Form 8594 Class For Prepaid Expenses In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

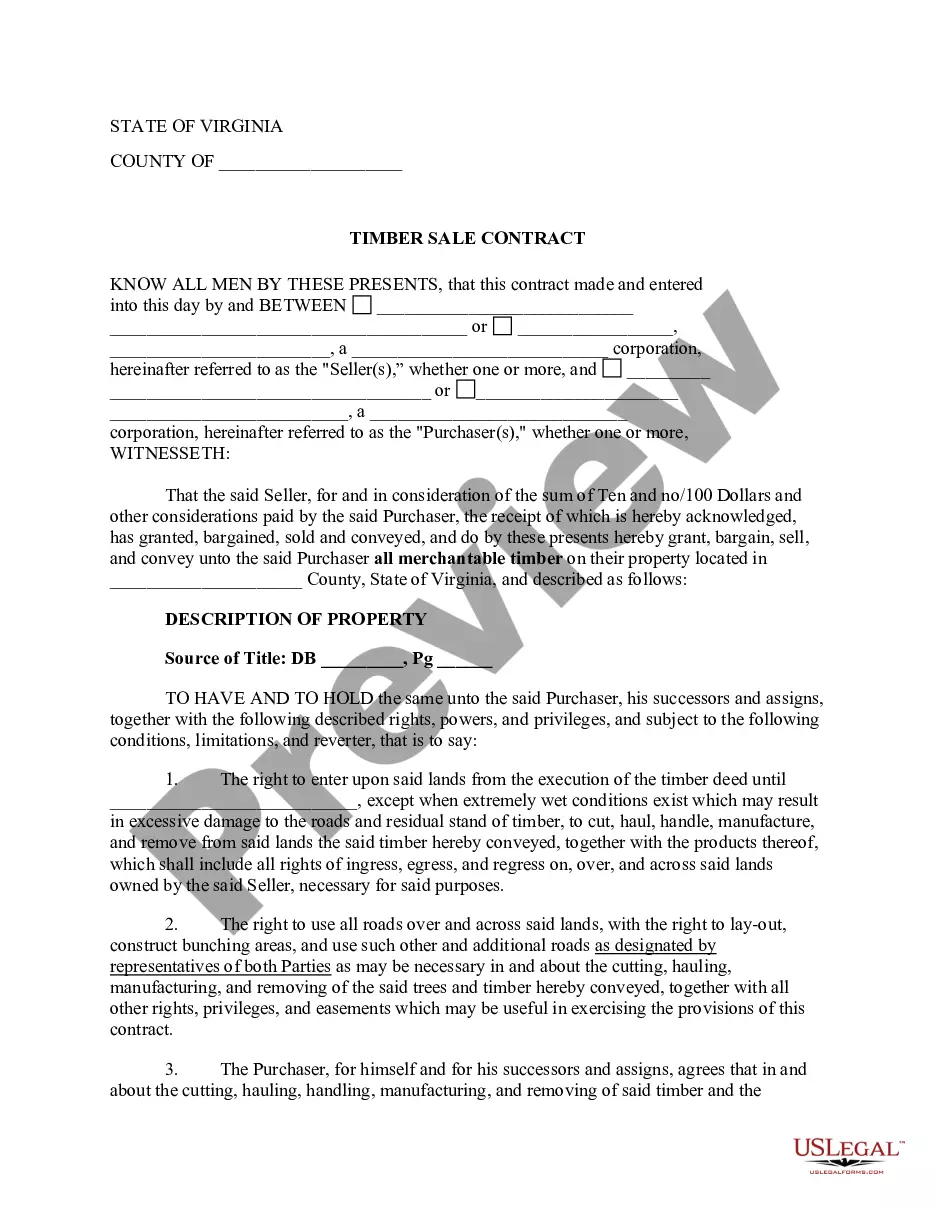

Form 8594 class for prepaid expenses in Fairfax is essential for accurately documenting the allocation of prepaid expenses during an asset sale. This form is particularly beneficial for legal professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants, as it facilitates compliance with IRS requirements on asset purchase agreements. Key features include sections for detailing the type and amount of prepaid expenses, as well as provisions to ensure clarity in the financial responsibilities of both involved parties. To fill out the form, users should gather necessary financial documents and ensure that all applicable information is included, making sure to modify the template as per their unique financial circumstances. Attorneys and paralegals can advise clients on the implications of the prepaid expenses listed, helping them navigate potential liabilities. This form is useful in transactions where an asset purchase agreement necessitates the careful accounting of non-cash items like prepaid expenses, helping to avoid disputes and ensuring tax compliance.

Free preview