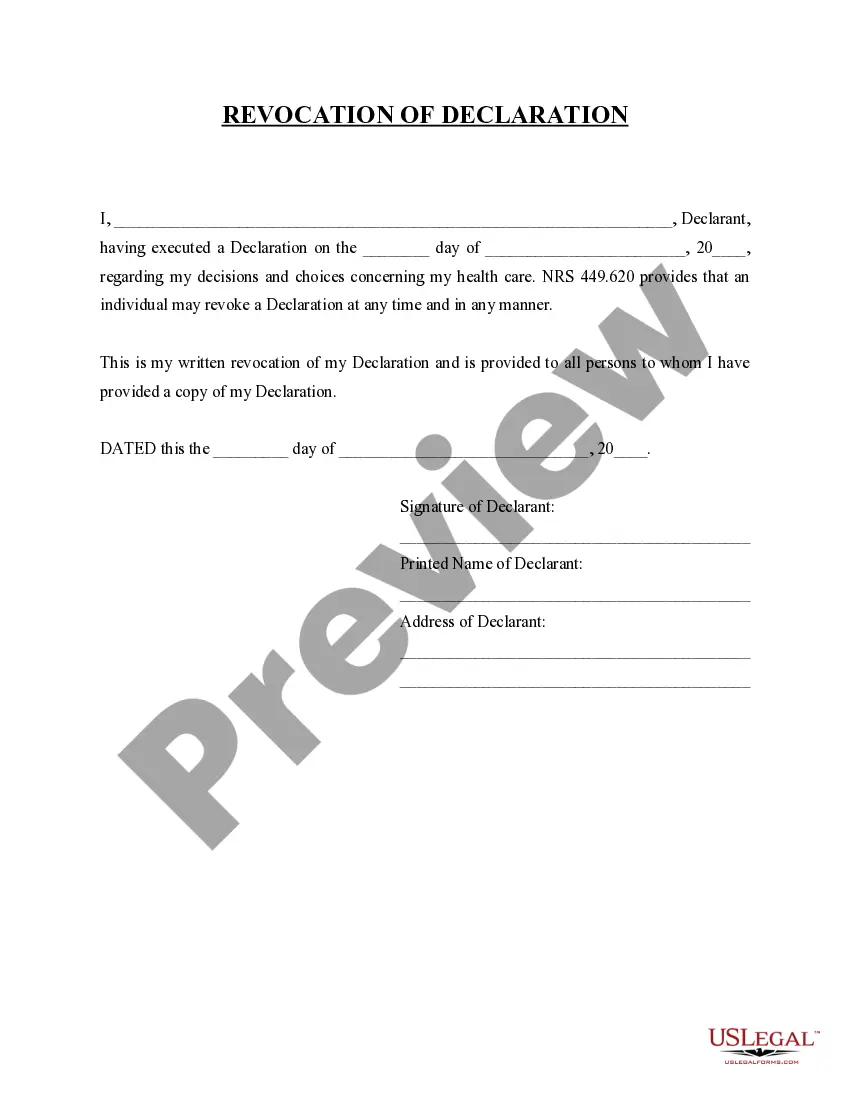

This form is a sample letter in Word format covering the subject matter of the title of the form.

Ejemplo De Recibos In Maricopa

Description

Form popularity

FAQ

Recorder's Office Main Downtown Office. 301 W Jefferson St. Second Floor, Suite 200. Phoenix, AZ 85003. am - pm. Monday - Friday. Map.

BENEFICIARY DEEDS §33-405 (statute includes a sample form) available from the Arizona Legislature Website. ➢ Beneficiary deeds are filed in the Maricopa County Recorder's Office.

Maricopa sales tax details The minimum combined 2025 sales tax rate for Maricopa, Arizona is 8.7%. This is the total of state, county, and city sales tax rates. The Arizona sales tax rate is currently 5.6%. The Maricopa sales tax rate is 2.0%.

Filing a Will or Probate Case The Probate Filing Counter is located at 201 W. Jefferson in Phoenix, or at our Southeast location, 222 E. Javelina in Mesa, or at our Northwest Regional Court Center location at 14264 W.

➢ Beneficiary deeds are filed in the Maricopa County Recorder's Office.

You can record a document in-person, by mail, or electronically. Your document must be an ORIGINAL or government-issued CERTIFIED copy to be accepted for recording. For more information on Recording Requirements, please see our Form Requirements, as pursuant to A.R.S. 11-480.

All records requests must be submitted in writing. Fill out our Records Request Form (see below) and submit it to the court. Your request can be submitted at our front counter, mailed to the Maricopa Municipal Court, 39600 W Civic Center Plaza, Maricopa, AZ 85138 or emailed.