Purchase Of Asset Double Entry In Alameda

Category:

State:

Multi-State

County:

Alameda

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

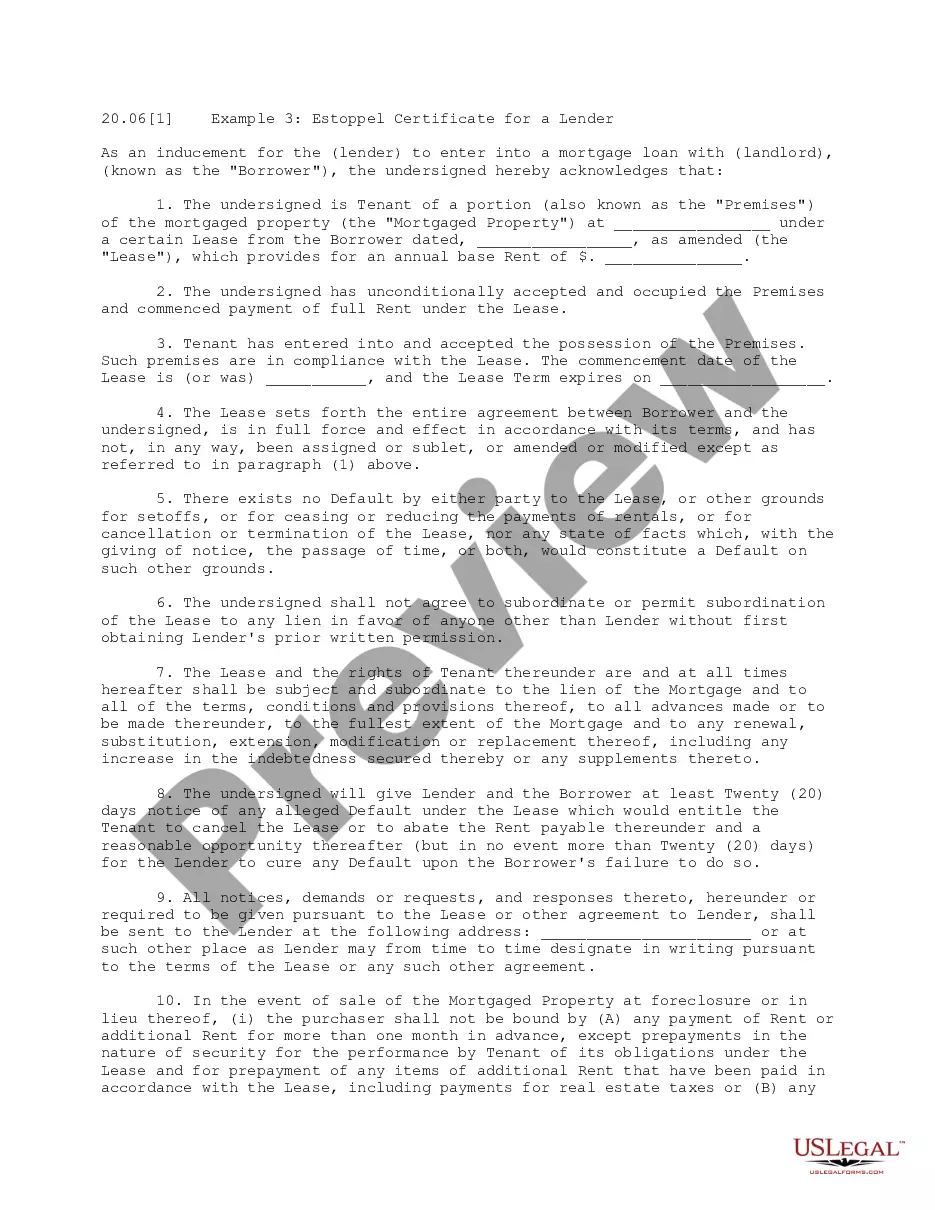

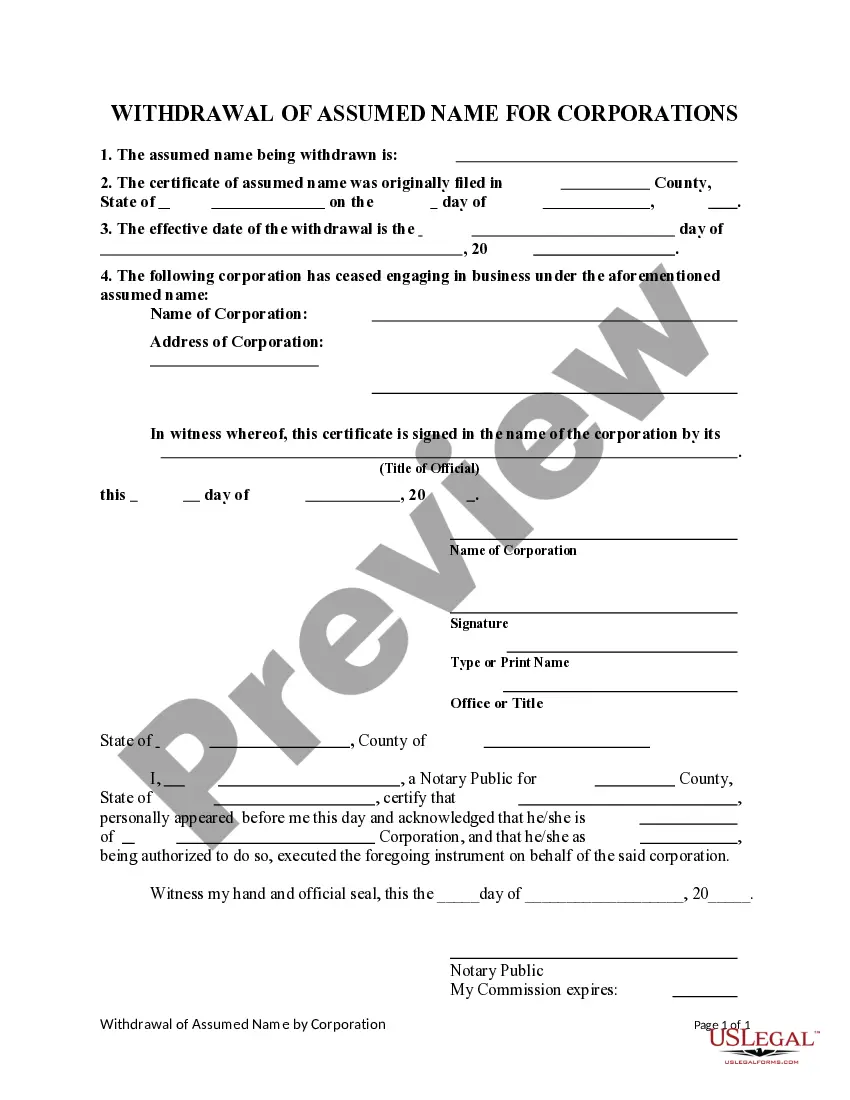

The Purchase of Asset Double Entry in Alameda form is designed for transactions involving the acquisition of assets between a Seller and a Buyer within the jurisdiction of Alameda. This comprehensive agreement outlines the terms of the sale, including the assets to be purchased, liabilities to be assumed, and the purchase price allocation. Key features include detailed sections addressing the purchase price payment structure, security interests, seller representations, and buyer obligations, ensuring clarity in the expectations and responsibilities of each party involved. Users are instructed to modify sections and insert specific details relevant to their transaction, such as closing dates and amounts owed, enhancing the form's usefulness. This document benefits attorneys, partners, owners, associates, paralegals, and legal assistants by providing a structured template to facilitate asset purchases, minimize legal risks, and ensure compliance with local laws. The use cases extend to any real estate, corporate transactions, or equipment sales where detailed asset transfer documentation is required. The clear structure and instructions also aid in effective communication and understanding among parties, making it accessible even to those with limited legal experience.

Free preview

Form popularity

FAQ

The double entry system requires two entries for each transaction: a debit and a credit. Any purchases, such as raw materials or assets, as well as any payments from customers, must all be recorded in two places in the ledger under this system.

Here's how to journalize the transaction. Step 1: Identify the Disposed Asset – ... Step 2: Calculate the Carrying Value – ... Step 3: Record the Disposal Date – ... Step 4: Adjust Accumulated Depreciation – ... Step 5: Update Fixed Asset Account – ... Step 6: Calculate Gain/Loss on Disposal – ... Step 7: Record Gain/Loss –