Form 8594 Examples In North Carolina

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

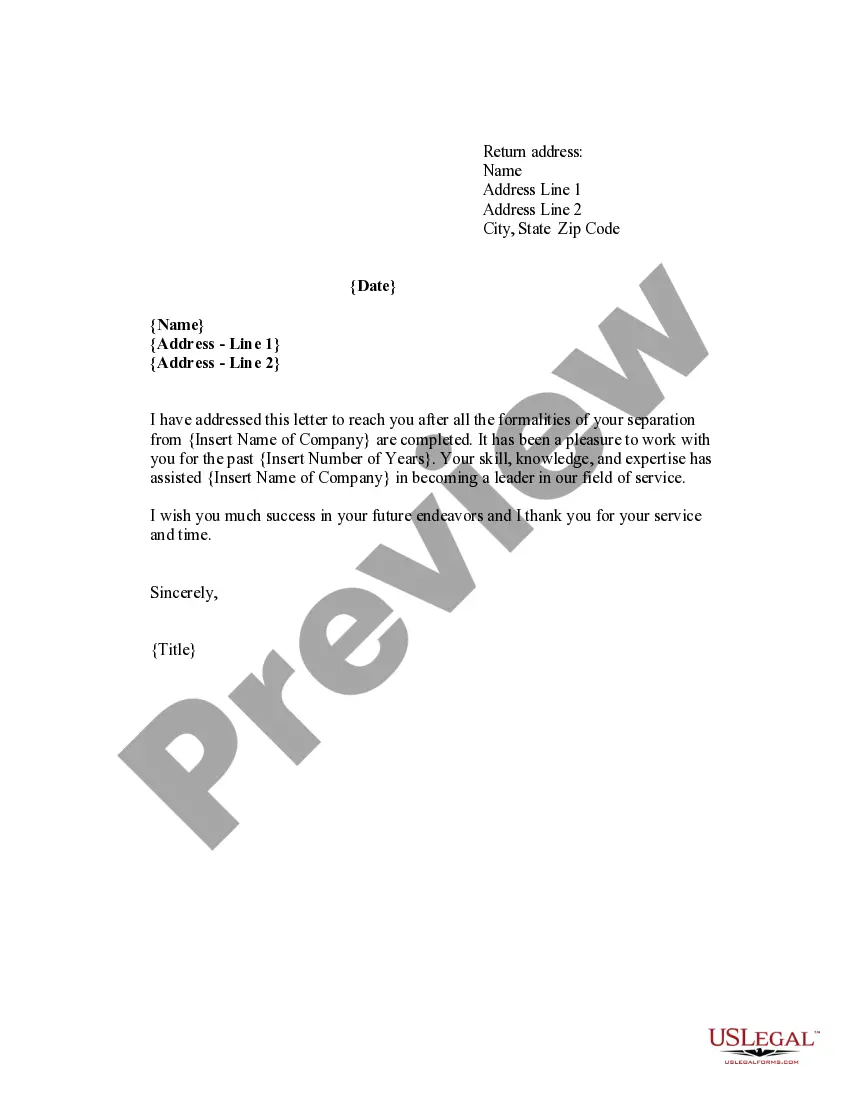

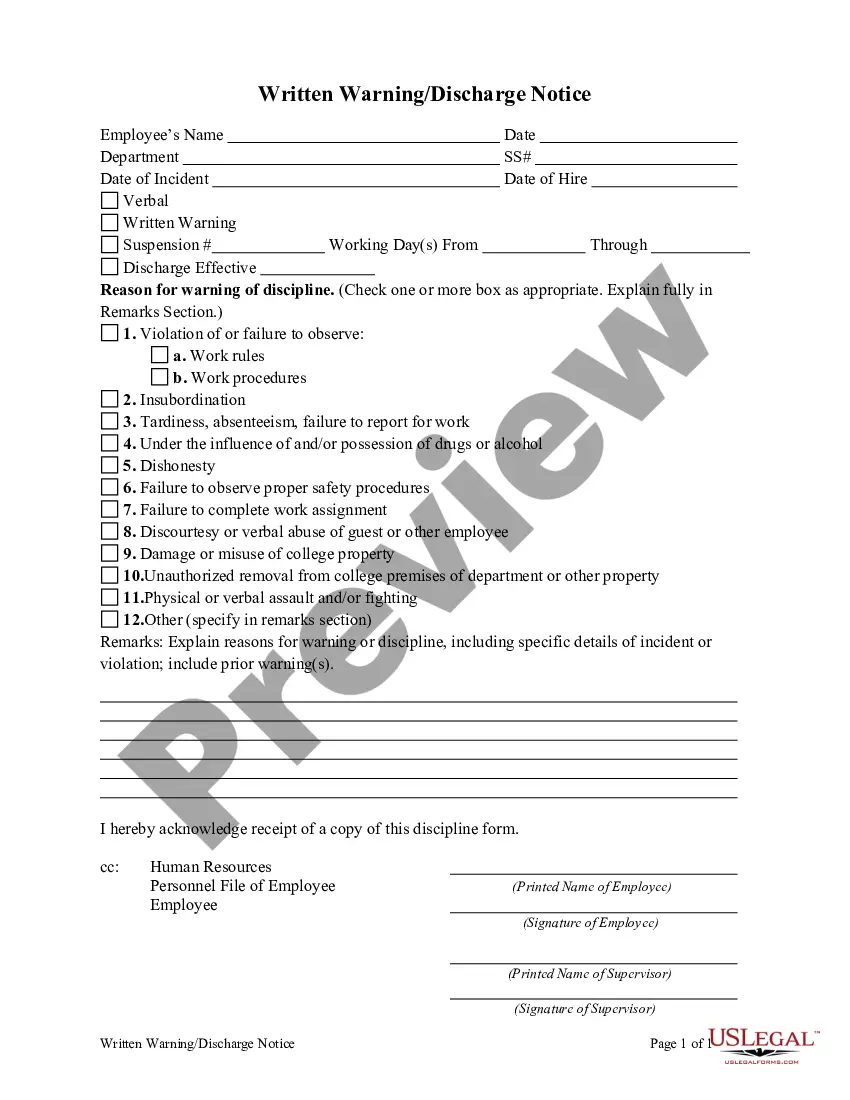

Form 8594, used in North Carolina, is integral for asset acquisitions, especially relevant for attorneys, partners, owners, associates, paralegals, and legal assistants. This form facilitates the reporting of the purchase or sale of business assets, ensuring accurate tax allocation among various asset classes. Key features include sections for detailing purchased assets, payment terms, and liability assumptions. Users are guided to specify assets included and excluded from the sale, alongside their respective purchase prices. Filling instructions emphasize clarity, urging users to replace bracketed sections with applicable information. Legal professionals often utilize this form when structuring transactions to maintain compliance and mitigate tax implications. In addition to the structured asset listing, the form addresses securities and warranties, ensuring protection against potential liabilities. Specifically, for partnerships or corporate transactions, it provides a comprehensive framework that outlines all parties’ obligations and expectations.

Free preview