Sale Business Asset With Customer In King

Category:

State:

Multi-State

County:

King

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

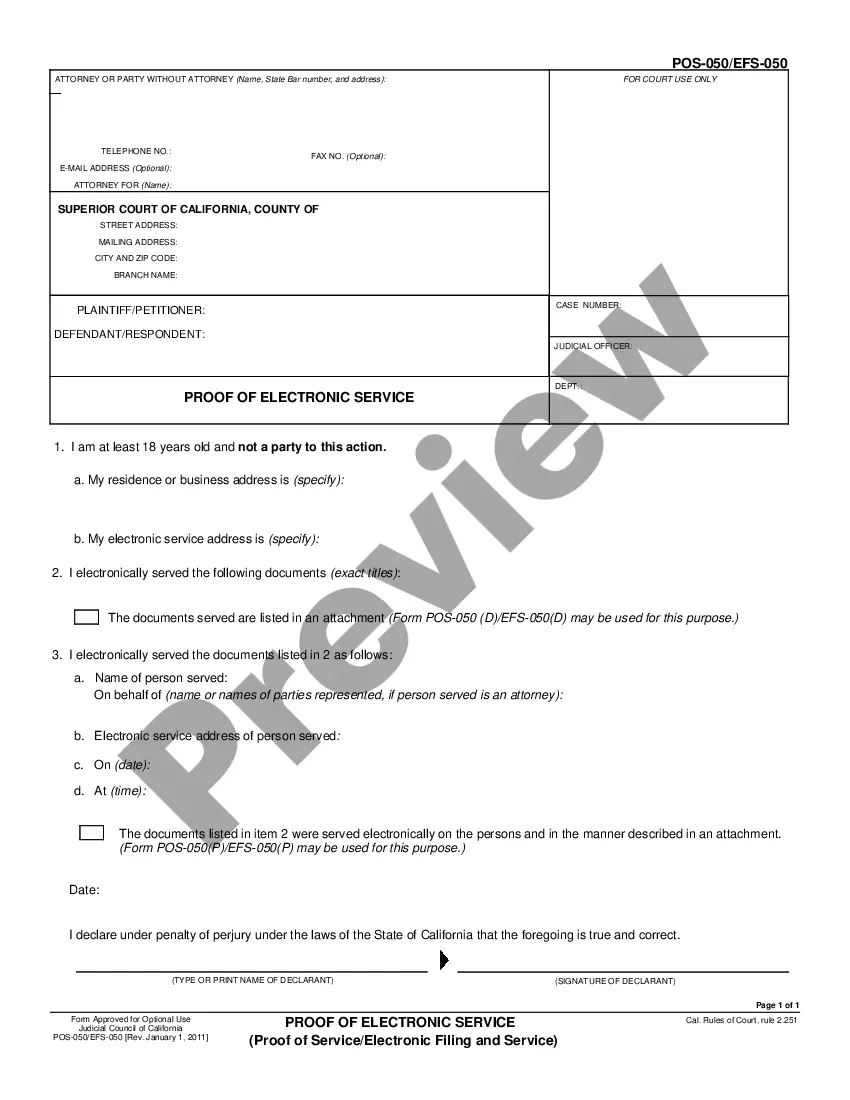

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Each sale has different pros and cons. This article offers guidance on helping clients take advantage selling personal goodwill as a tax strategy.In an asset sale, the new owner purchases the business's physical assets. The seller retains all rights to the legal entity. A business usually has many assets. In this article, we discuss what asset sales are, how they work and how to calculate a loss or gain because of an asset sale. Question: King wanted to purchase the business but explained that he could not afford to pay the entire amount in cash. An asset sale involves the purchase of individual assets and liabilities. An asset sale occurs when the assets of your business are sold to a buyer. Buy and sell online businesses and websites that have been thoroughly vetted on the largest curated marketplace at Empire Flippers.