Letter Of Instruction To Bank Format In Massachusetts

Description

Form popularity

FAQ

Formal Letter Format Sample To Bank Subject: Briefly describe the purpose of the letter Dear Bank Manager's Name, Opening paragraph: Begin by introducing yourself and providing a brief overview of the purpose of. Complimentary close: Sincerely, Yours faithfully, Yours truly, etc. Your Full Name

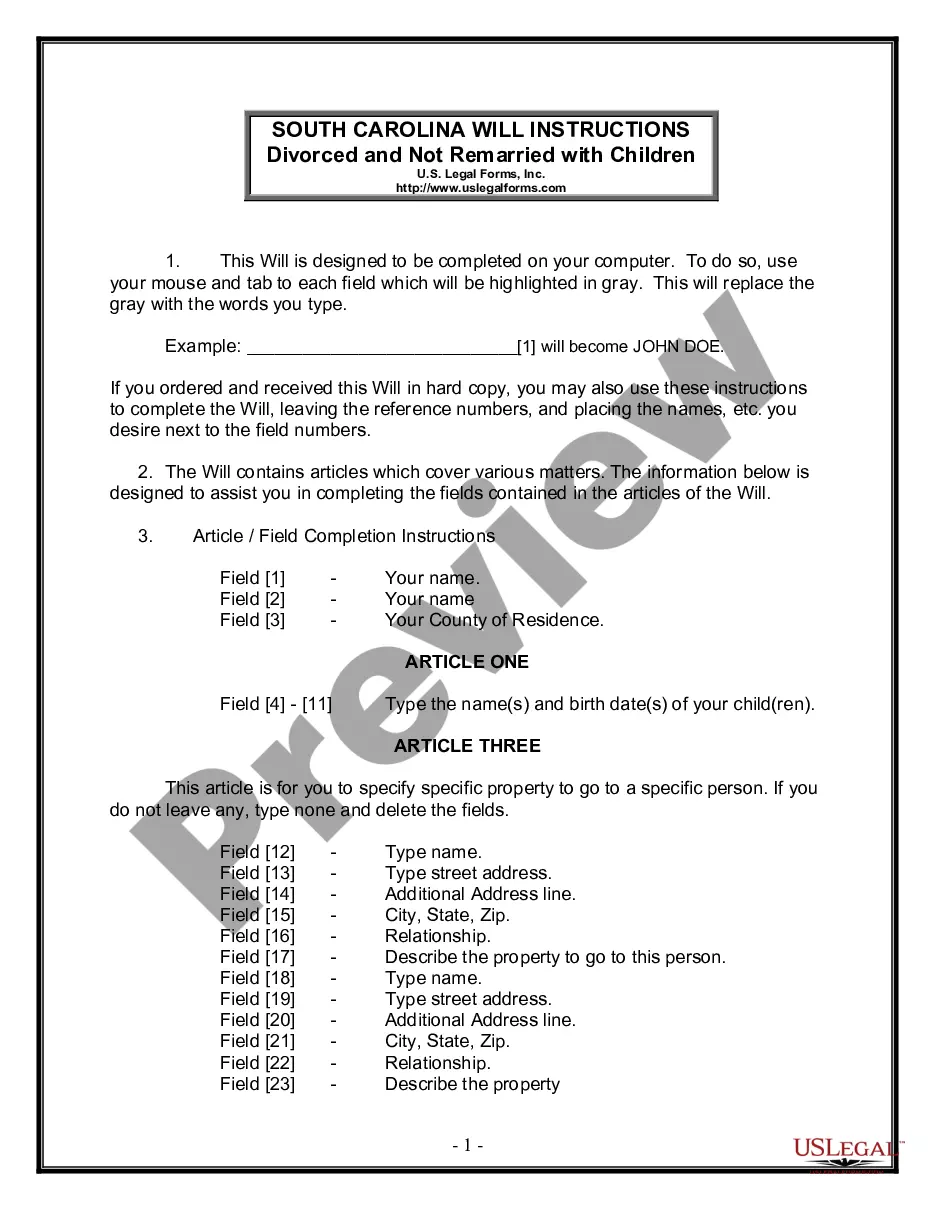

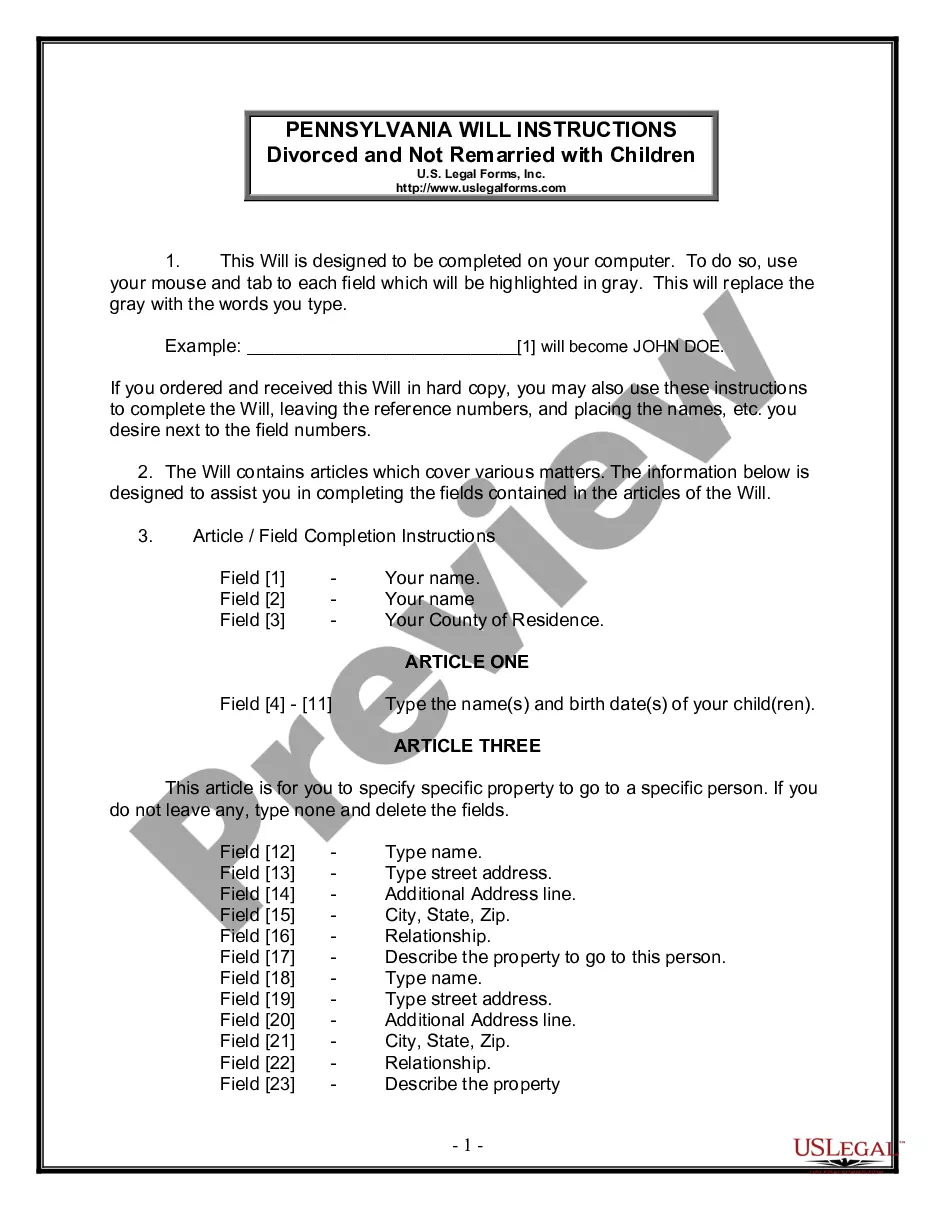

Here are six steps to write a letter of instruction: Create a header. Before you write the content of the letter, create a header at the top left-hand corner of the document. Address the reader. Explain the project or task. List each step. Conclude your letter. Revise the document.

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

The letter of instruction should include the following information: A summary of all assets and debts. The location of valuable physical assets (e.g., jewelry, art, collectibles, real estate) Details about your retirement and investment accounts.

It's a good way to let to those trusted to take care of your affairs know what you would want them to know. Since the letter of instruction is not a legal document, it does not need to be notarized or signed in the presence of witnesses or with any other special formality.

