Form 8594 And Contingent Consideration In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

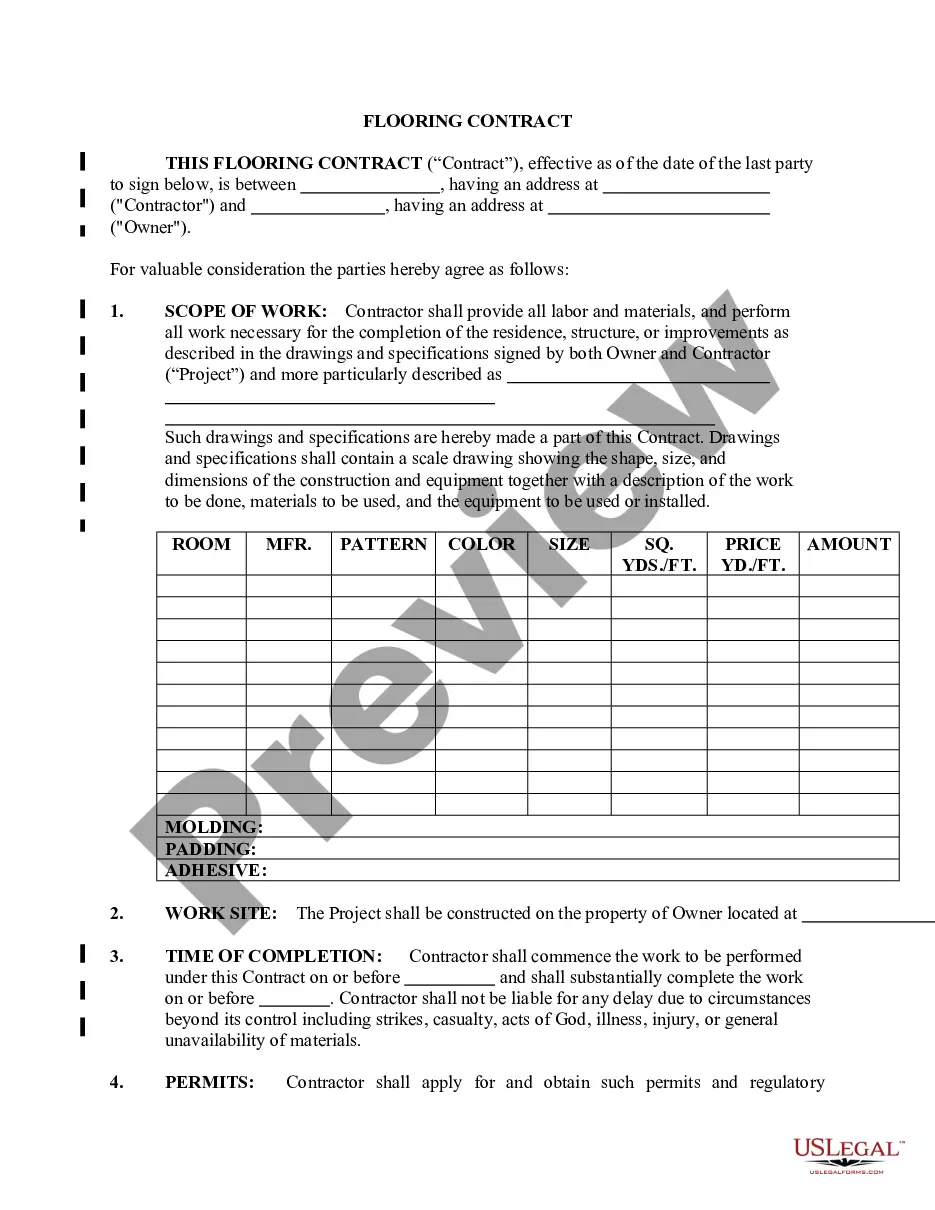

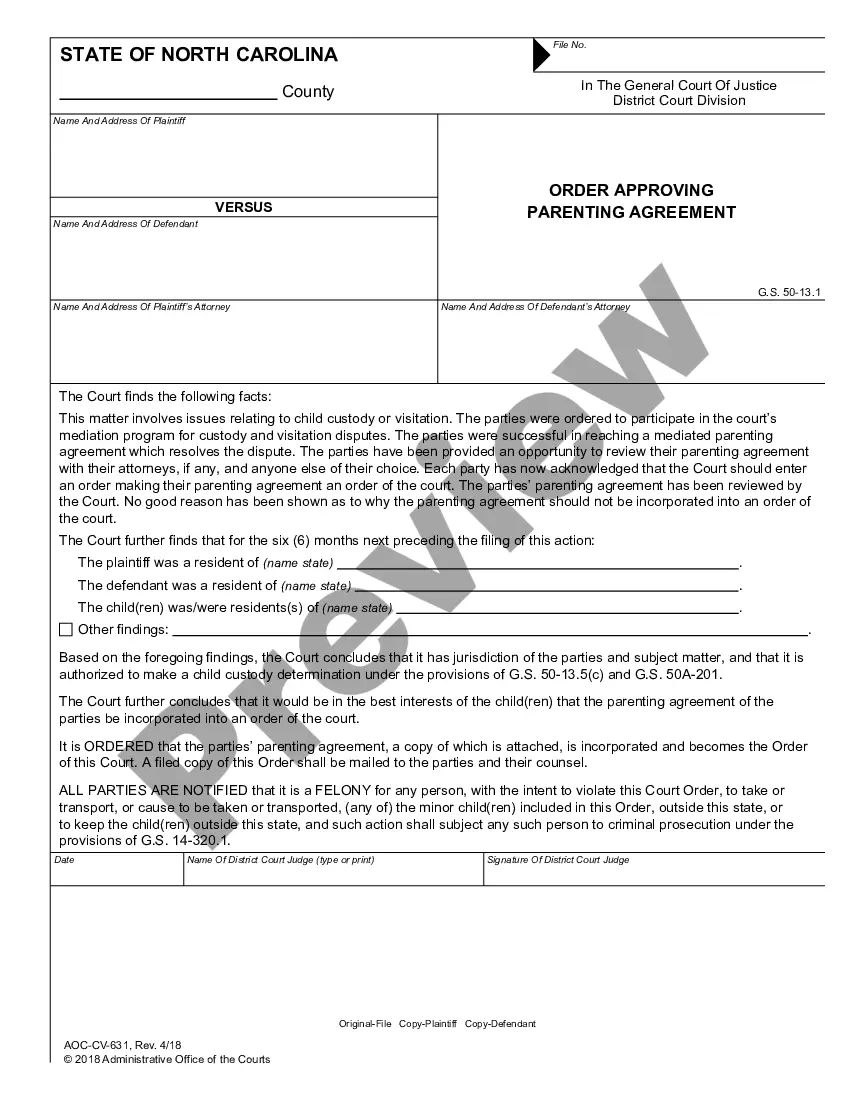

Form 8594 is a crucial document used for asset purchase agreements, particularly when the consideration includes contingent payments in transactions such as those involving Cook. This form helps parties allocate the purchase price among various asset classes, ensuring compliance with IRS regulations. Key features of this form include a clear delineation of assets being sold, liabilities assumed by the buyer, and a structured payment schedule. Additionally, it provides a mechanism for handling contingent consideration, which may arise after the closing of the transaction, thus safeguarding against potential disputes regarding the valuation of assets. Filling out Form 8594 requires detailed attention to the specific attributes of the assets and an accurate assessment of the purchase price allocation. The form can be edited to fit specific transaction facts and should exclude any irrelevant provisions. For the target audience—attorneys, partners, owners, associates, paralegals, and legal assistants—this form is essential in facilitating smooth asset transfers, ensuring both parties have a mutual understanding of the terms and conditions of the sale, and aids in future tax assessments or audits.

Free preview