Ohio Deferred Comp Withdrawal

Description

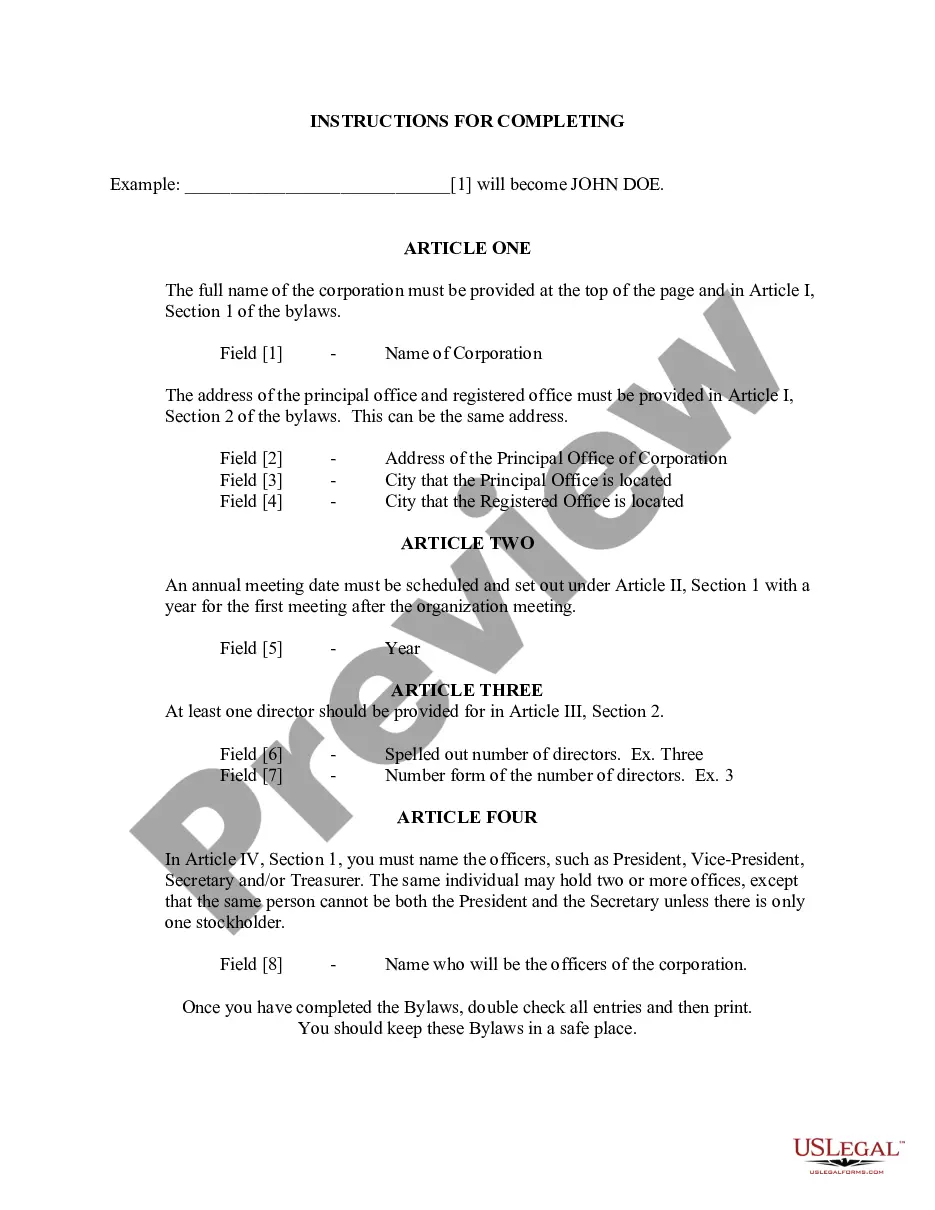

How to fill out Deferred Compensation Agreement - Long Form?

Regardless of whether for commercial reasons or personal issues, everyone encounters legal circumstances at some stage in their lifetime. Completing legal documents requires meticulous care, starting with choosing the appropriate form template.

For example, if you select an incorrect version of an Ohio Deferred Comp Withdrawal, it will be denied upon submission. Therefore, it is essential to find a trustworthy source of legal documents such as US Legal Forms.

With a vast collection of US Legal Forms available, you will never need to waste time searching for the correct document online. Take advantage of the library’s straightforward navigation to find the appropriate form for any situation.

- Search for the template you need using the search bar or catalog browsing.

- Review the form’s details to verify it aligns with your circumstances, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Ohio Deferred Comp Withdrawal template you require.

- Download the file if it corresponds to your requirements.

- If you have a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Select the desired file format and download the Ohio Deferred Comp Withdrawal.

- Once it is saved, you can fill out the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

Choosing a hardship withdrawal may not always be the best financial move. While it provides immediate access to funds, it can hinder your long-term savings and future retirement plans. Carefully consider your current financial situation and consult with experts about Ohio deferred comp withdrawal before proceeding.

A hardship withdrawal from deferred compensation allows you to access funds in your account under specific conditions. This option is intended to help you when facing immediate financial difficulties. By understanding Ohio deferred comp withdrawal rules, you can make informed decisions about accessing your resources.

In Ohio, the penalty for early withdrawal from a 401k is generally 10% of the amount taken out if you are under age 59½. This penalty applies unless you qualify for specific exemptions. Understanding these penalties is crucial when planning your finances and making withdrawal decisions. Uslegalforms offers numerous resources to help you understand your options and related penalties, so you can make more informed choices.

The early withdrawal penalty for an Ohio deferred comp withdrawal is calculated as a percentage of the amount withdrawn. Generally, this is 10% of the taxable amount if you are under the age of 59½. To ensure accurate calculations, it’s advisable to consult with a financial advisor or use online calculators that consider your specific circumstances. Taking these steps can help you avoid unpleasant surprises come tax time.

