Overpayment Letters For Employees In Phoenix

Category:

State:

Multi-State

City:

Phoenix

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

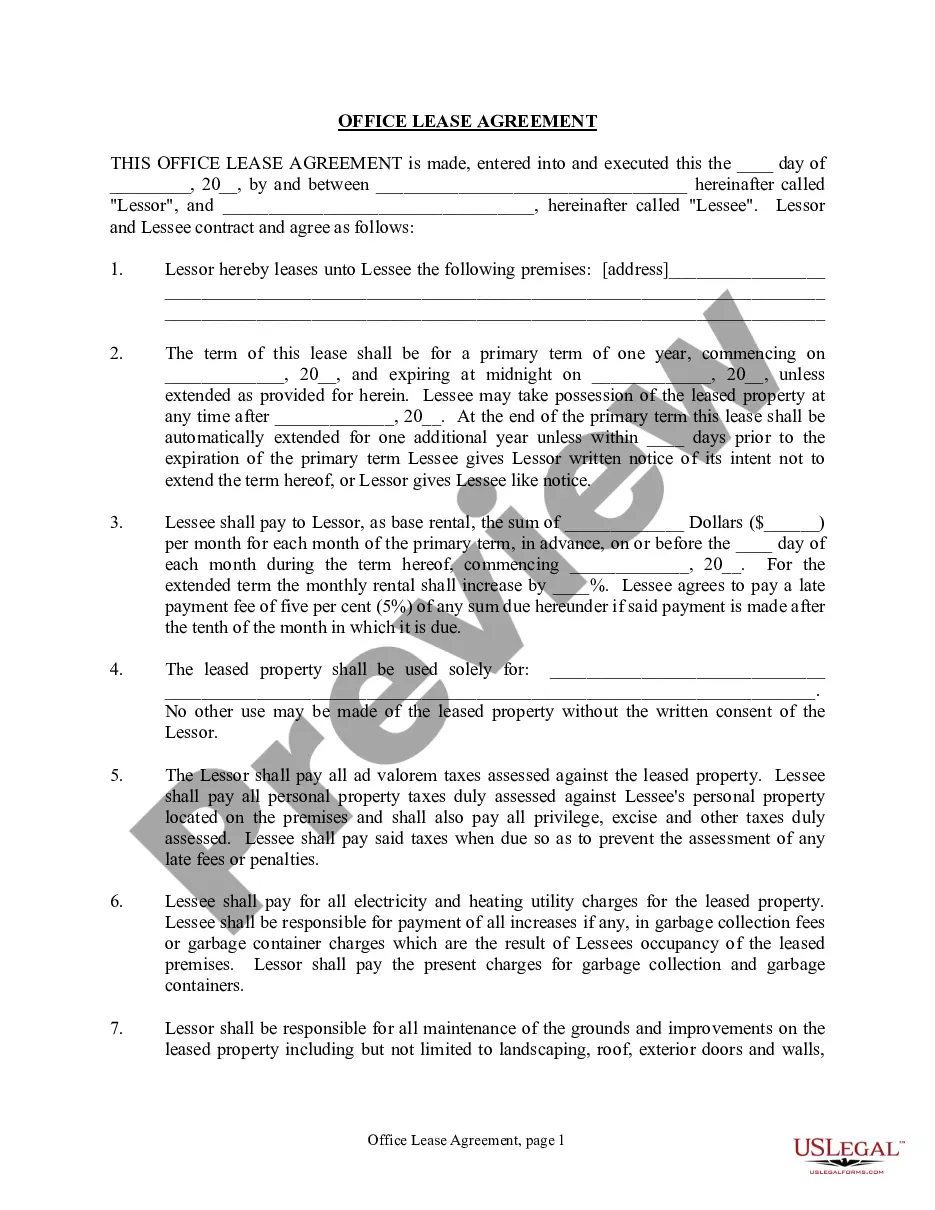

The Overpayment Letters for Employees in Phoenix serve as a formal notification to individuals who have overpaid in their dealings with the state, outlining the specifics of the payment received and providing essential details about the refund process. This document typically includes a section for the recipient's name and address, along with the date and an explanation of the overpayment situation. Users are instructed to customize the letter to reflect their particular circumstances, making it a flexible tool for various situations. For attorneys, this form aids in representing clients who need to reclaim overpaid taxes or fees efficiently. Partners and owners can utilize it to maintain proper financial communication with stakeholders and clients. Associates, paralegals, and legal assistants find this document helpful for managing client correspondence and ensuring every detail of the refund process is documented correctly. The letter encourages professional courtesy and establishes clear communication, reinforcing trust in financial dealings. Overall, this form plays a crucial role in addressing overpayment issues within the legal framework of Phoenix.