Change Ownership Of Shares In Minnesota

Description

Form popularity

FAQ

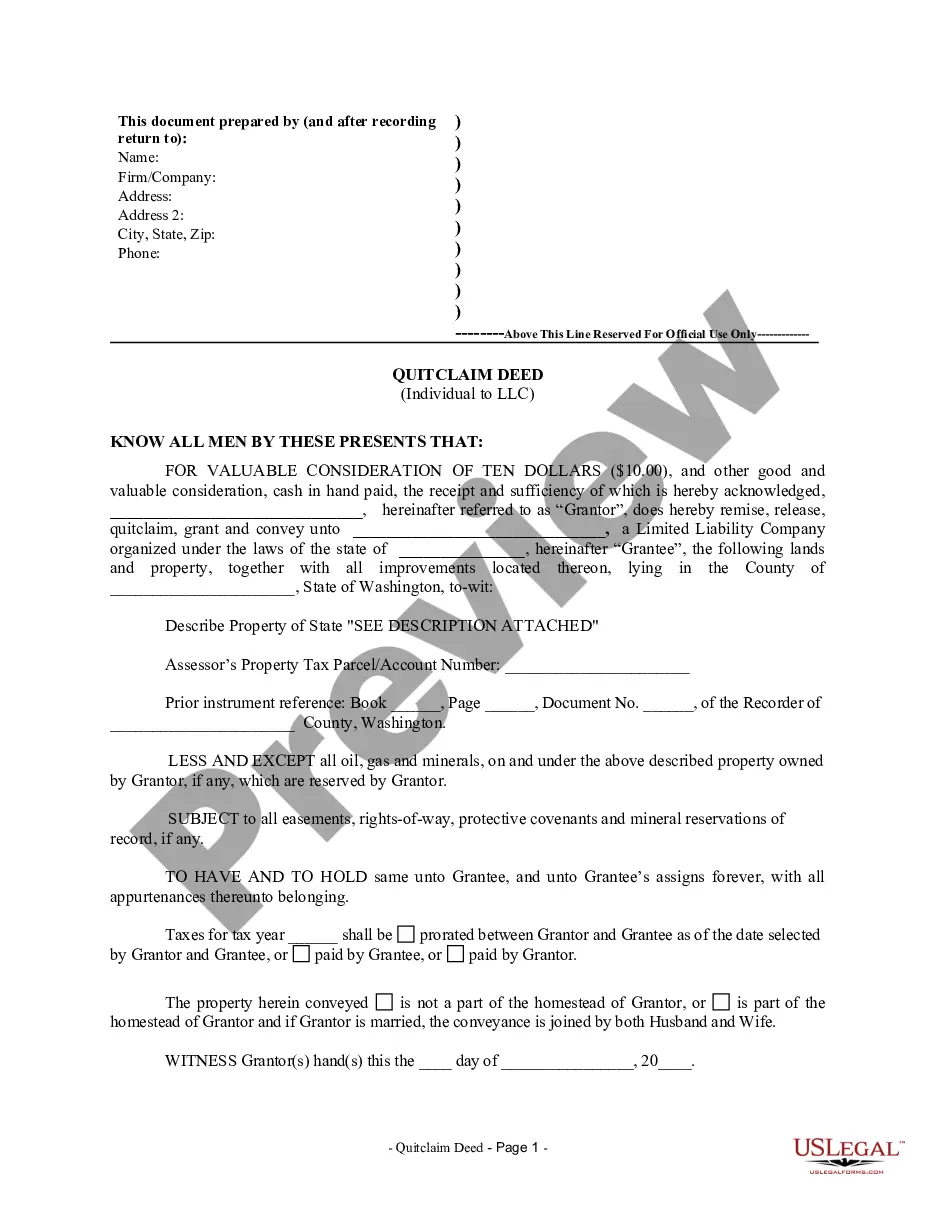

A Minnesota Quitclaim Deed does not provide any of the statutory covenants of title which are provided by a Minnesota Warranty Deed. In addition, the interest conveyed by the grantor in a Minnesota Quitclaim Deed: is limited to that which the grantor held at the time of execution of the deed, and.

