Asset Purchase Agreement Irs Form In Franklin

Category:

State:

Multi-State

County:

Franklin

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

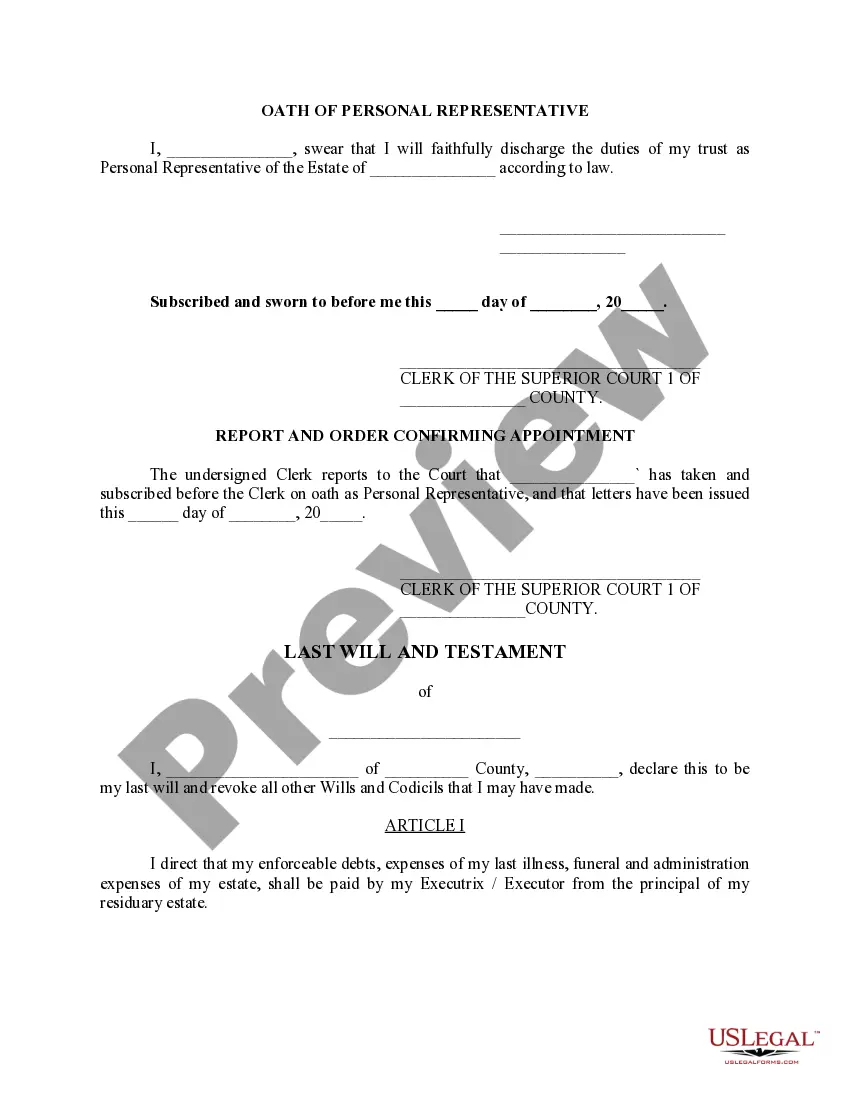

The Asset Purchase Agreement IRS form in Franklin facilitates the transfer of business assets from a seller to a buyer, ensuring clarity in the terms of sale. Key features include sections outlining assets purchased, liabilities assumed, payment structure, and representations and warranties from both parties. Users are guided to modify the agreement to suit their specific circumstances and delete non-applicable provisions. It is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who need a comprehensive framework for asset transactions. The form emphasizes the importance of details like purchase price allocation, payment timelines, and agreements regarding non-competition, which mitigate potential disputes. Blank spaces provided ensure customizability for legal entities involved. Strict adherence to local laws and IRS regulations is crucial, making this form a vital tool for professionals engaged in business transactions.

Free preview