Form 8594 For Stock Purchase In New York

Description

Form popularity

FAQ

Key Takeaways. Inventory is the raw materials used to produce goods as well as the goods that are available for sale. It is classified as a current asset on a company's balance sheet.

Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

Key Takeaways. Inventory is the raw materials used to produce goods as well as the goods that are available for sale. It is classified as a current asset on a company's balance sheet.

Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

Form 8949 is required for anyone who sells or exchanges a capital asset, such as stocks, land, or artwork. It tracks both short-term and long-term transactions, with different tax implications for each.

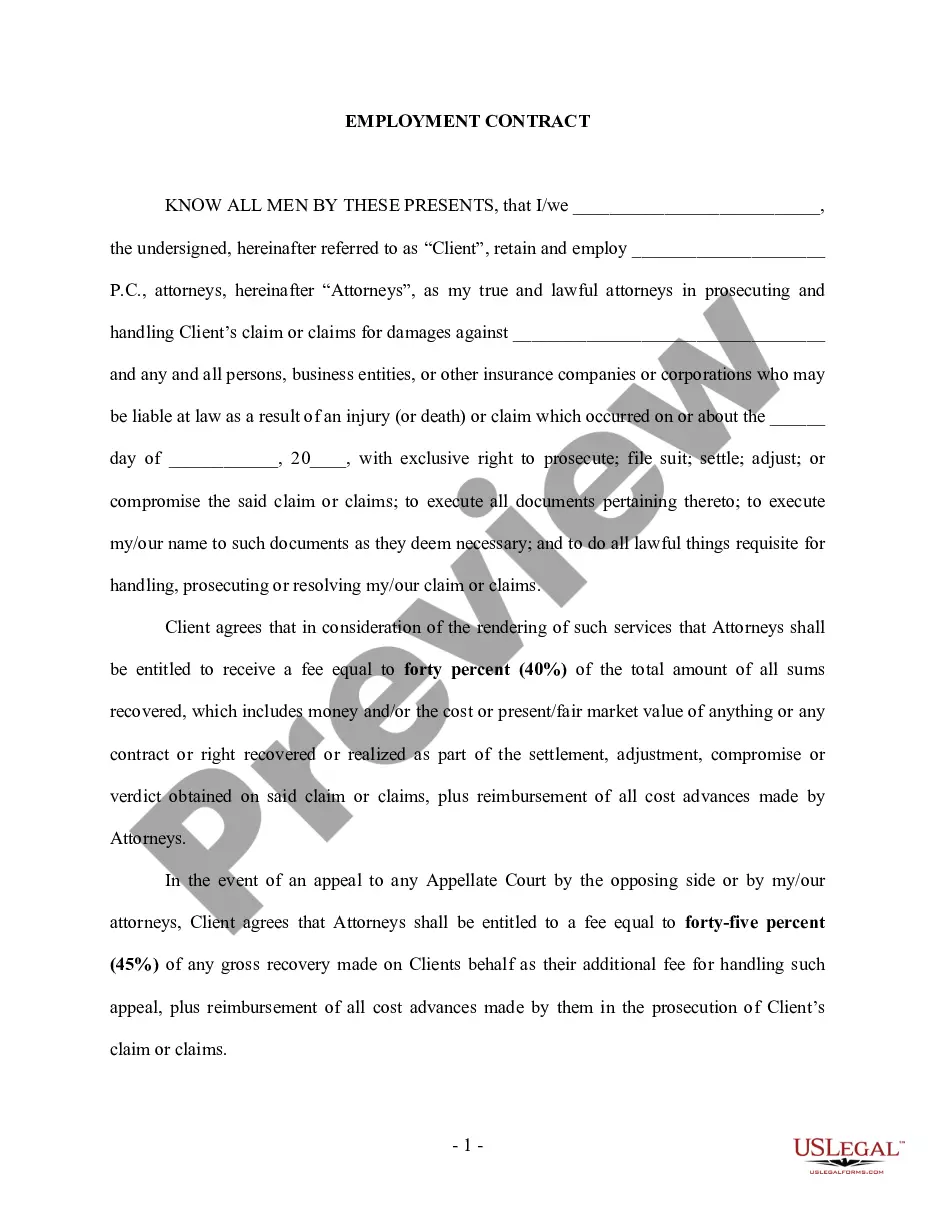

For the target, a stock sale is usually a nonevent from a tax perspective. The buyer in a stock sale does not get a step-up in tax basis in the assets that comprise the target company, and thus is not able to increase their depreciation and amortization deductions in the same way as in an asset sale.