Asset Purchase Form Irs In Broward

Category:

State:

Multi-State

County:

Broward

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

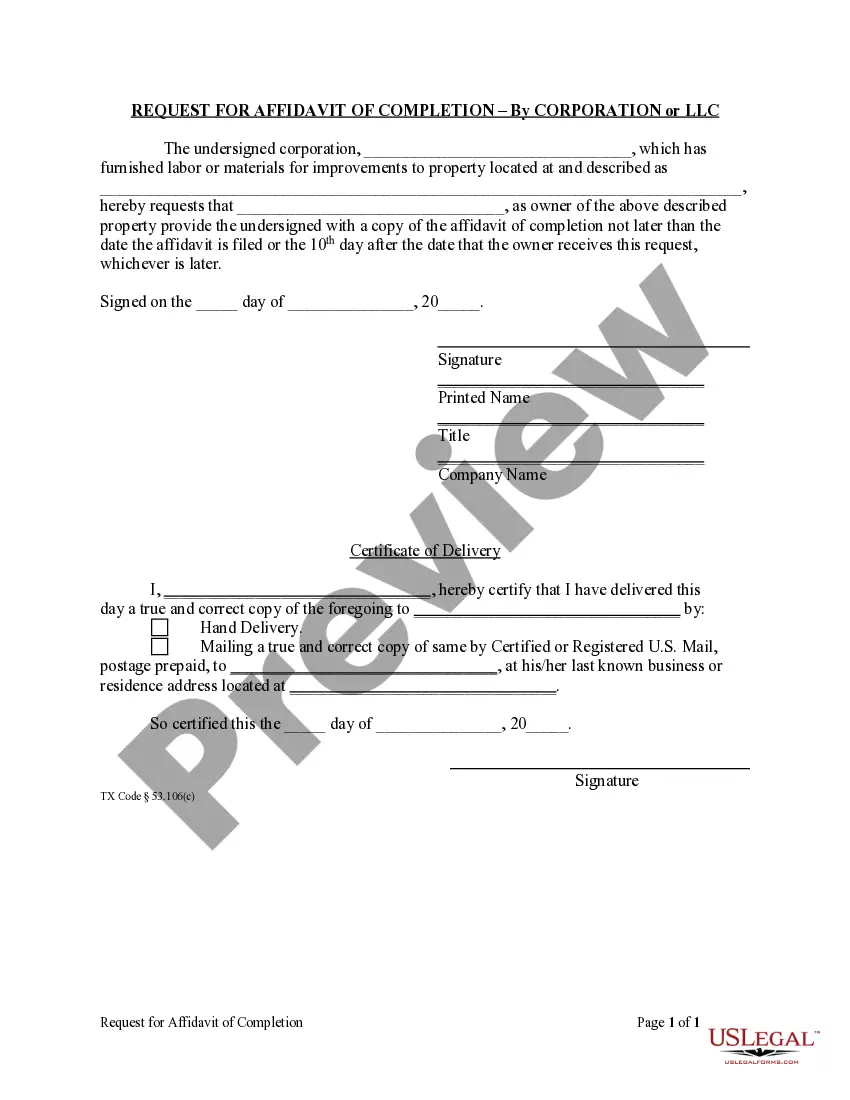

The Asset Purchase Form IRS in Broward serves as a formal agreement detailing the terms under which a buyer acquires a seller's business assets. This document outlines key aspects such as the specific assets being sold, the purchase price, and any liabilities that are not assumed by the buyer. It is structured to protect the interests of both parties, ensuring that the seller transfers assets free of liens and encumbrances while maintaining certain responsibilities until the closing. The agreement is comprehensive, detailing representations and warranties from both the seller and buyer regarding their respective corporate statuses and other material facts. It includes instructions for payment and conditions for closing the agreement, facilitating a smooth transaction. For attorneys, this form aids in drafting enforceable agreements, while partners and owners can utilize it to structure asset sales strategically. Associates and paralegals may find it helpful for managing documentation and ensuring compliance, while legal assistants can support in filling out and reviewing required forms. This form is essential for any business transaction where assets are purchased in Broward, aligning legal and financial interests effectively.

Free preview