Form 8594 Examples In Miami-Dade

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

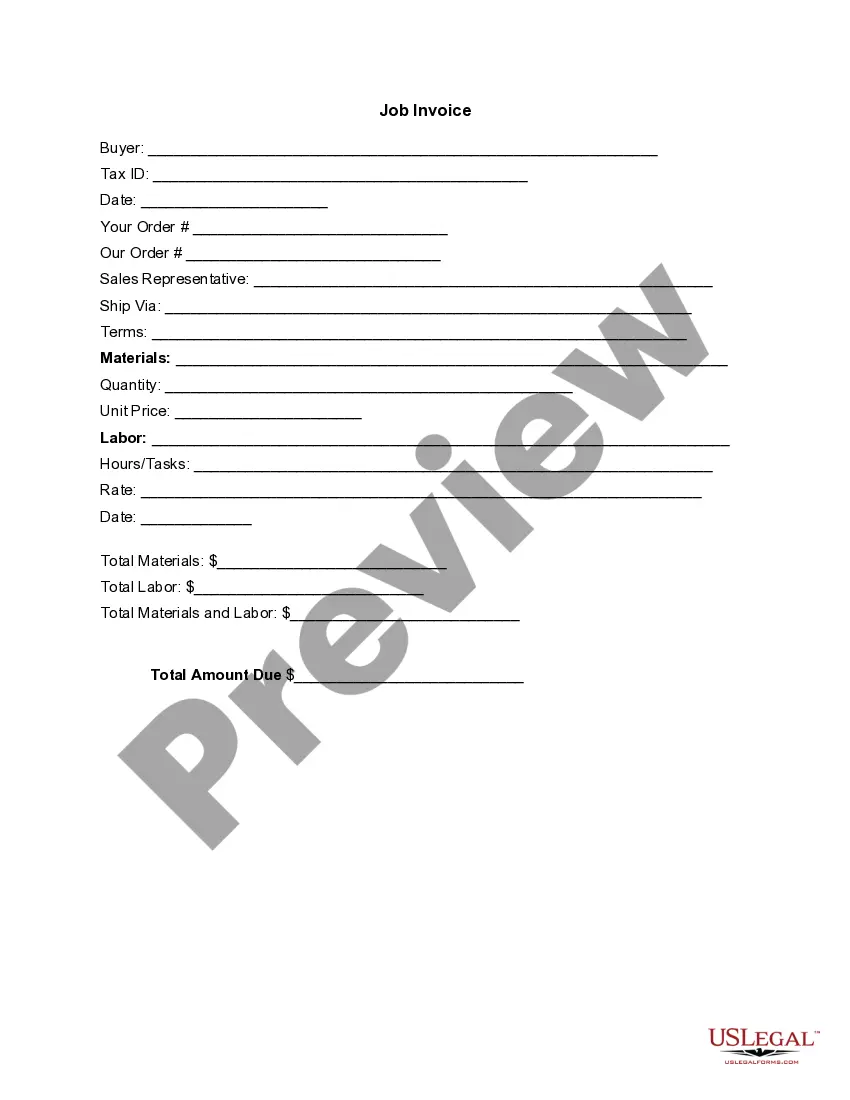

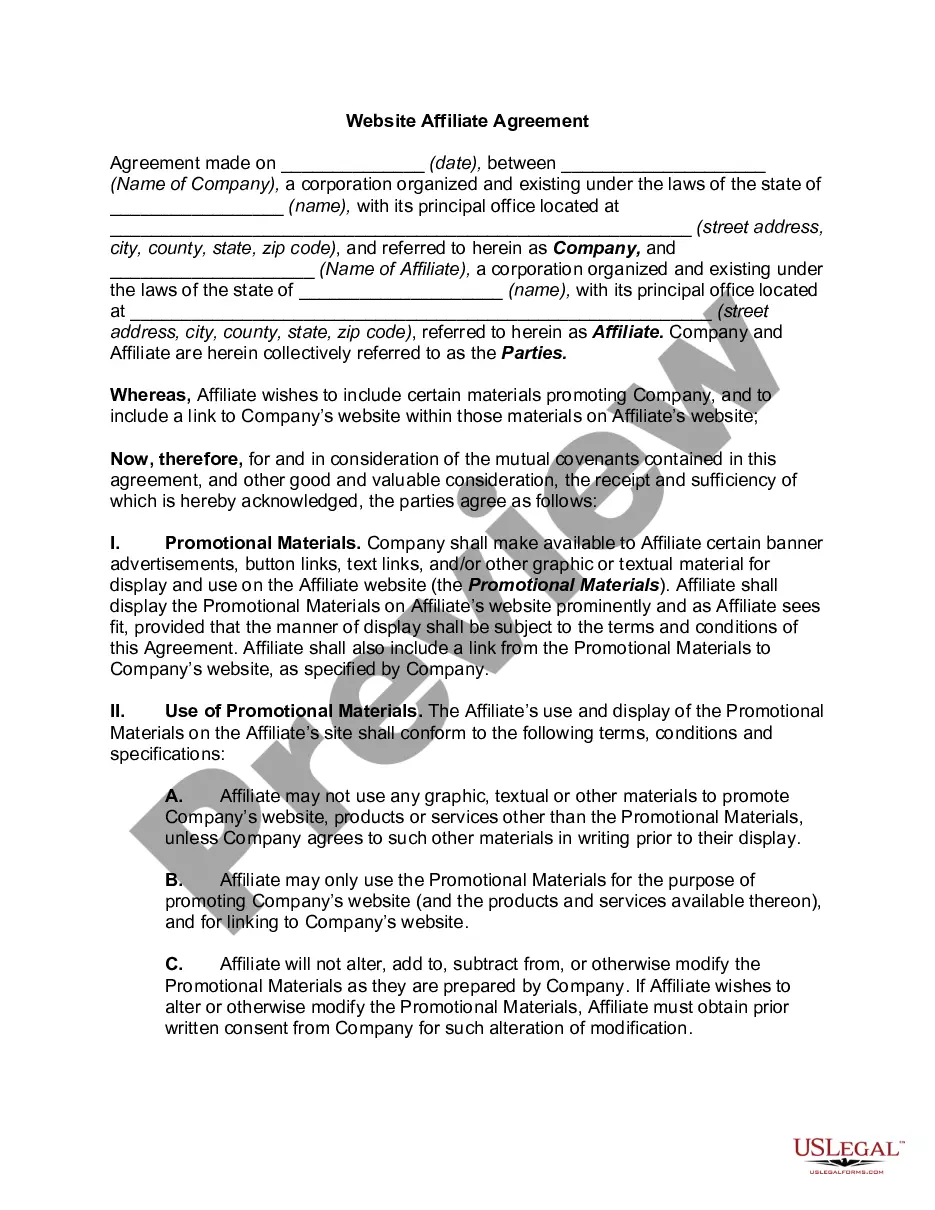

Form 8594 examples in Miami-Dade serve to outline the specifics of asset purchase agreements in business transactions. This form is particularly important for attorneys, partners, owners, associates, paralegals, and legal assistants involved in the sale or acquisition of business assets. Key features of Form 8594 include sections detailing the assets purchased, liabilities assumed, payment terms, and conditions precedent to closing. Users must fill in transaction specifics, including asset descriptions and purchase prices, while ensuring compliance with local laws. The form also captures critical agreements related to non-competition and security interests. It provides clear guidance on representation and warranties for both buyers and sellers, which strengthens the legal standing of both parties. Filling out the form accurately ensures that both parties understand their rights and obligations, while editing allows customization to fit specific transactions. The form is essential for maintaining a legally sound framework in business asset transactions.

Free preview