Overpayment Letter From Irs In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

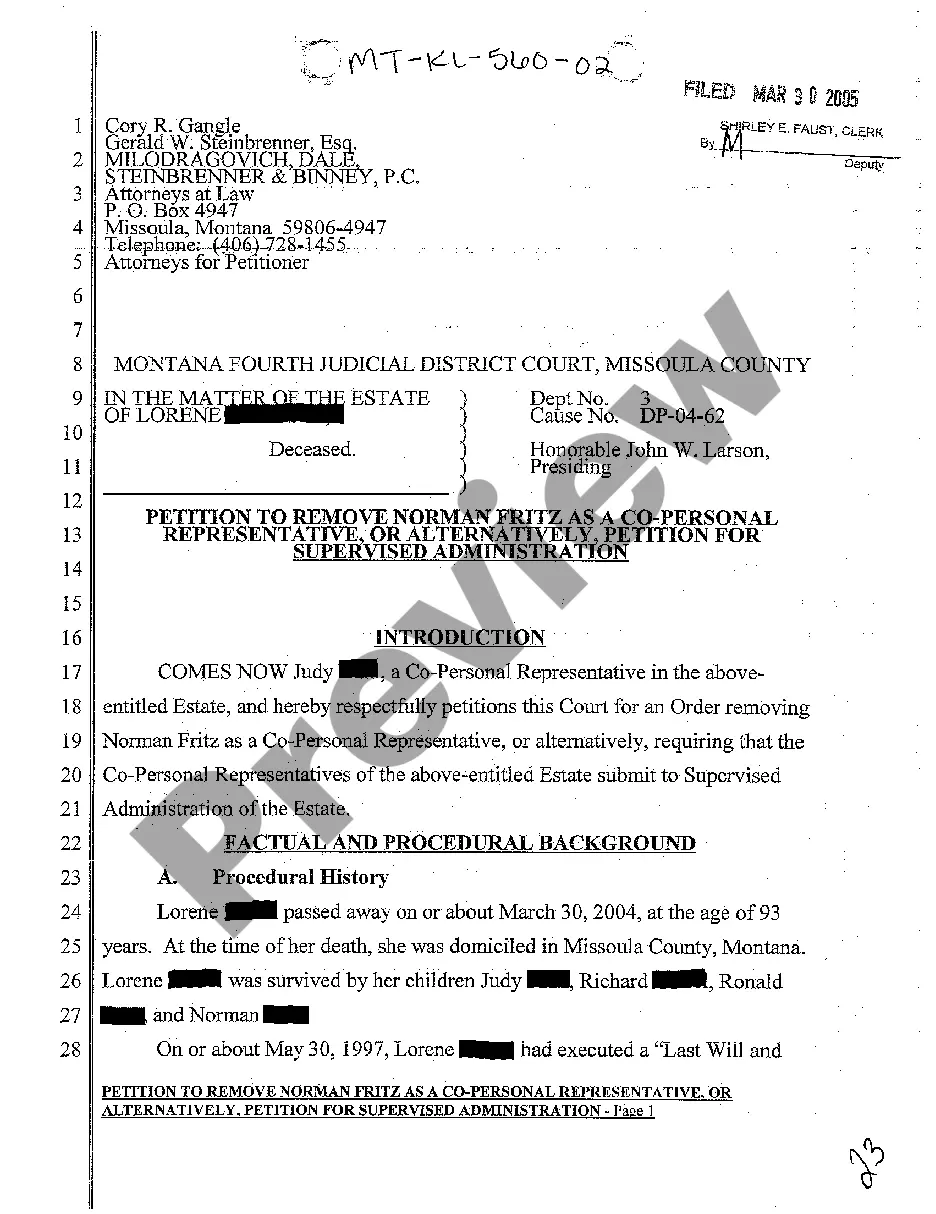

The Overpayment Letter from IRS in Fulton is a model correspondence intended for notifying recipients about the receipt of an overpayment from a government agency. This letter serves to inform individuals or organizations that a payment voucher and check have been issued due to an overpayment during the submission of an Annual Report. Key features of the letter include a structured format allowing users to personalize essential details such as date, name, address, and the amount of the overpayment. Filling out the form involves replacing placeholders with specific facts related to the recipient's situation, ensuring accuracy and relevance. For target users such as attorneys, partners, owners, associates, paralegals, and legal assistants, this letter provides a clear and professional approach to communicating financial discrepancies. Specific use cases include notifying clients about refund matters or clarifying payment issues with financial institutions. The form emphasizes a supportive and professional tone, promoting transparent communication in potentially confusing financial situations.