Accounts Receivable Contract With Payment

Description

How to fill out Accounts Receivable - Contract To Sale?

It’s evident that you cannot transform into a legal expert instantly, nor can you master the art of rapidly drafting an Accounts Receivable Contract With Payment without possessing a specific set of abilities.

Assembling legal documents is a lengthy process that necessitates a particular education and expertise.

So why not entrust the formulation of the Accounts Receivable Contract With Payment to the specialists.

You can revisit your documents anytime from the My documents section. If you are an existing customer, simply Log In, and find and download the template from the same section.

Regardless of the intent behind your documents—be it financial, legal, or personal—our platform is here to assist you. Give US Legal Forms a try today!

- Utilize the search bar at the top of the page to find the document you require.

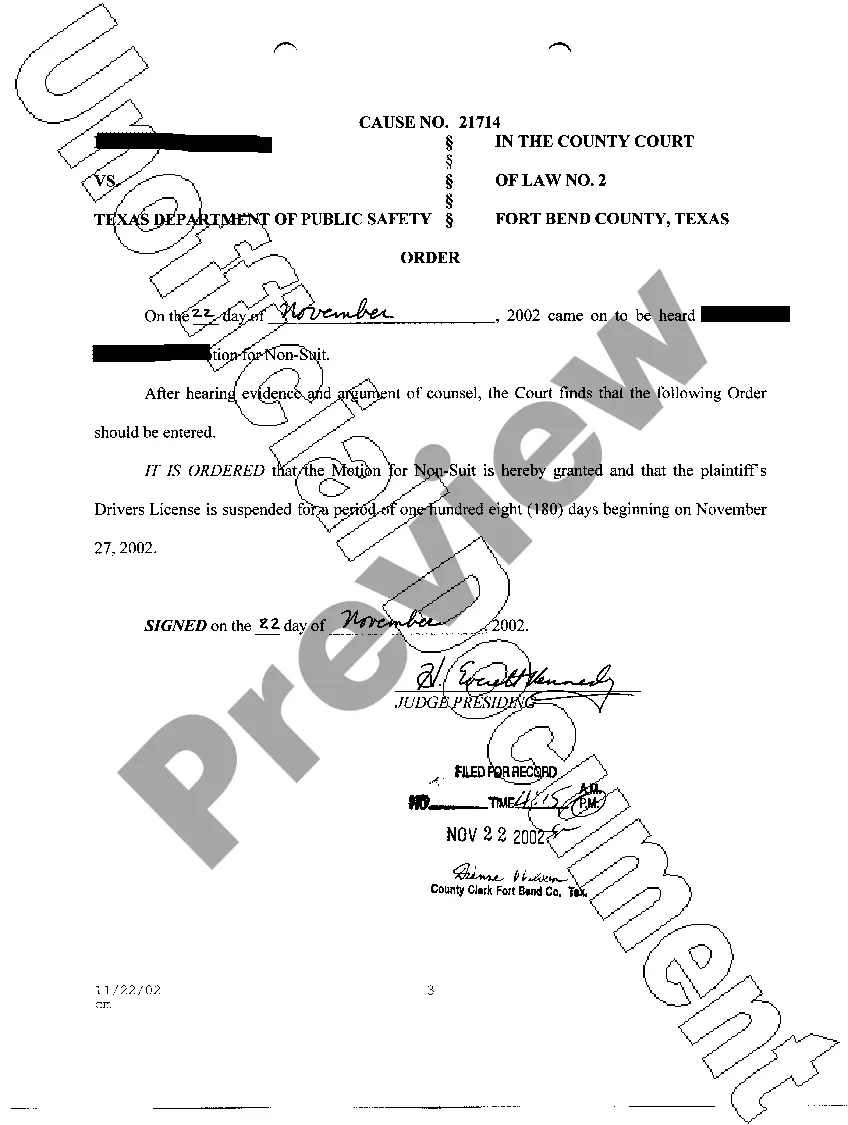

- If the preview option is available, examine it and read the accompanying description to ascertain if the Accounts Receivable Contract With Payment aligns with your needs.

- If you require a different document, restart your search.

- Create a free account and select a subscription plan to acquire the form.

- Click Buy now. Once the payment is processed, you can download the Accounts Receivable Contract With Payment, fill it out, print it, and send it to the relevant individuals or organizations.