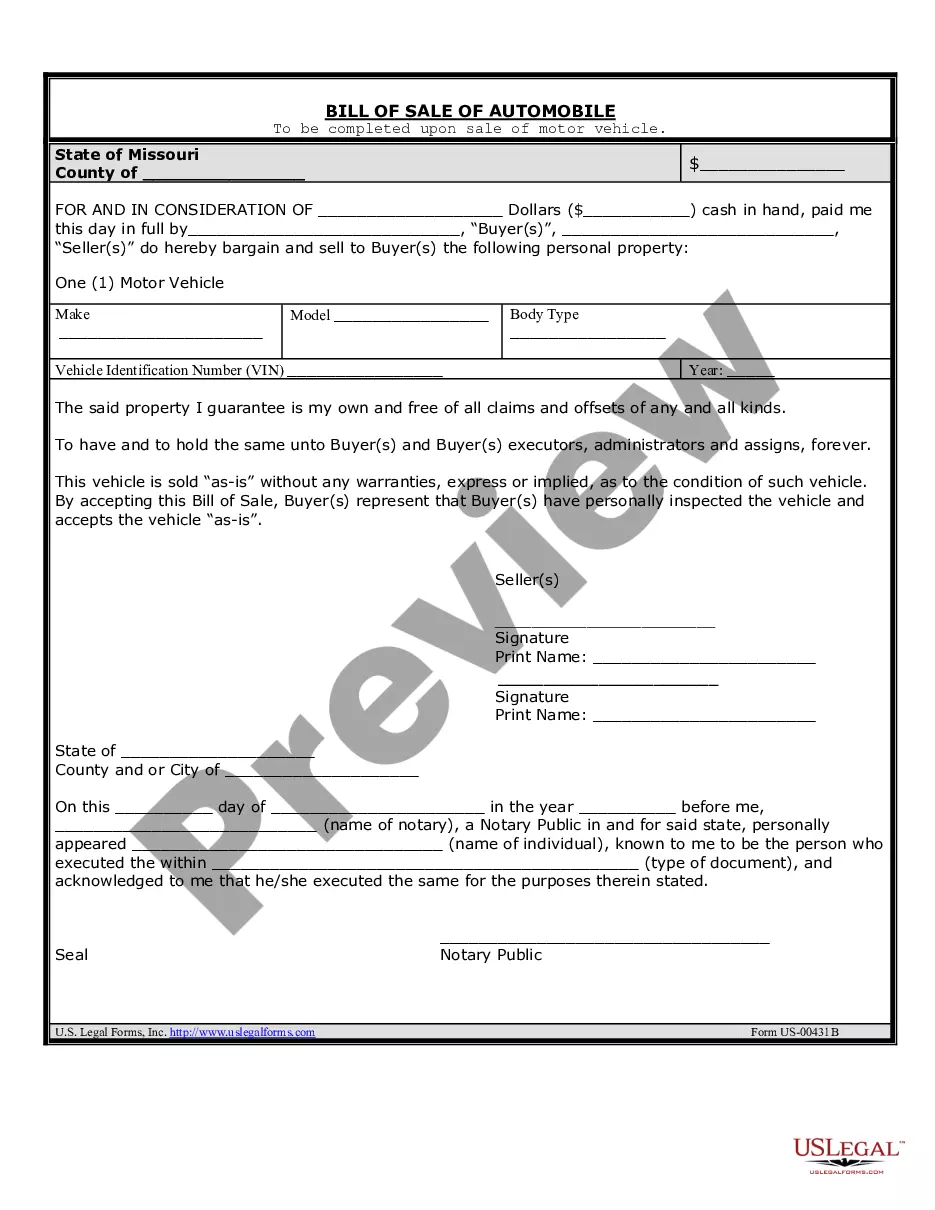

Bank forms we will provide to you, if necessary: – Notarized Letter of Instruction is completed by the entitled party (executor or person handling the decedent's affairs) and provides instruction on where the disbursed funds should be sent or transferred.

Whether visiting a bank location in person or using a bank's customer service phone line to initiate a name change, you should be prepared to provide these documents: A certified copy of your marriage certificate. Your updated Social Security card. Your updated photo ID (driver's license, passport, etc.).