Buyback Of Shares Resolution Format In San Antonio

Description

Form popularity

FAQ

Board Resolutions (Corporation): Acceptance of Contribution in Exchange for Stock. Resolutions of the board of directors of a corporation authorizing its acceptance of a contribution of assets or shares in exchange for stock in the corporation.

Resolutions of the board of directors authorizing and approving a reporting company's stock repurchase program. These resolutions are drafted as standard clauses and should be inserted into board minutes or a form of unanimous written consent.

Board resolutions deal with operational and management decisions, while shareholder resolutions address more significant, often strategic, matters affecting the company.

A board resolution is a document that formalises important decisions made by the board of directors and the actions relating to them. It is legally binding and functions as a compliance record to provide evidence of decisions made by the board regarding pivotal company matters.

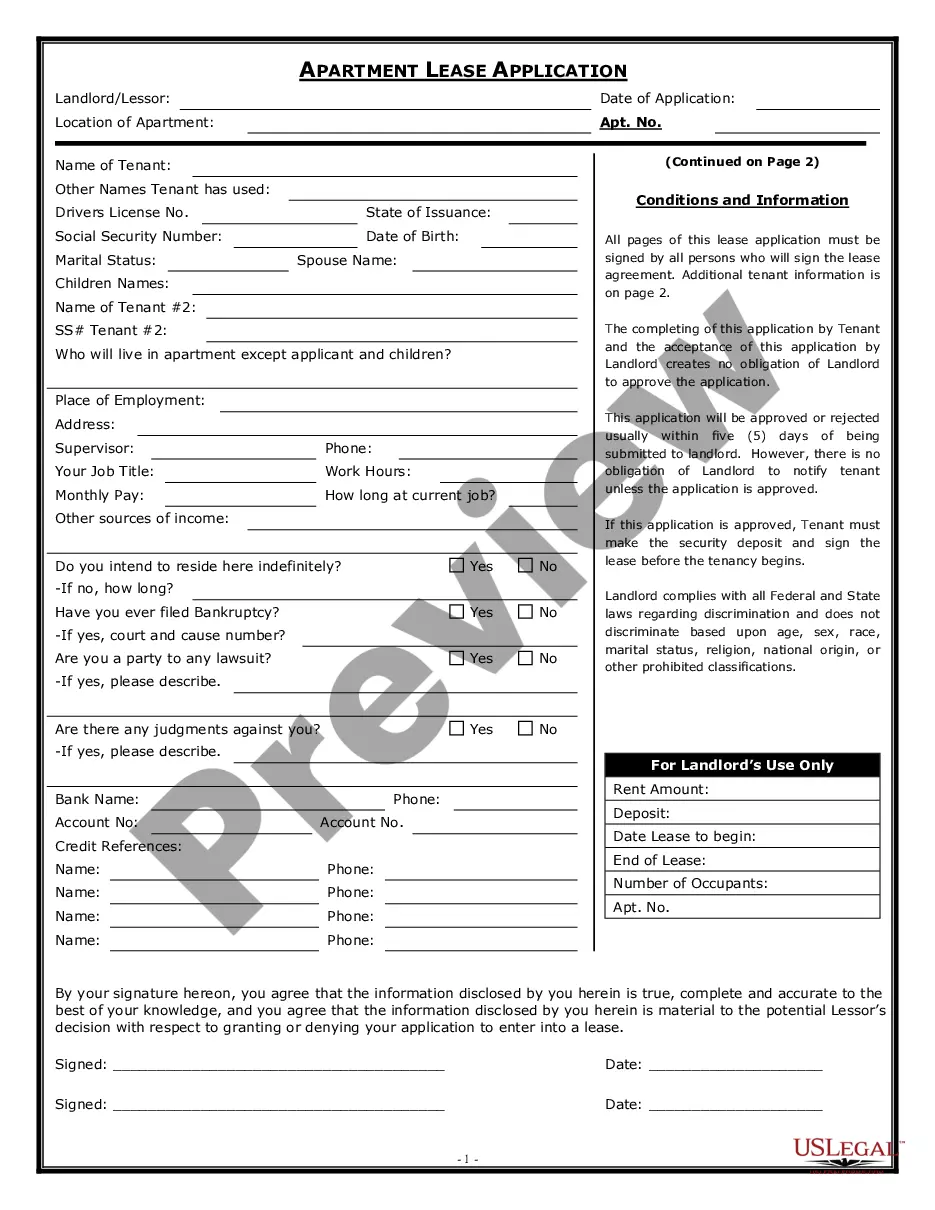

What should shareholder resolutions include? Your corporation's name. Date, time and location of meeting. Statement that all shareholders agree to the resolution. Confirmation of the necessary quorum for business to be conducted. Names of shareholders present or voting by proxy. Number of shares for each voting shareholder.

Before company shares may be sold or transferred from one person to another, the company must establish a resolution to sell corporate shares. The sale of this stock must be approved by the company's board of directors. Afterwards, shares would be eligible to be sold from one person to another.

Some examples of matters and decisions that may require an ordinary resolution of members include: Election or re-election of directors. Appointment of an auditor. Acceptance of reports at the general meeting. Strategic or commercial decisions. Increasing or reducing number of directors.

If a company wishes to issue additional shares to a new shareholder, all existing shareholders within the company must pass a special board resolution to that effect.

Generally speaking, the directors of a company may currently only allot shares (or grant rights to subscribe for shares or to convert any security into shares) if they are authorised to do so by ordinary resolution of the company's members or by the articles.