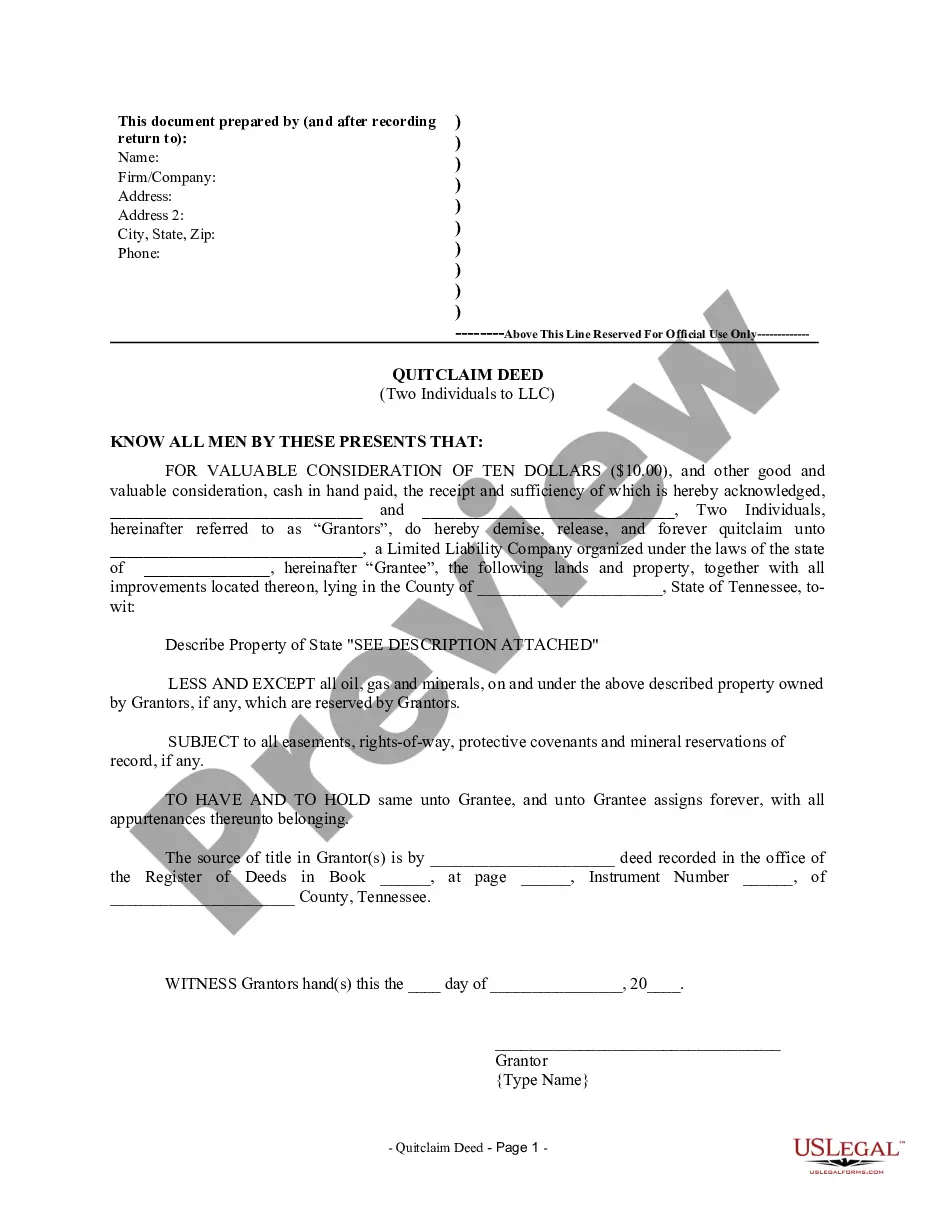

Documenting gifts Both parties should sign and date the document, and the document should be notarized. If the gifted property is a titled asset such as a vehicle or real estate, transferring the title serves as documentation that a gift has been made.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

Contact your broker to get the appropriate forms to complete. The process will be simpler if the new owner also has or will have an account with the same broker, because no change in the actual registration of the shares will be necessary. The broker will simply make the transfer on its own internal books.

Once you have decided to transfer the shares, you will have to fill out a Stock Transfer Form in order to legally transfer the shares. At this point in time, there is no need to inform Companies House, this will be done during your next Confirmation Statement.

Minnesota Deed Transfer A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

Shares or debentures are movable property. They are transferable in the manner provided by the articles of the company, especially, the shares of any member of a public company. The transfer of securities is possible through any contract or arrangement between two or more persons.

Contact your broker to get the appropriate forms to complete. The process will be simpler if the new owner also has or will have an account with the same broker, because no change in the actual registration of the shares will be necessary. The broker will simply make the transfer on its own internal books.

Here are some ways ownership can be transferred within an S-corp: Issuing new stock shares. You can issues new shares of company stock by by creating a bill of sale—BUT make sure you're following the protocols set-out in your Articles of Incorporation. Selling existing stock shares. Through a shareholder's estate.