Nys Deferred Comp Withdrawal Age In Bexar

Category:

State:

Multi-State

County:

Bexar

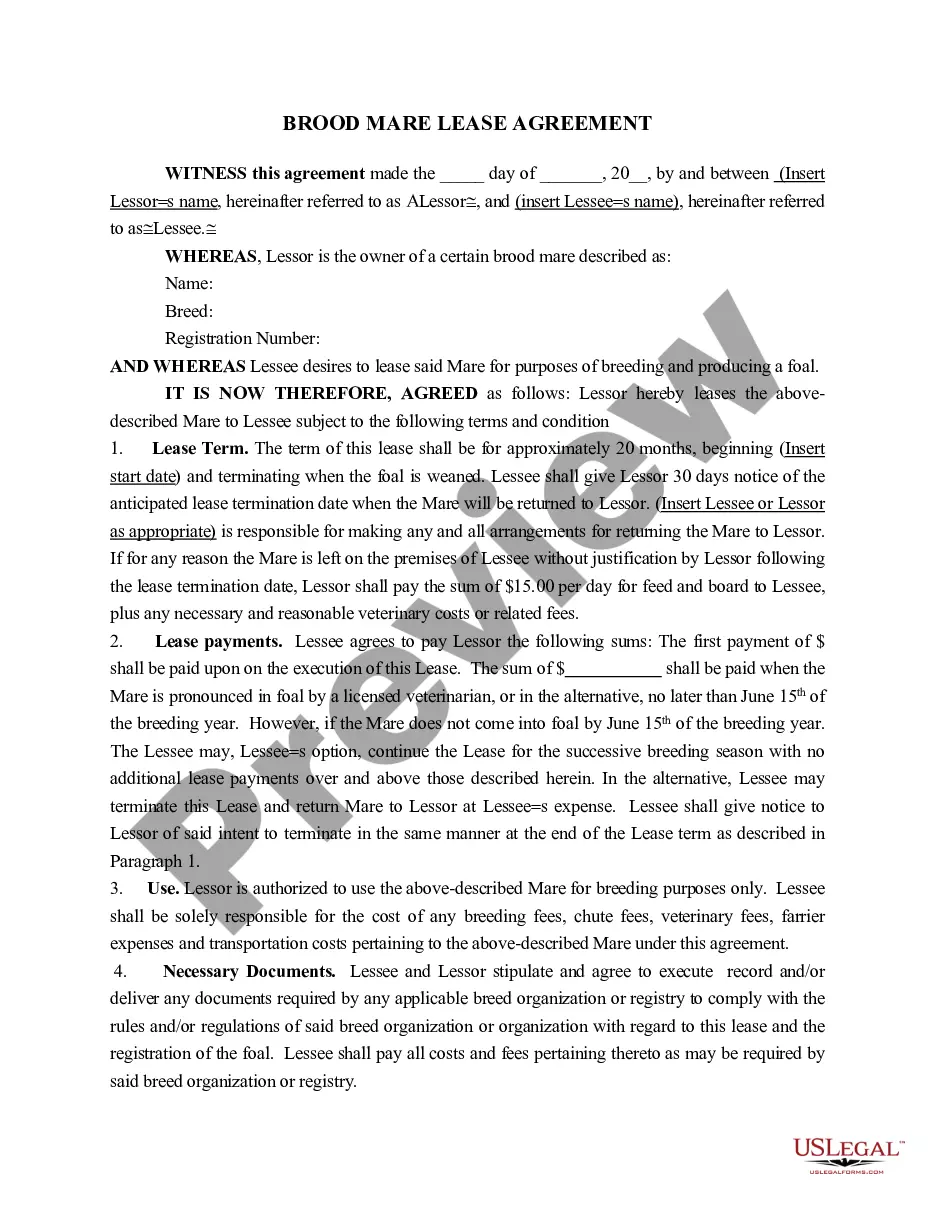

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

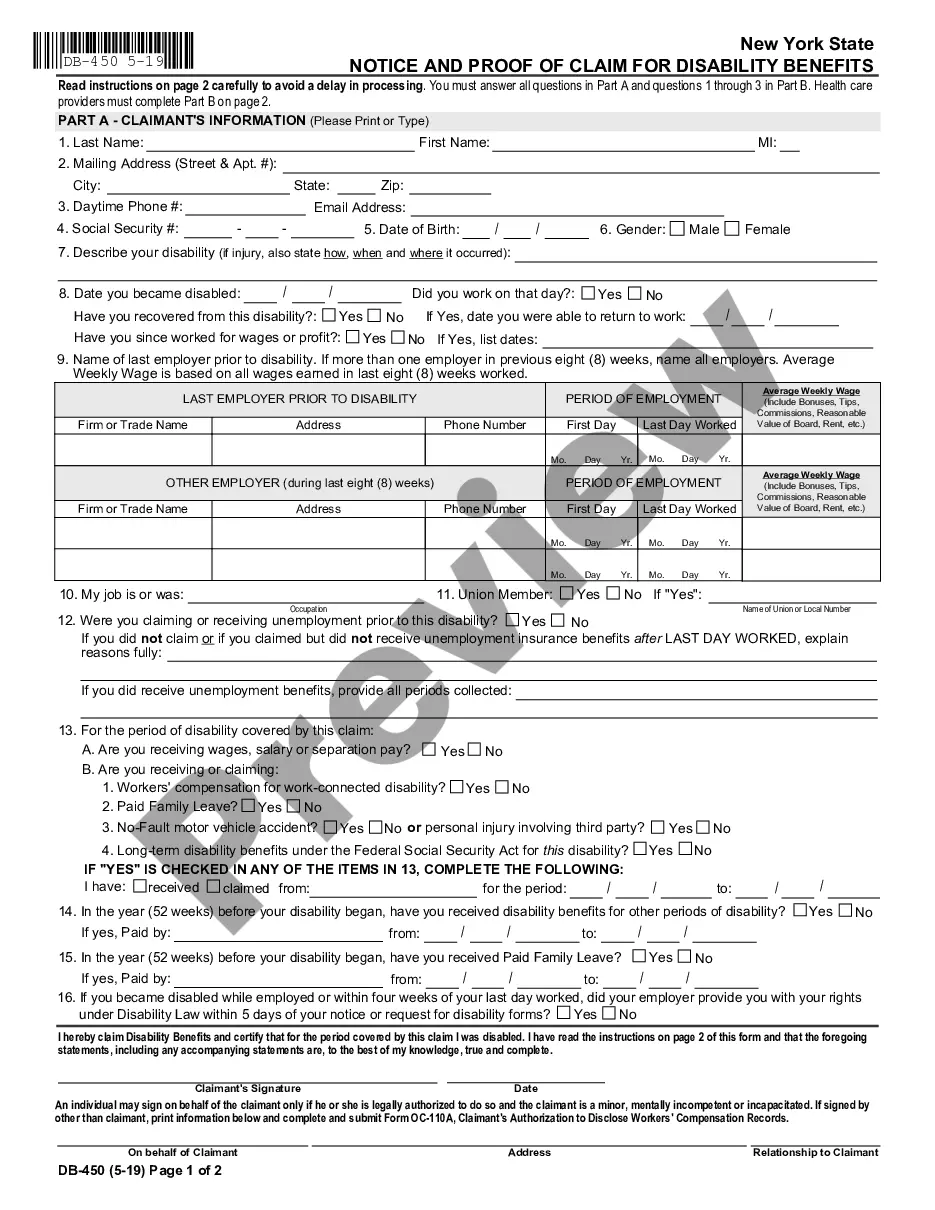

The Nys Deferred Comp Withdrawal Age in Bexar pertains to an agreement designed to provide supplemental retirement income for employees, establishing critical terms between the corporation and the employee. Key features of the agreement include provisions for retirement payments based on specified ages, handling of payments in cases of death, and conditions under which payments may cease. Users are guided on filling and editing the form to ensure compliance with corporate policies and legal requirements. Notably, the form outlines specific use cases relevant to legal professionals, such as determining withdrawal age and eligibility for deferred compensation benefits. The agreement mandates careful attention to termination policies and noncompetition clauses that affect an employee's entitlement to benefits. Legal practitioners, including attorneys and paralegals, can utilize this form to advise clients on financial planning and retirement strategies within legal frameworks. Additionally, it serves as a useful resource for business owners and partners, ensuring that compensation strategies align with organizational goals while complying with state laws.

Free preview