Yes, deferred compensation in Ohio is subject to state income tax when you withdraw it. This means that when you choose to make an Ohio deferred comp withdrawal, you should be prepared for tax implications. Understanding this can assist you in planning your finances for retirement. For clarity on your specific situation, consider utilizing resources from uslegalforms, which can help you navigate state tax laws.

The penalty on early withdrawal from your Ohio deferred comp withdrawal typically stands at 10% if you withdraw funds before reaching the age of 59½. This penalty applies to both federal and state taxes, and understanding it can help you make more informed financial decisions. It's essential to consider these deductions to avoid unexpected financial burdens. Consulting with a tax professional can provide you with tailored advice.

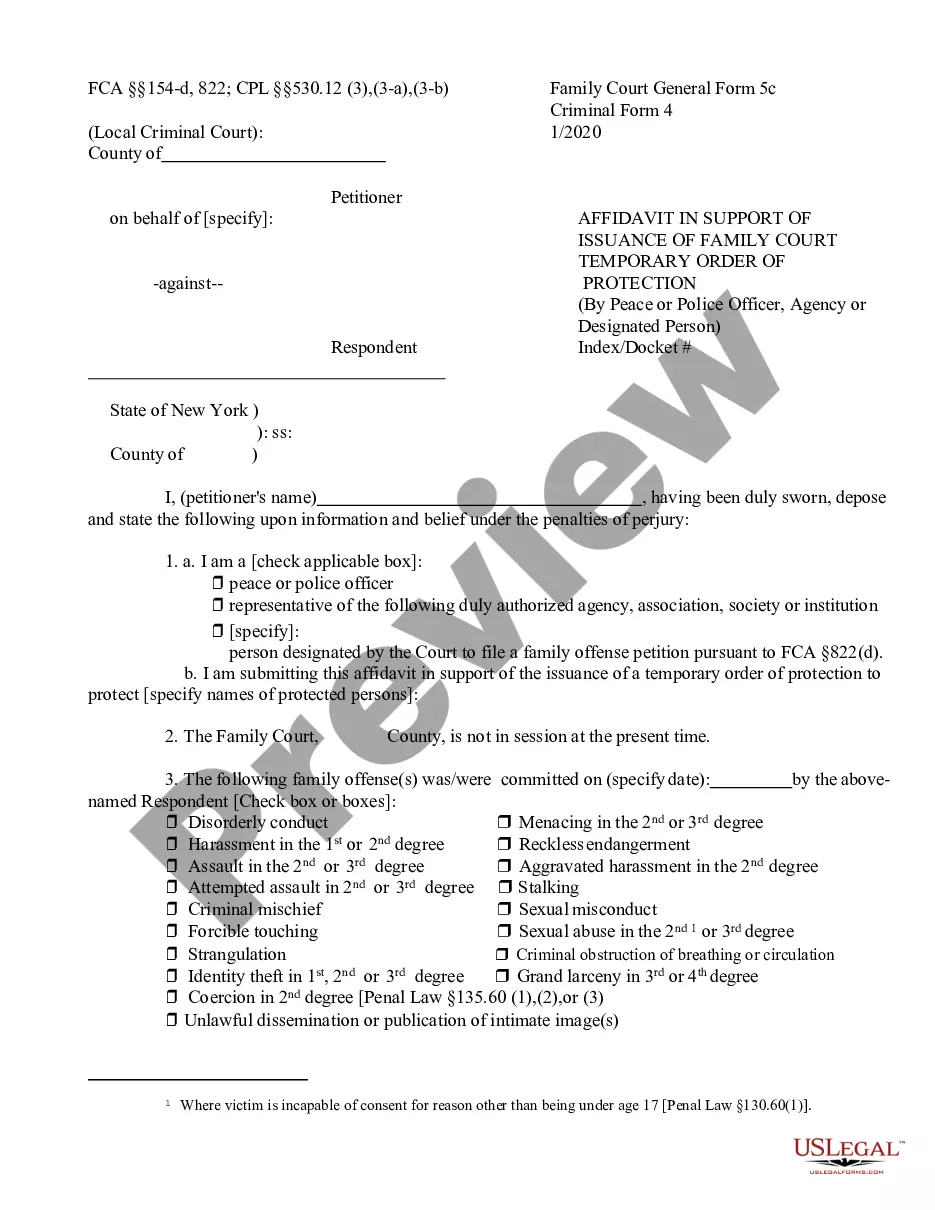

To withdraw from Ohio Deferred Compensation, you must fill out the appropriate form available on their website. Make sure to follow all instructions carefully to ensure your Ohio deferred comp withdrawal is processed swiftly. If you find the process complex, realigning your efforts with a service like USLegalForms can streamline your experience and help you avoid potential pitfalls.

Withdrawing from your Ohio deferred comp requires a few simple steps. First, you need to complete the withdrawal application available on the Ohio Deferred Compensation website. It's important to provide all necessary information and documentation to process your Ohio deferred comp withdrawal smoothly. If you need assistance, consider using platforms like USLegalForms to simplify the process.

Yes, you can withdraw from your Ohio deferred comp account. However, certain conditions apply that may affect your eligibility. Typically, you need to have separated from your employment or reached a specific age to initiate a withdrawal. Understanding these requirements can help you make informed decisions.

Yes, you can withdraw from your Ohio deferred comp, but there are specific rules and conditions to consider. Generally, you may make withdrawals upon reaching retirement age, experiencing certain financial hardships, or if you become disabled. It's important to evaluate your options and understand potential tax implications before initiating an Ohio deferred comp withdrawal. For assistance, US Legal Forms provides resources to help you navigate the withdrawal process efficiently.