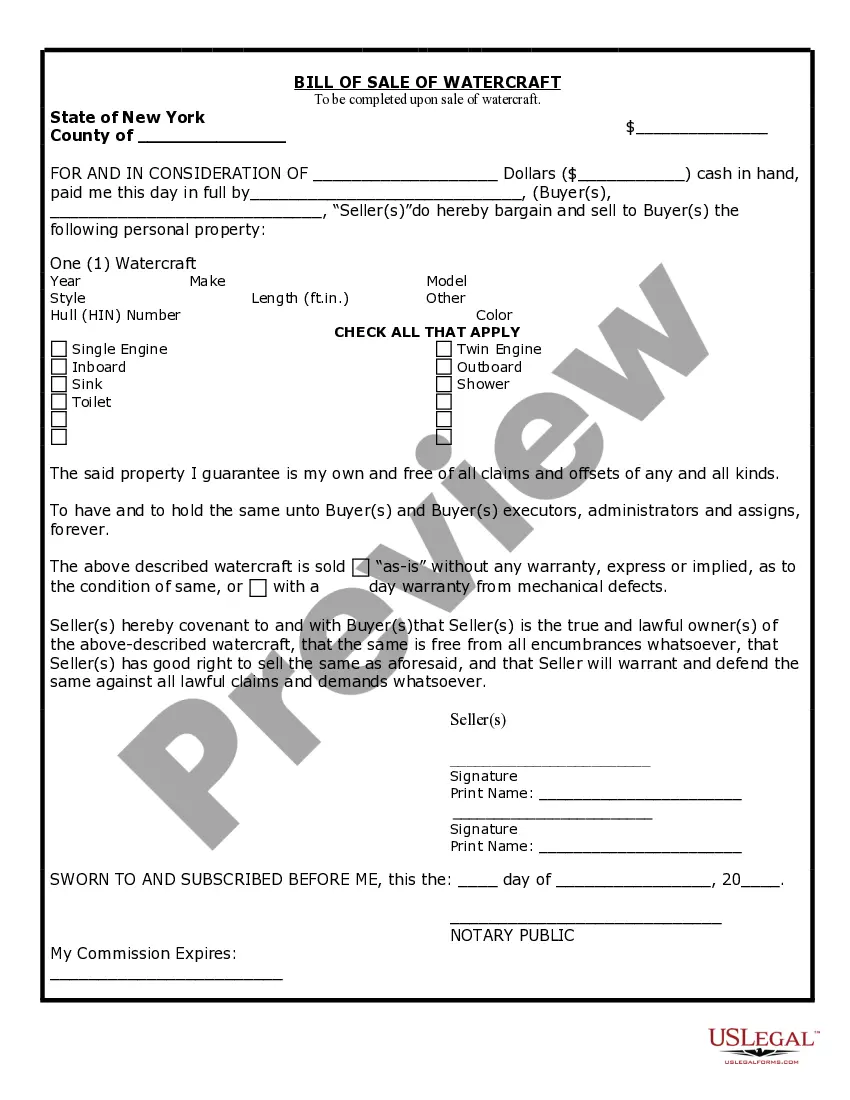

The Promissory Note procedure in Harris is a legal document that formalizes a borrower's promise to pay a specified sum to a lender, with specific terms for interest and repayment. This document includes critical components such as the loan amount, interest rate, payment schedule, and provisions for default. Users must fill in the applicable details, including names, addresses, and amounts, ensuring clarity in each section. The form allows for monthly installments, includes a balloon payment due at the end of the term, and addresses prepayment options with associated penalties. It's applicable in various scenarios, such as personal loans between individuals or for business financing. For attorneys, partners, and paralegals, this note serves as a foundational tool in financing agreements and debt recovery processes. Legal assistants can aid in drafting the note, ensuring compliance with state laws regarding interest rates and usury. Overall, this form is widely used in Harris for establishing clear legal obligations between parties while providing avenues to manage payment defaults.

Free preview