Balloon Found With Note In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

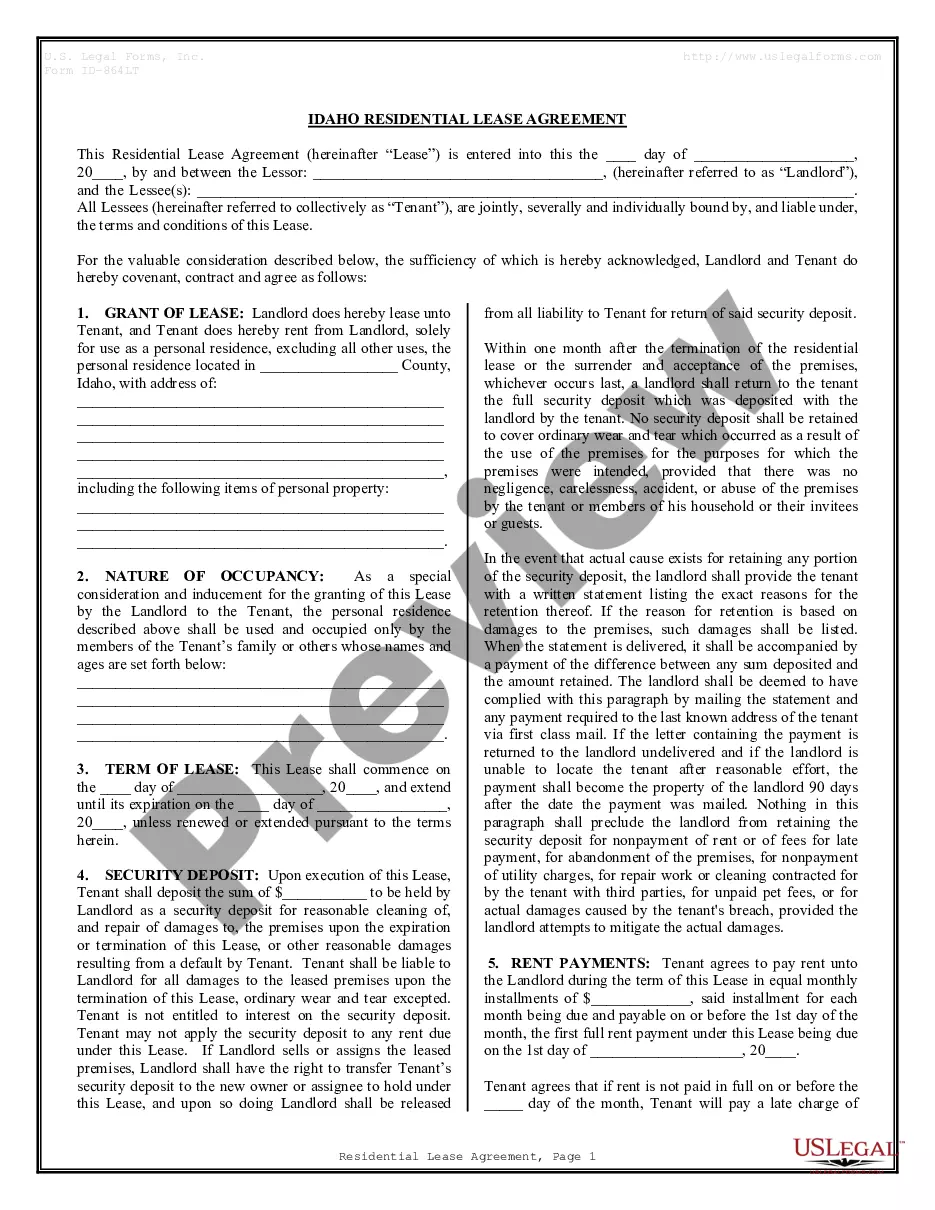

The Balloon Note is a financial document that outlines a borrower’s promise to repay a specified amount to a lender in installments, concluding with a final balloon payment. This form is particularly useful for users such as attorneys, partners, owners, associates, paralegals, and legal assistants, as it provides a structured method for loan repayment, with key features including a defined principal amount, interest rate, installment schedule, and provisions for prepayments and defaults. To fill out the form, users must specify the loan amount, lender information, interest rate, amortization period, and payment schedule, ensuring clear terms and conditions. The balloon payment due at the end of the term serves to settle the remaining balance, making the document suitable for short-term financing needs. Users are encouraged to edit the form according to their specific lending agreements while being mindful of state usury laws, ensuring compliance is maintained. Additionally, the form allows for the addition of prepayment penalties, and emphasizes the importance of proper notice for any changes in terms or payment defaults. This comprehensive approach helps streamline financial transactions, mitigate risks, and provide clarity to all involved parties.

Free preview