Nyc Deferred Comp Withdrawal Rules In Oakland

Category:

State:

Multi-State

County:

Oakland

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

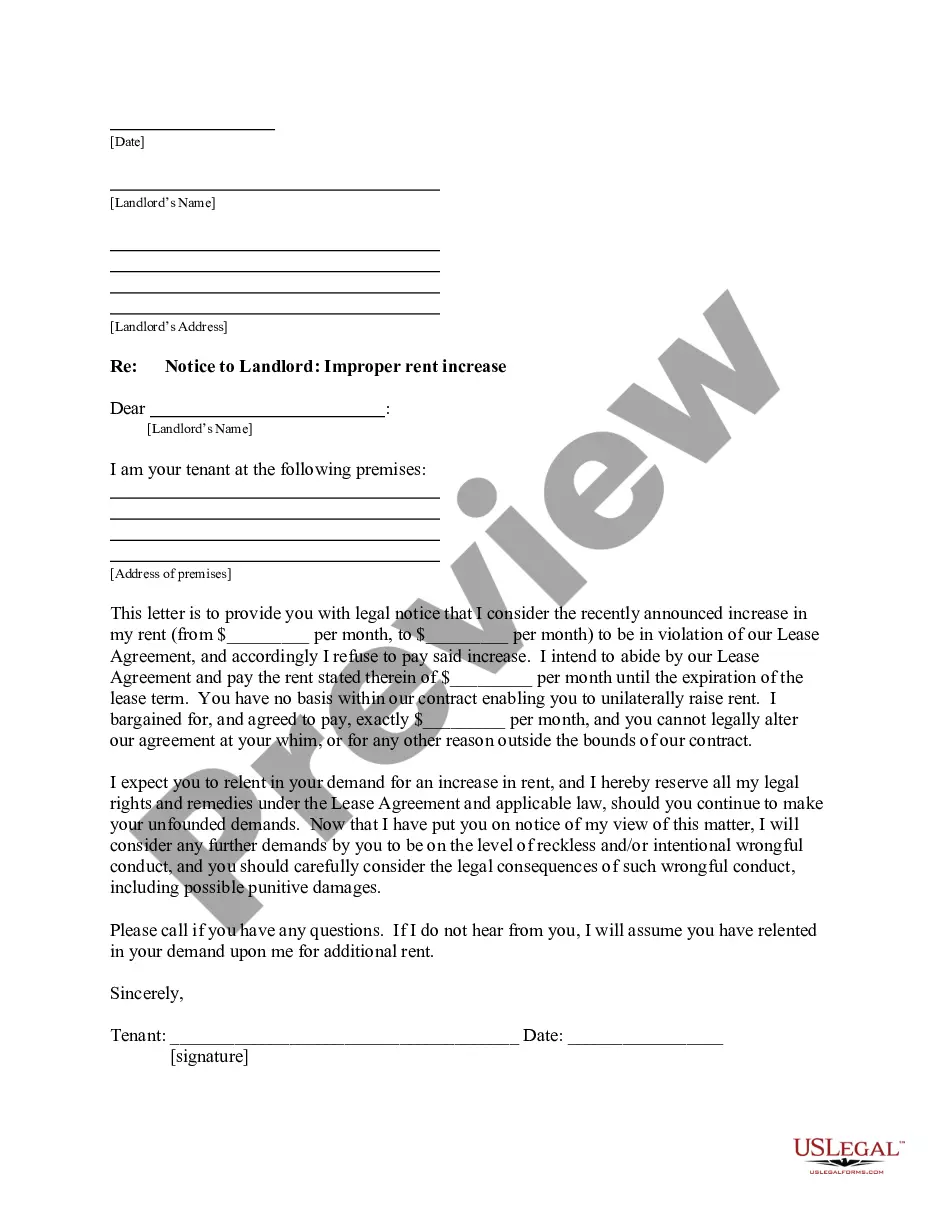

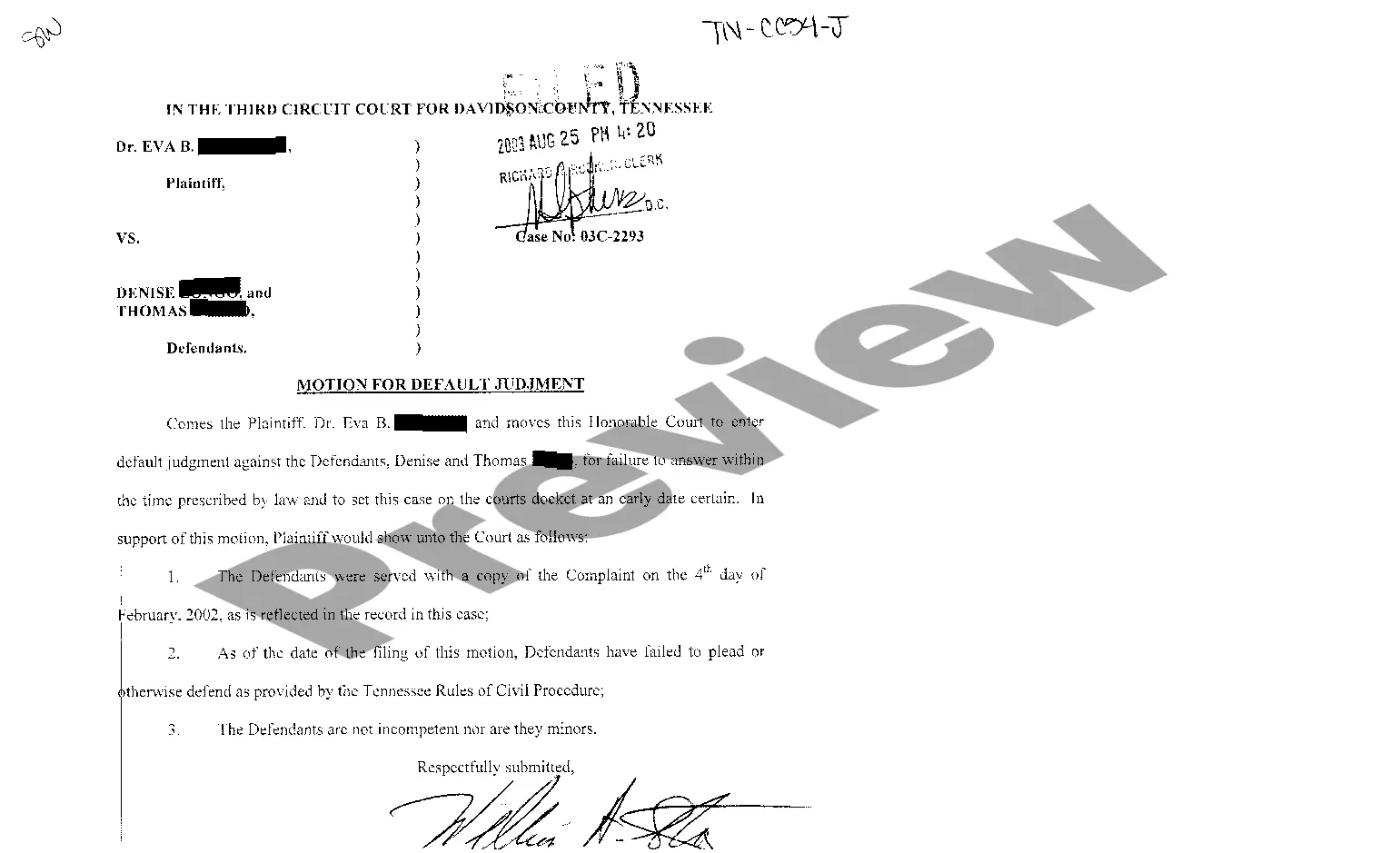

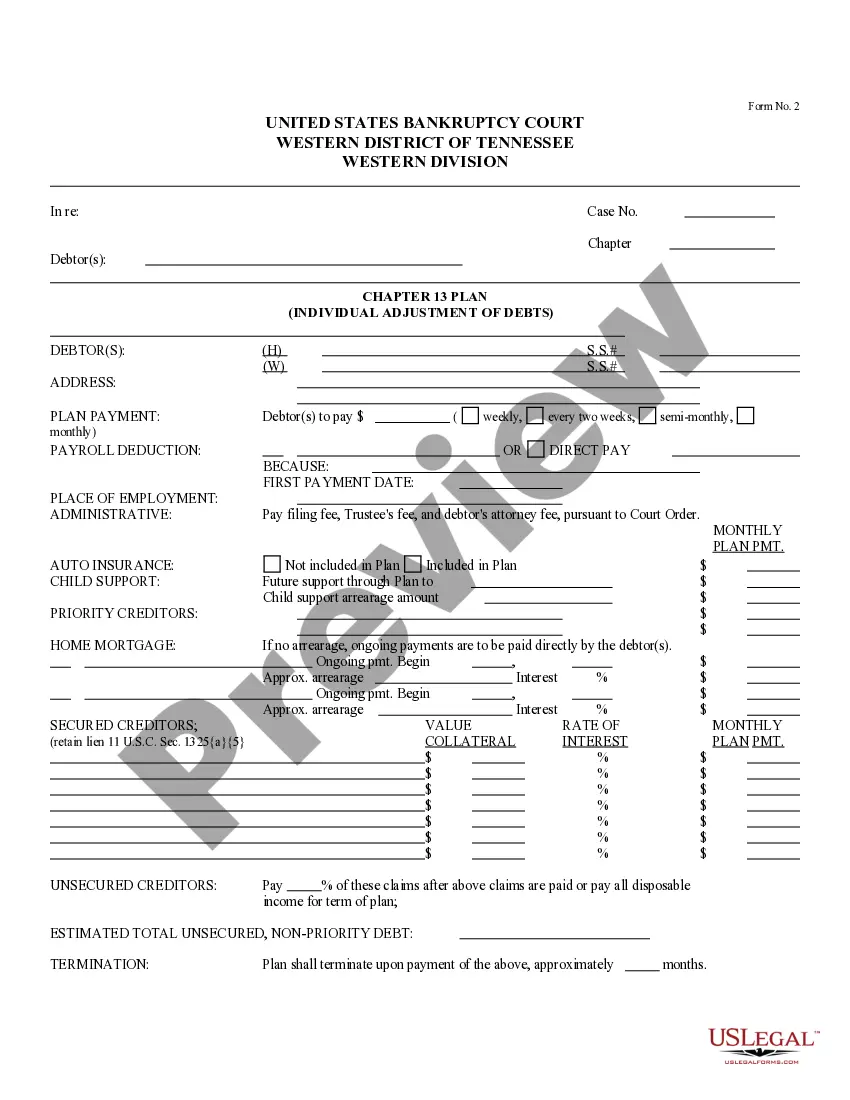

The document is a Deferred Compensation Agreement between an employer and an employee, outlining the terms of deferred compensation benefits. Specifically, it details the rules surrounding NYC deferred comp withdrawals in Oakland, where employees can access funds upon retirement or death. The agreement specifies monthly payment amounts and the impact of the National Consumer Price Index on these payments. Key features include clauses on retirement, death benefits, noncompetition, and conditions for payment termination. Filling out the agreement requires accurate entries for employee details, compensation amounts, and conditions for retirement. Attorneys, partners, and legal assistants will find this form particularly useful in structuring employment contracts, ensuring compliance with state laws, and advising clients on retirement planning. Paralegals and legal assistants may assist in drafting and implementing these agreements, emphasizing the importance of adhering to legal standards and protecting both employee and employer interests.

Free preview