Asset Purchase Buy With Gst In Suffolk

Category:

State:

Multi-State

County:

Suffolk

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

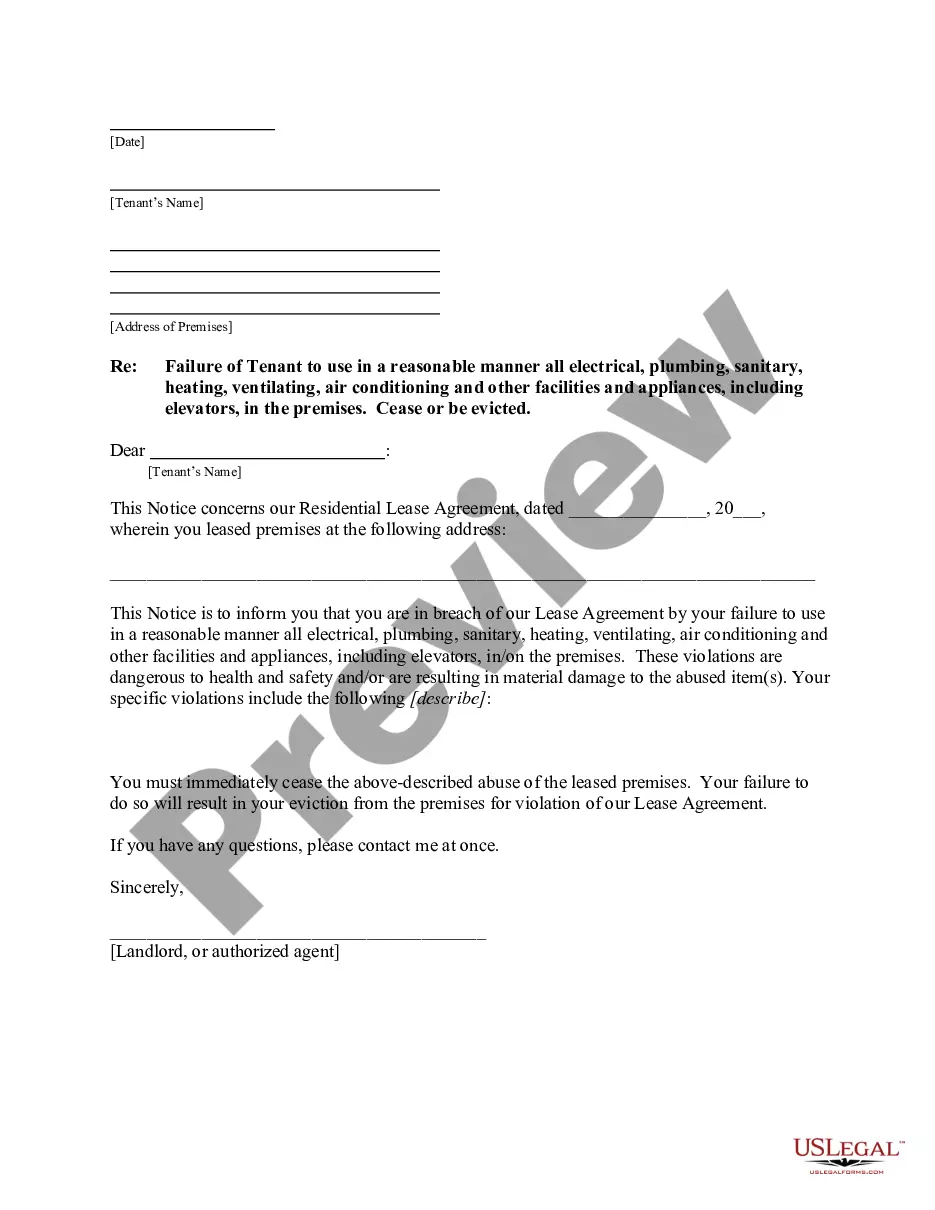

The Asset Purchase Agreement for asset purchase buy with GST in Suffolk is a legal contract that facilitates the sale of assets between a seller and a buyer. It outlines key details such as the assets included in the sale, the purchase price, and responsibilities for any liabilities. The agreement emphasizes that the buyer will not assume previous liabilities of the seller, ensuring clarity in financial responsibilities. Specific sections detail the payment structure, representations and warranties by both parties, and additional agreements such as non-competition clauses. This form is crucial for attorneys, partners, owners, associates, paralegals, and legal assistants as it provides a structured framework for asset transactions in compliance with state regulations. Proper filling and editing of the document are essential to protect the interests of both parties, including clear definitions of excluded assets and payment terms to avoid future disputes. Attorneys will find it useful for drafting and negotiation, while paralegals and legal assistants can utilize it for document preparation and understanding legal implications.

Free preview