Fixed Asset Purchase With Gst Entry In Collin

Category:

State:

Multi-State

County:

Collin

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

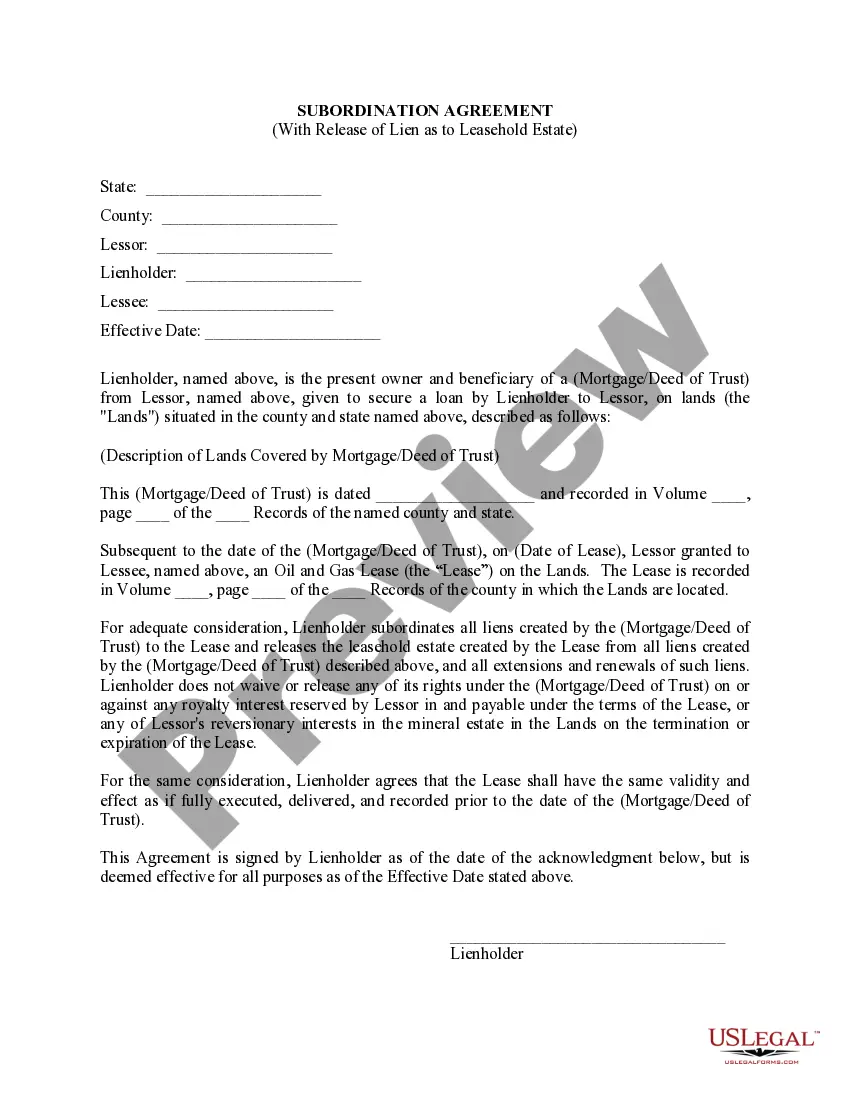

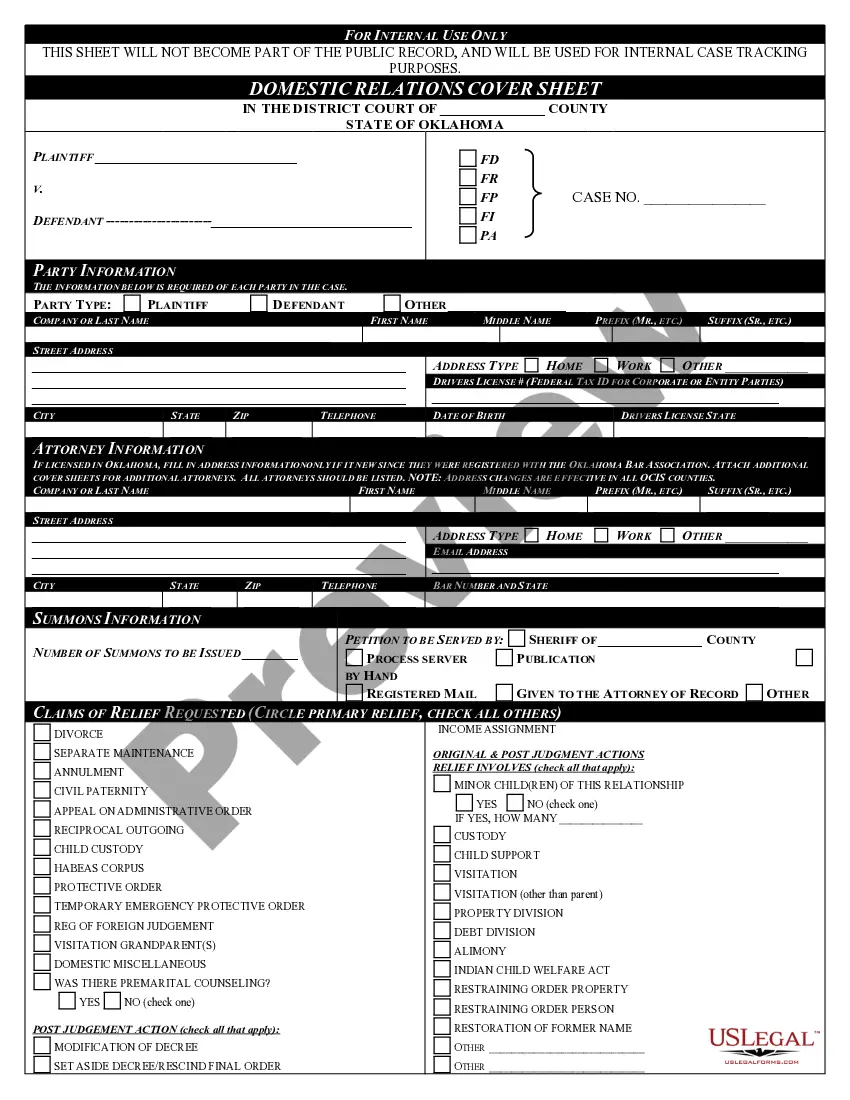

The Asset Purchase Agreement is a formal document outlining the terms for the purchase of fixed assets from a seller to a buyer, which includes specific provisions for the inclusion of goods and the associated Goods and Services Tax (GST) entry in Collin. This agreement delineates the assets included in the sale, which range from equipment to goodwill, while explicitly excluding certain liabilities and assets. Key features of the form include clear sections detailing the purchase price, payment structure, security interests, and representations and warranties from both parties. Users can expect instructions for filling out each section accurately, noting important dates for payments, and outlining responsibilities regarding taxes, particularly GST. The document serves various target audiences — including attorneys, partners, owners, associates, paralegals, and legal assistants — by providing a structured approach to facilitate asset transactions, ensuring legal compliance, safeguarding interests, and enhancing clarity in such business dealings. Familiarity with the form and its legal implications helps these professionals advise clients effectively and manage potential risks in asset acquisition.

Free preview