Employment Application En Español Withholding Allowance Certificate In Georgia

Description

Form popularity

FAQ

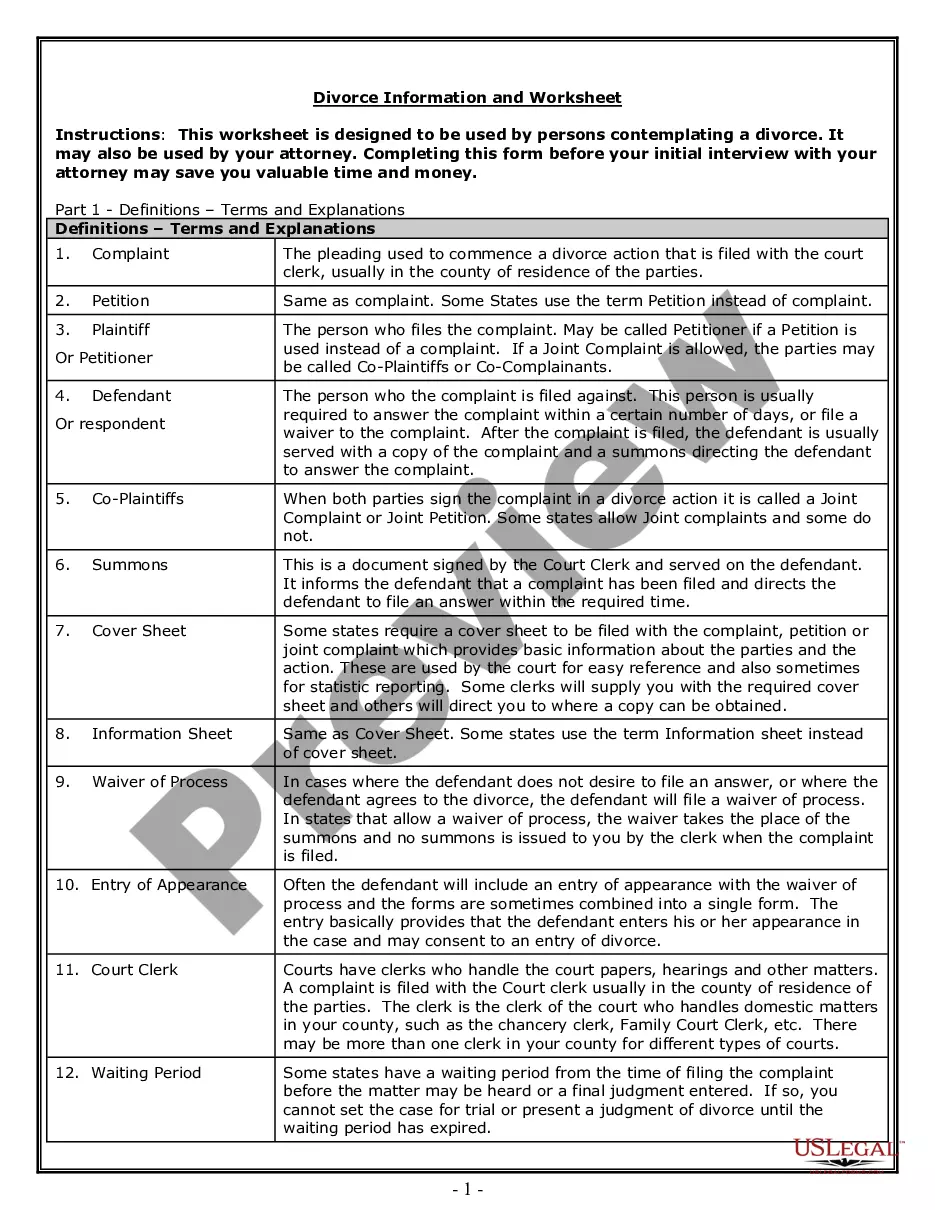

The Georgia Form G-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

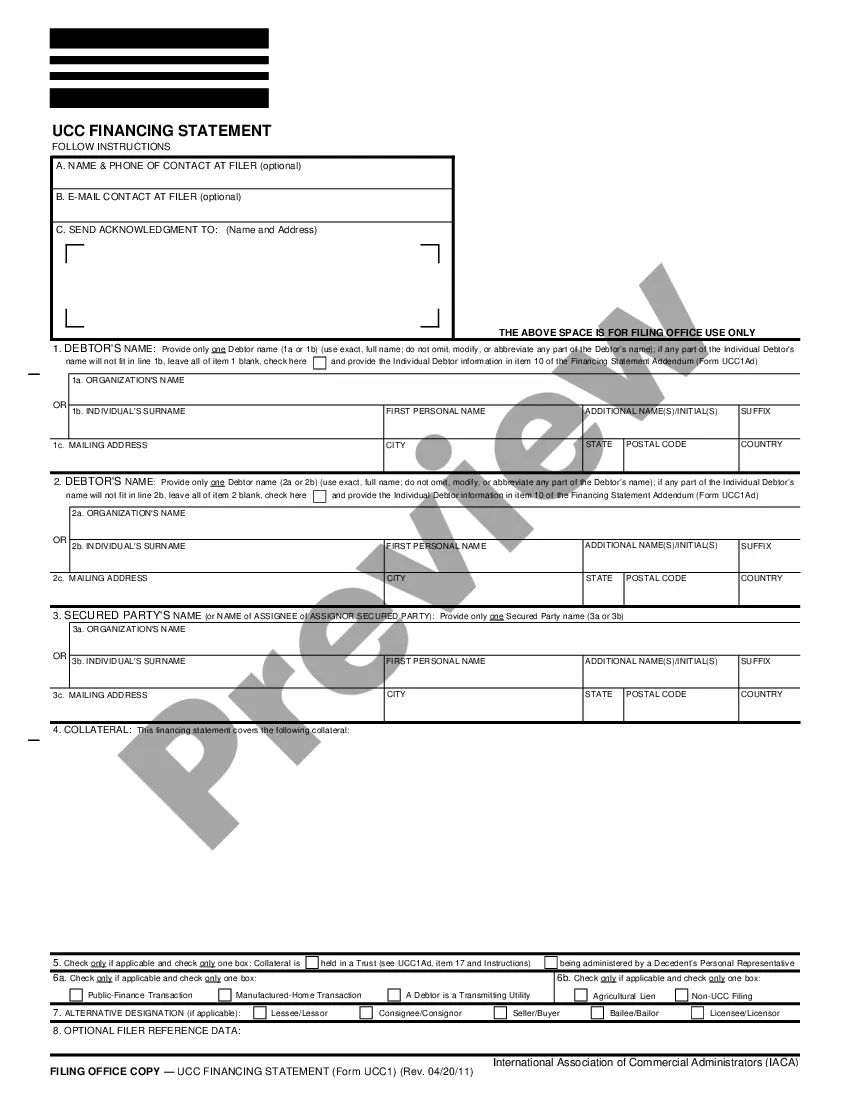

Register online as a new business on the Department of Revenue Georgia Tax Center platform, then select "Withholding Tax" as the account type. Your account number is typically issued immediately upon registration.

What is Georgia's standard deduction? The standard deduction allows taxpayers to reduce their taxable income by a fixed amount. In 2024 (taxes filed in 2025), the Georgia standard deduction is $24,000 for those married filing jointly and $12,000 for single filers, heads of household and those married filing separately.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

Dependent Allowance = $3,000 x Number of Dependents and additional allowances. Apply taxable income computed in step 7 to the following table to determine the annual Georgia tax withholding.

Beside the correct marital status, enter either a one (-1-) if you wish to claim yourself or a zero if you do not. 4 Enter the number of dependent allowances you wish to claim, if any. 5 Enter the number of additional allowances you wish to claim, if any, based on completion of the worksheet in the middle of the page.

Georgia payroll taxes A 2022 house bill eliminated the personal income tax brackets and replaced them with a flat tax rate of 5.49%.

Two allowances at one job and zero at the other. If you are married and have one child, you should claim three allowances. Can I Fill out a New W-4 Form? Yes, employees can submit a new W-4 form to their employee at any time during their employment.