Buyback Of Shares Resolution Format In Travis

Description

Form popularity

FAQ

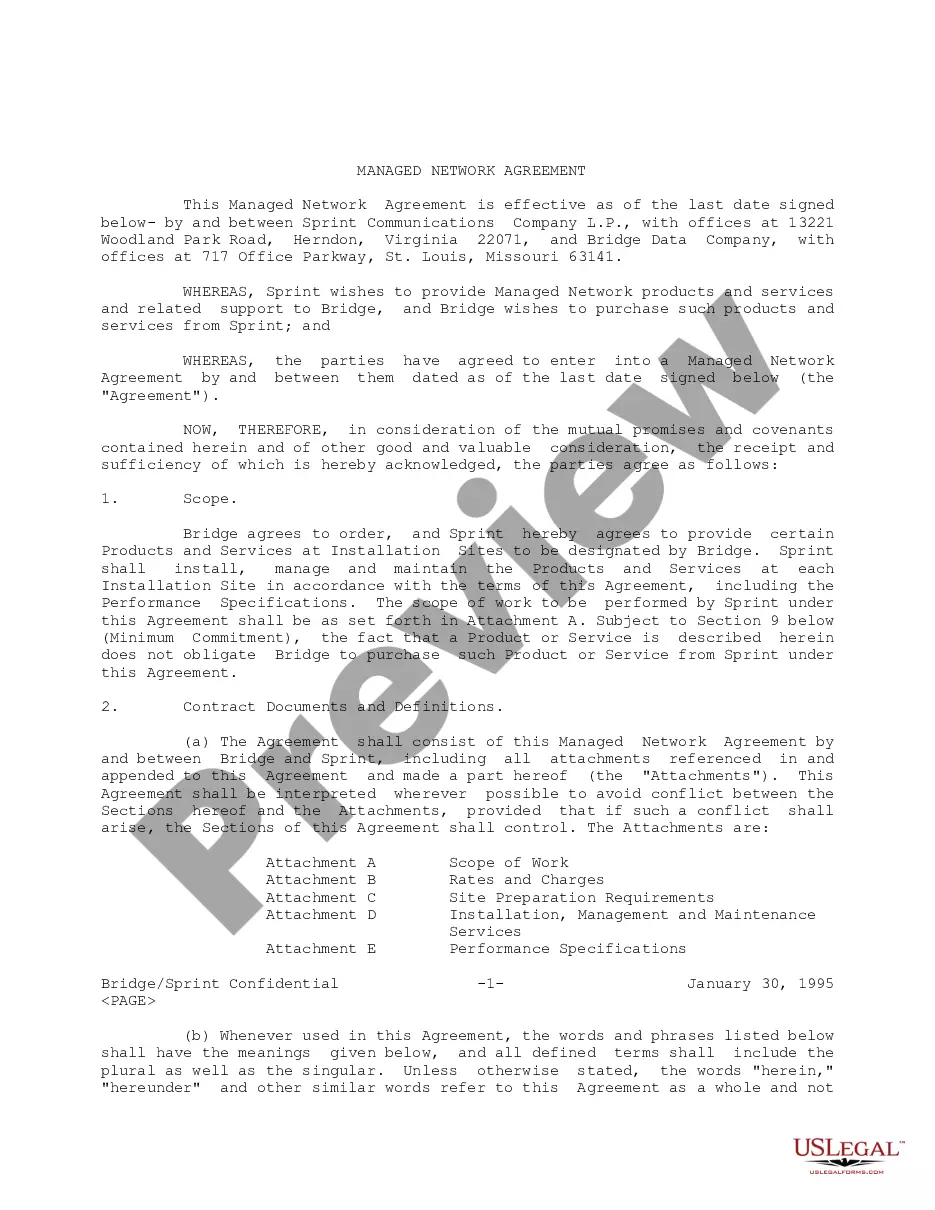

The buyback contract must be approved by a resolution of the shareholders. An ordinary resolution will normally suffice, unless the articles require a higher majority, and the company may implement the share buyback at any time after the shareholder resolution approving the buyback contract is passed.

Resolutions of the board of directors authorizing and approving a reporting company's stock repurchase program. These resolutions are drafted as standard clauses and should be inserted into board minutes or a form of unanimous written consent.

