Difference Between Asset Sale And Stock Sale For Tax Purposes In Broward

Description

Form popularity

FAQ

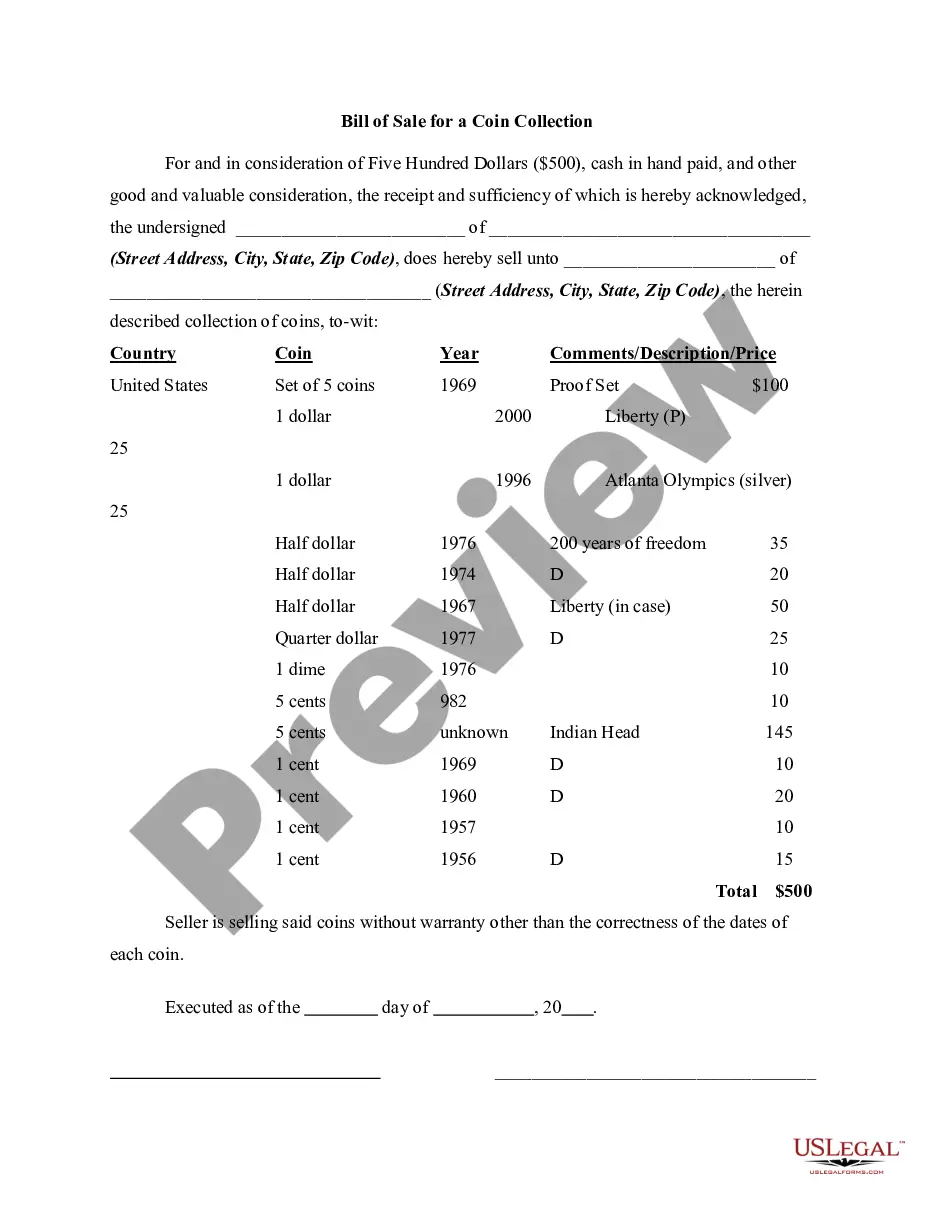

Asset transaction means any transaction or related series of transactions whereby the Issuer transfers certain of its assets to ReGen AG through a sale, capital contribution or otherwise.

The benefit of an asset sale, from the buyer's perspective, is that it can select which assets and liabilities to acquire in the deal, compared to a stock sale or merger, where the buyer acquires all the assets and liabilities of the target.

In an asset sale, the ownership of these acquired assets would change hands, with the buyer negotiating separately for each asset. In a stock sale, ownership of such assets does not change hands in the same way. The target still retains its ownership typically, even if the target has a new owner.

Disadvantages of an asset sale More complex: Since individual assets need to be transferred, the transaction can be more time-consuming and require more paperwork. Consents and assignments: Some contracts or agreements may require specific consents or approvals for the transfer of assets.

Stocks are considered a capital asset, however personal property are also considered capital assets.

The short answer is that a stock sale is better for you, the seller, while the buyer benefits from an asset sale. But, since we're talking about the IRS, there are infinite variations and complications. As such, you will want to get professional tax and legal advice before proceeding.