Form 8594 Examples In New York

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

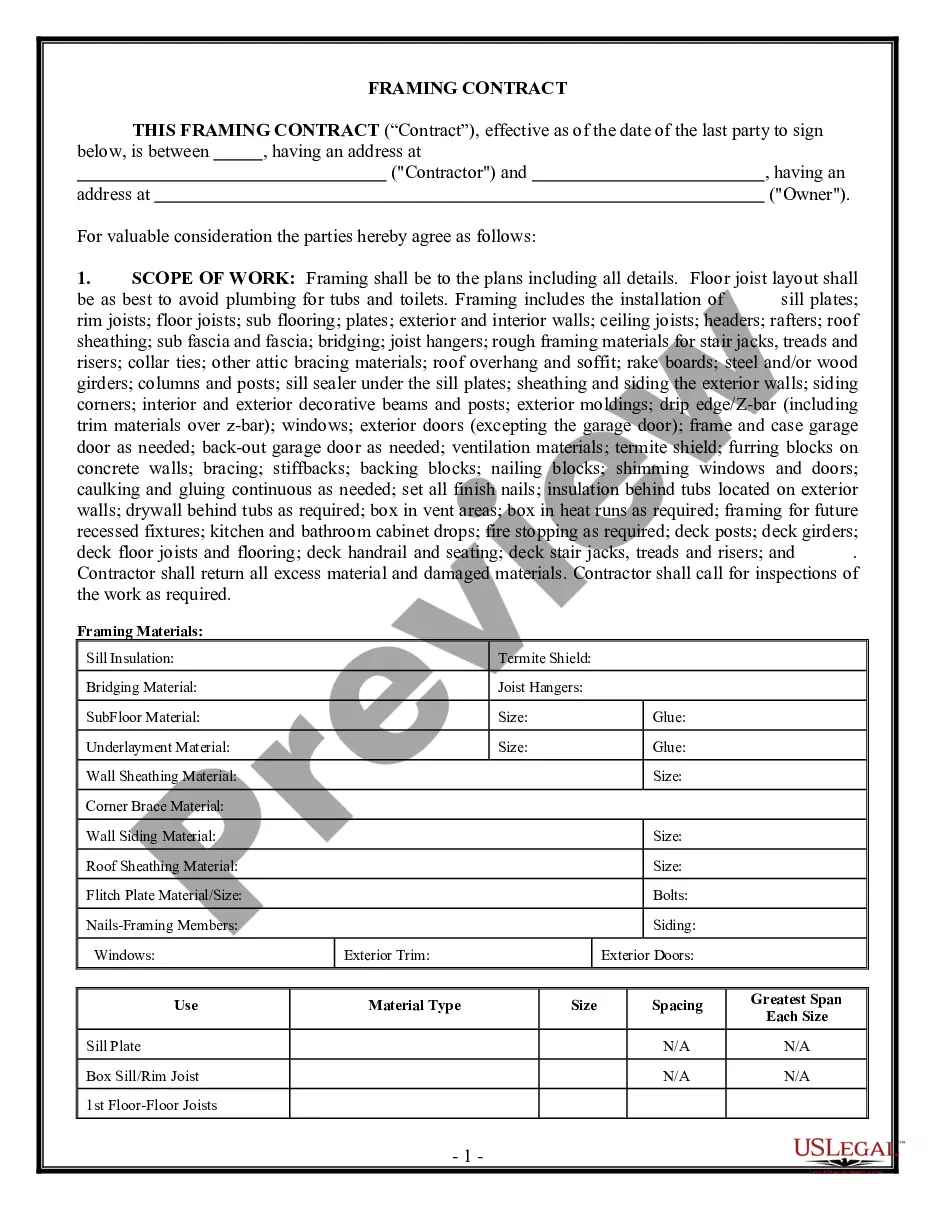

Form 8594 in New York is a vital document used during the asset acquisition process, primarily applicable to attorneys, partners, owners, associates, paralegals, and legal assistants involved in business transactions. This form provides a structured way to allocate the purchase price among various asset categories, including equipment, inventory, and goodwill. It requires the user to provide detailed terms of the sale, such as purchase price, payment terms, and obligations relating to liabilities. Key features include sections for listing the assets being transferred and any excluded assets, ensuring clarity and mutual understanding regarding the transaction. Filling out the form necessitates attention to detail, including accurate allocation of values and compliance with local legal laws. Users should carefully review the representations and warranties sections to ensure protection against future claims. Consulting on the implications of the form is advisable, especially for those new to legal agreements, reinforcing the importance of legal guidance in asset transactions. It is particularly useful in cases where a business is sold as a going concern, helping to facilitate smooth transitions and compliance with tax regulations.

Free preview