Ejemplo Recibo Formato In Georgia

Description

Form popularity

FAQ

Georgia dependent allowances The measure increases the state's dependent tax exemption by 33%. Each eligible Georgia taxpayer can deduct $4,000 per dependent rather than the previous $3,000.

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

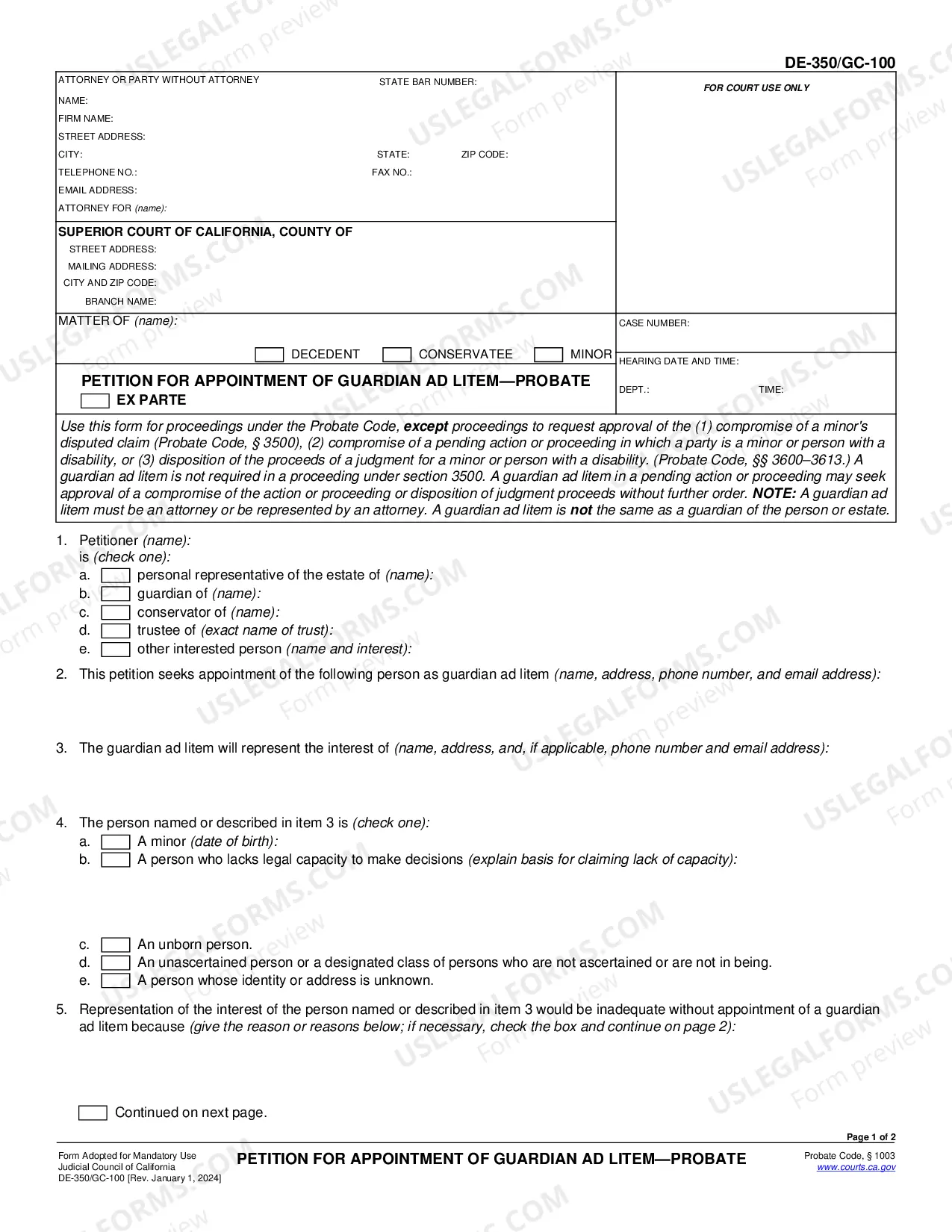

Identification number is a combination of numbers consisting of seven digits and approved by the decree of the Head of the Revenue Service (including 2 to 7 digits) and the codes of the taxpayer's legal forms.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your 9-character Withholding Number (0000000-XX; the first seven characters are numbers, and the last two are letters) once you complete the registration process.

The number of allowances you claim on your W-4 doesn't have to match the actual number of dependents or family members you have on your tax return. There could be other reasons, such as side income, for you to reduce the number of allowances you claim.

Mailing Address - Individual/Fiduciary Income Tax Individual/Fiduciary Income Tax FormMailing Address 500 and 500 EZ (refunds and no balance due) Georgia Dept. of Revenue PO Box 740392 Atlanta, GA 30374-0392 500 and 500 EZ (payments) Georgia Dept. of Revenue PO Box 740399 Atlanta, GA 30374-03995 more rows

For most taxpayers, sales tax returns are due every month; however, taxpayers may submit a written request to change their filing frequency.

AMENDED RETURNS To amend a return, check the amended return block on Form 600. A copy of the Federal Form 1120X or Federal audit adjustments must be attached. Mail the amended return to Georgia Department of Revenue, Processing Center, P.O. Box 740397, Atlanta, Georgia 30374-0397.