Approval requirements: Selective buybacks require either unanimous approval from all shareholders or a special resolution passed by 75% of eligible votes.

A special resolution is a method of passing a company decision that requires at least 75% of the votes cast by shareholders to be in favour of it.

Form 7208 is used by corporations to calculate the excise tax on stock repurchases. Under the IRS regulation in Section 4501 (the stock repurchase excise tax), certain corporations, known as "covered corporations," are required to file this excise tax for any stock repurchases made during the tax year.

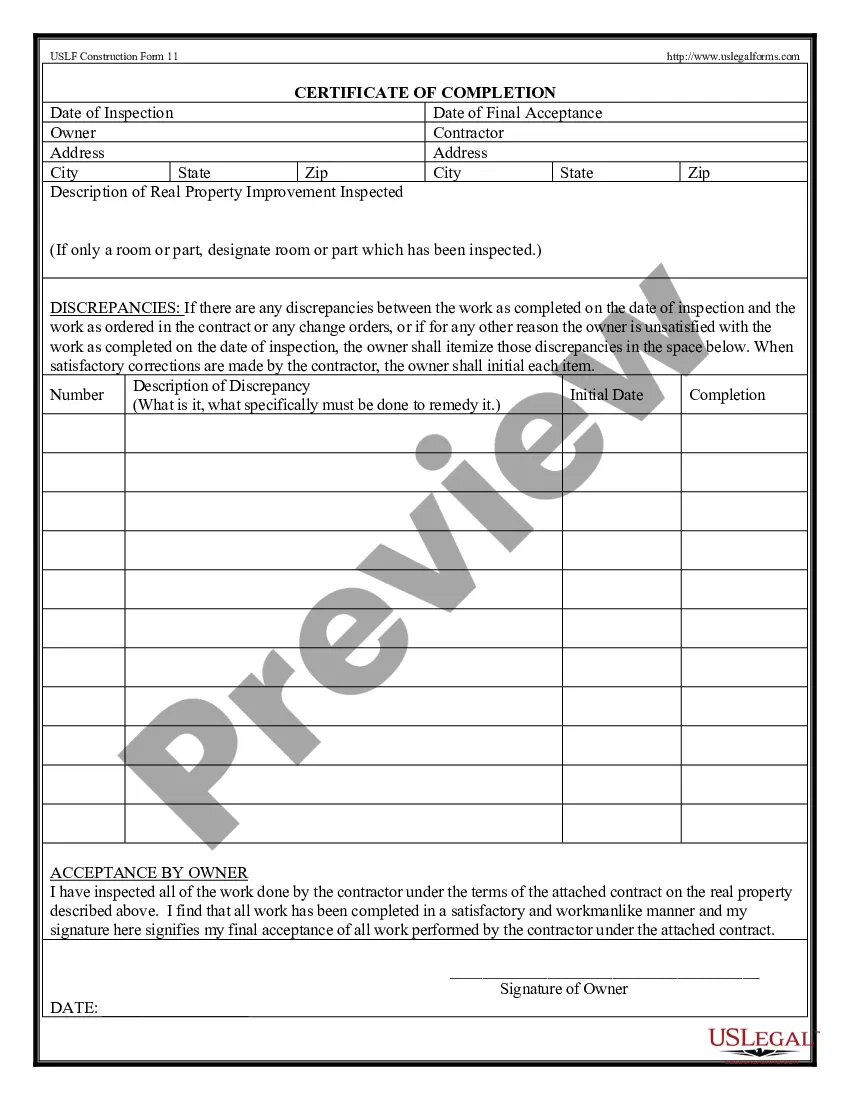

Before company shares may be sold or transferred from one person to another, the company must establish a resolution to sell corporate shares. The sale of this stock must be approved by the company's board of directors. Afterwards, shares would be eligible to be sold from one person to another.

Stock buybacks are reported to the IRS though Form 1099-B (Proceeds from Broker and Barter Exchange Transactions) or Form 1099-DIV (Dividends and Distributions), depending on the circumstance.

A company has to file return of buy back in form no. SH-11 containing particulars related to the buy-back within 30 days of its completion. The return is to be filed with the Registrar, and in case of a listed company with the Registrar and the Securities and Exchange Board of India.

This form is used to figure the excise tax on repurchases of corporate stock. Form 7208 is attached to Form 720.