Form popularity

FAQ

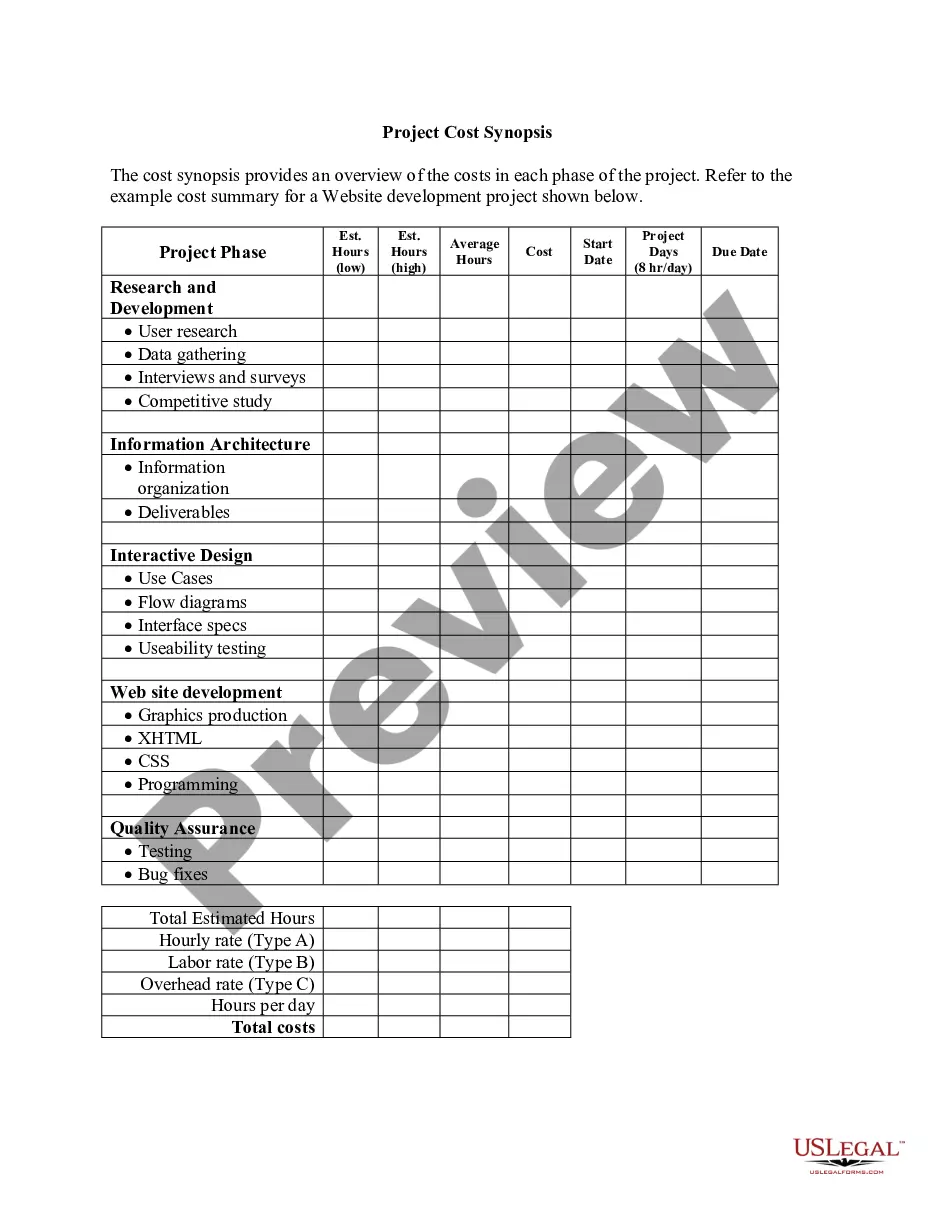

Writing payment terms in a contract involves clearly stating the due date, accepted payment methods, and any penalties for late payments. It is essential to be specific about the payment schedule to avoid misunderstandings. Including these details in an accounts receivable contract with payment can help ensure all parties understand their obligations, leading to smoother transactions.

When establishing accounts receivable, you will typically make a journal entry that debits accounts receivable and credits sales revenue. This entry reflects the transaction where you have provided goods or services on credit. Keeping clear records of these transactions is crucial for managing your financial health. An efficient accounts receivable contract with payment can assist in monitoring these entries effectively.

Yes, a payment agreement can be legally binding if it meets the necessary legal requirements, such as mutual consent and consideration. Ensure both parties sign the agreement, and consider having it notarized for added protection. A properly drafted accounts receivable contract with payment will provide both parties with legal recourse in case of non-compliance.

To record accounts receivable payments, first, create a record of the payment received, noting the date, amount, and method of payment. Update your accounting software or ledger to reflect the transaction, reducing the outstanding balance. Accurate recording is essential for maintaining financial health and tracking the success of your accounts receivable contracts with payment.

To write a contract agreement for payment, start with the names and contact information of both parties, followed by a detailed description of the payment terms. Include the total amount due, payment methods, and timelines. A well-structured accounts receivable contract with payment will minimize misunderstandings and provide clarity.

An accounts receivable contract is a legal document that outlines the terms of payments owed by a debtor to a creditor. It specifies payment schedules, interest rates, and any penalties for late payments. This contract helps protect both parties and provides a clear framework for managing debts effectively.

To ensure a payment plan is legally binding, include essential elements such as offer, acceptance, consideration, and mutual consent in your agreement. Clearly outline the payment terms and have both parties sign the document. By using a well-drafted accounts receivable contract with payment, you can enhance the enforceability of the agreement.

To create a payment agreement contract, start by outlining the terms clearly, including the total amount owed, payment schedule, and consequences for missed payments. Ensure both parties sign the document to acknowledge their agreement. Utilizing platforms like US Legal Forms can streamline the process, providing templates specifically for accounts receivable contracts with payment.

A payment agreement does not necessarily have to be notarized to be valid. However, notarization can provide an extra layer of security and help prevent disputes. It is advisable to review your specific state laws or consult with a legal professional when drafting an accounts receivable contract with payment to ensure compliance.

To write a legal contract for payment, begin by clearly outlining the terms, including payment amounts, due dates, and consequences for late payments. Include details about the goods or services provided, as well as any applicable laws or regulations. Using a platform like USLegalForms can simplify this process, ensuring your accounts receivable contract with payment is both effective and compliant with legal standards.