Form 8594 Examples In Cuyahoga

Category:

State:

Multi-State

County:

Cuyahoga

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

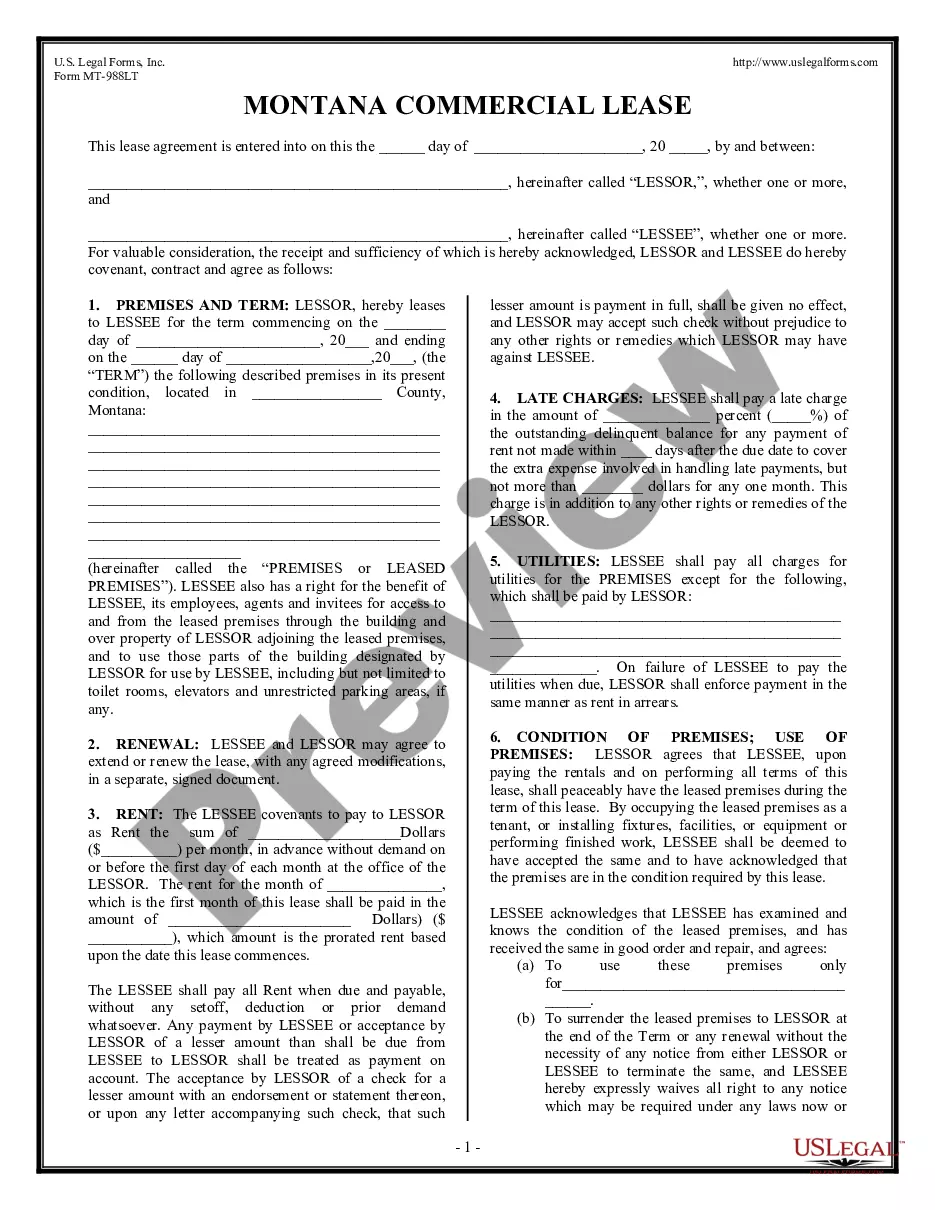

Form 8594, especially relevant in Cuyahoga, is critical for documenting asset purchases, detailing both the assets being sold and the terms of the transaction. It primarily benefits attorneys, partners, owners, associates, paralegals, and legal assistants by ensuring compliance with various legal requirements and protecting both buyer and seller interests. This form clearly specifies the assets involved, outlines the purchase price, and addresses liabilities and exclusions, promoting clarity in transactions. Additionally, it sets forth payment terms and timelines, which is essential for financial planning and execution. Users can expect guidance on filling out the form effectively, including sections where they may need to delete non-applicable provisions. Specific use cases include businesses acquiring new assets, selling divisions, or merging partnerships, where a well-documented agreement is crucial for legal and financial clarity. The drafting process also emphasizes due diligence, requiring both parties to confirm the truth of representations made and to address indemnification to mitigate risks associated with undisclosed liabilities. Overall, Form 8594 serves as an essential tool in facilitating smooth and legally binding asset transactions.

Free preview