Sample Cease And Desist Letter To Debt Collectors In Bexar

Description

Form popularity

FAQ

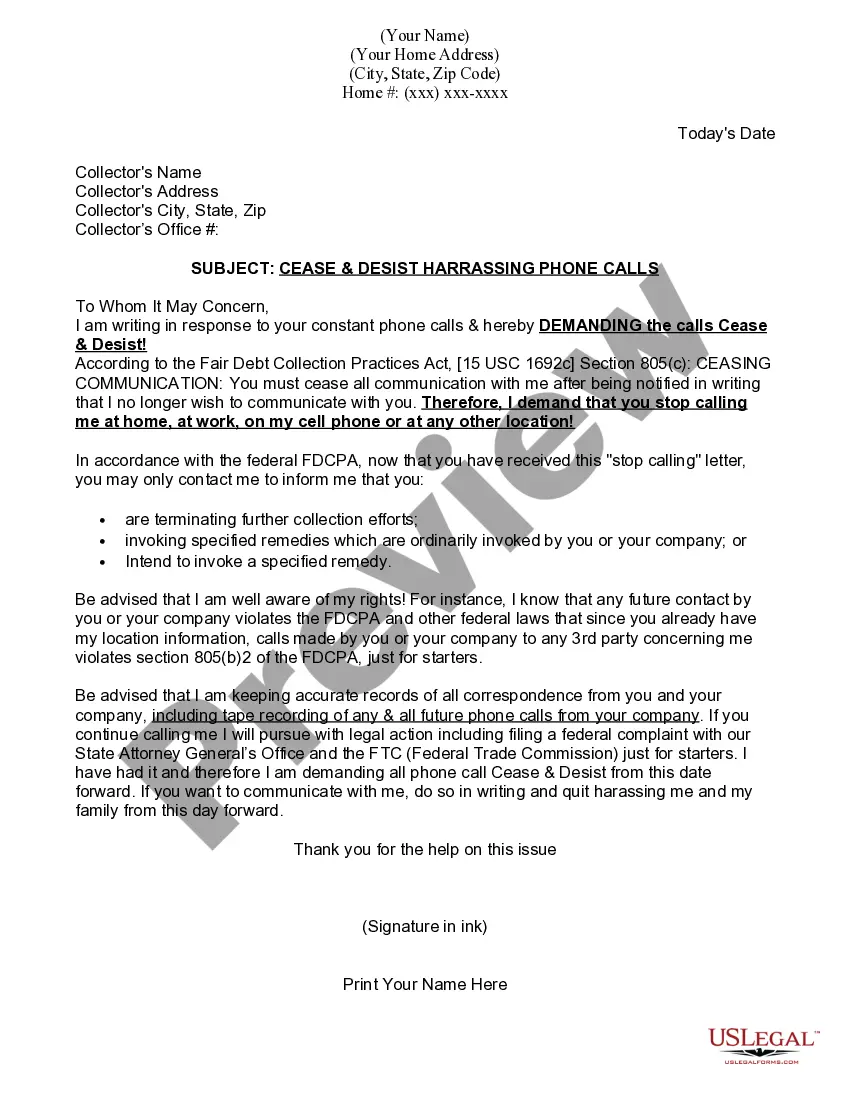

You can serve it via mail, email, an attorney and, in some cases, in person. However you choose to serve the letter, keep a record of delivery and receipt by the offending party. If you are sending the cease-and-desist letter yourself, send it via certified mail so that you have a record of delivery.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

Dear Sir/Madam: I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

If you don't believe you owe the debt, you can dispute it with the debt collector and the credit reporting company. If you dispute the debt in writing within 30 days of receiving information about the debt from the collector, then the debt collector must send you verification of the debt.

The Fair Debt Collection Practices Act lays out the rules for debt collectors and states that if the creditor is told to stop contacting the debtor, they must comply. If the harassing calls and letters persist, a cease and desist letter can be sent by an attorney to formally advise the creditor to stop violating the de.

Giving personal information. This just gives the collection agency information about property, wages, and financial accounts to seize if it obtains a judgment against you.

The 7-in-7 rule, established by the Consumer Financial Protection Bureau (CFPB) in 2021, limits how often debt collectors can contact you by phone. Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt.

"This debt belongs to me." You should never acknowledge ownership of a debt during initial contact with a collector. While it may seem like a valid debt, it's important to verify that the debt is actually yours and that the debt is still legally collectible.