Deferred Agreement Sample With Solution In Massachusetts

Description

Form popularity

FAQ

You may increase, decrease or stop your contributions at any time by calling the SMART Plan Service Center at 877-457-1900 or by logging on to the website at .mass-smart.

My withdrawal may be subject to fees and/or loss of interest based upon my investment options, my length of time in the Plan and other possible considerations. If I have not been advised of the fees and risks associated with my withdrawal, I may contact Service Provider for a withdrawal quote at 1-877-457-1900.

You may voluntarily defer additional income into the 457(b) plan/MA SMART Plan through Empower Retirement up to the IRS limit of $23,500 if you are under 50 years of age, or $31,000 if you are 50 years or older. New for calendar year 2025, if you are aged 60-63, your limit is $34,750.

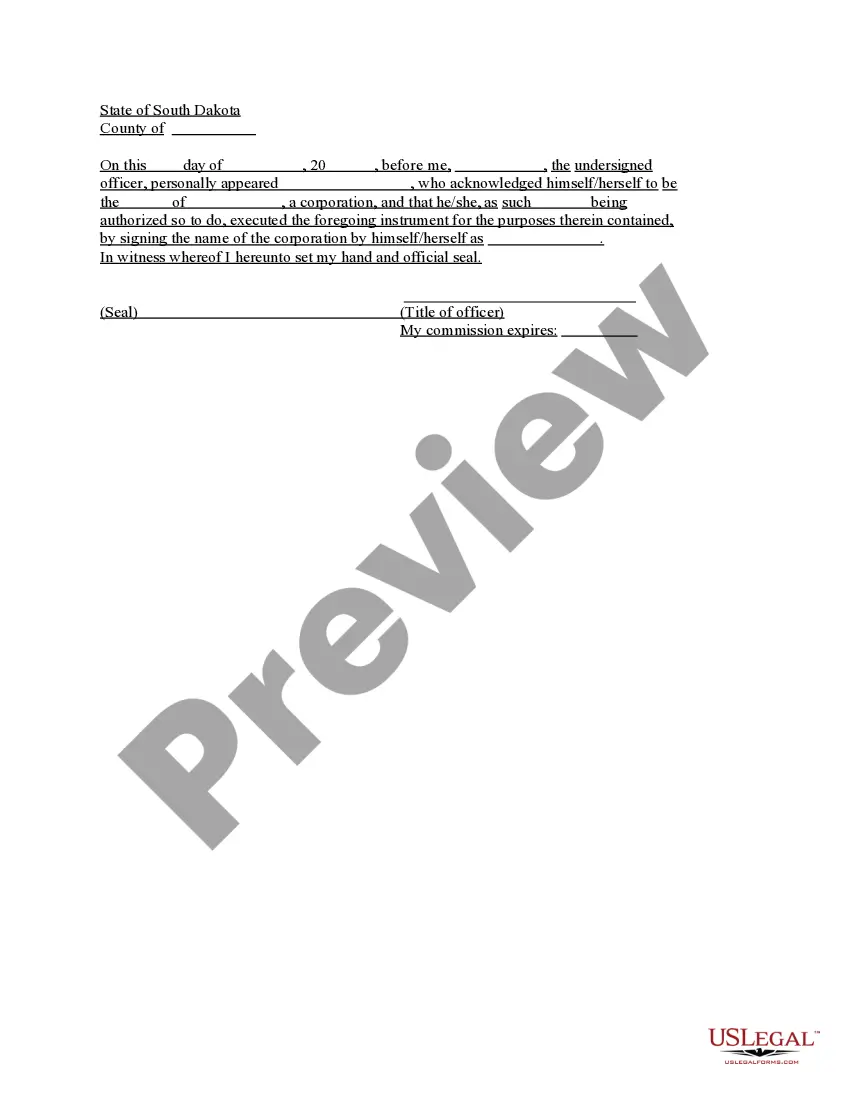

A deferral agreement is a legally binding document between parties that agree to postpone a specific action or obligation to a later date.

A deferral agreement is a legally binding document between parties that agree to postpone a specific action or obligation to a later date.

Here are some examples of deferrals: Insurance premiums. Subscription based services (newspapers, magazines, television programming, etc.) Prepaid rent.

A deferred payment is one that is delayed, either completely or in part, in order to give the person or business making the payment more time to meet their financial obligations. In accounting terms, any merchant allowing customers to set up a deferred payment agreement will be dealing with accrued revenue.

The act of deferring or putting something off until later; postponement: If you are unable to take the exam, you can request a deferral of your registration fees to the next exam date.