Applying For Homestead Exemption In Texas In Travis

Description

Form popularity

FAQ

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

Travis County offers a 20% homestead exemption, the maximum allowed by law. The Commissioners Court also offers an additional $85,500 exemption for homesteads of those 65 years and older or are disabled.

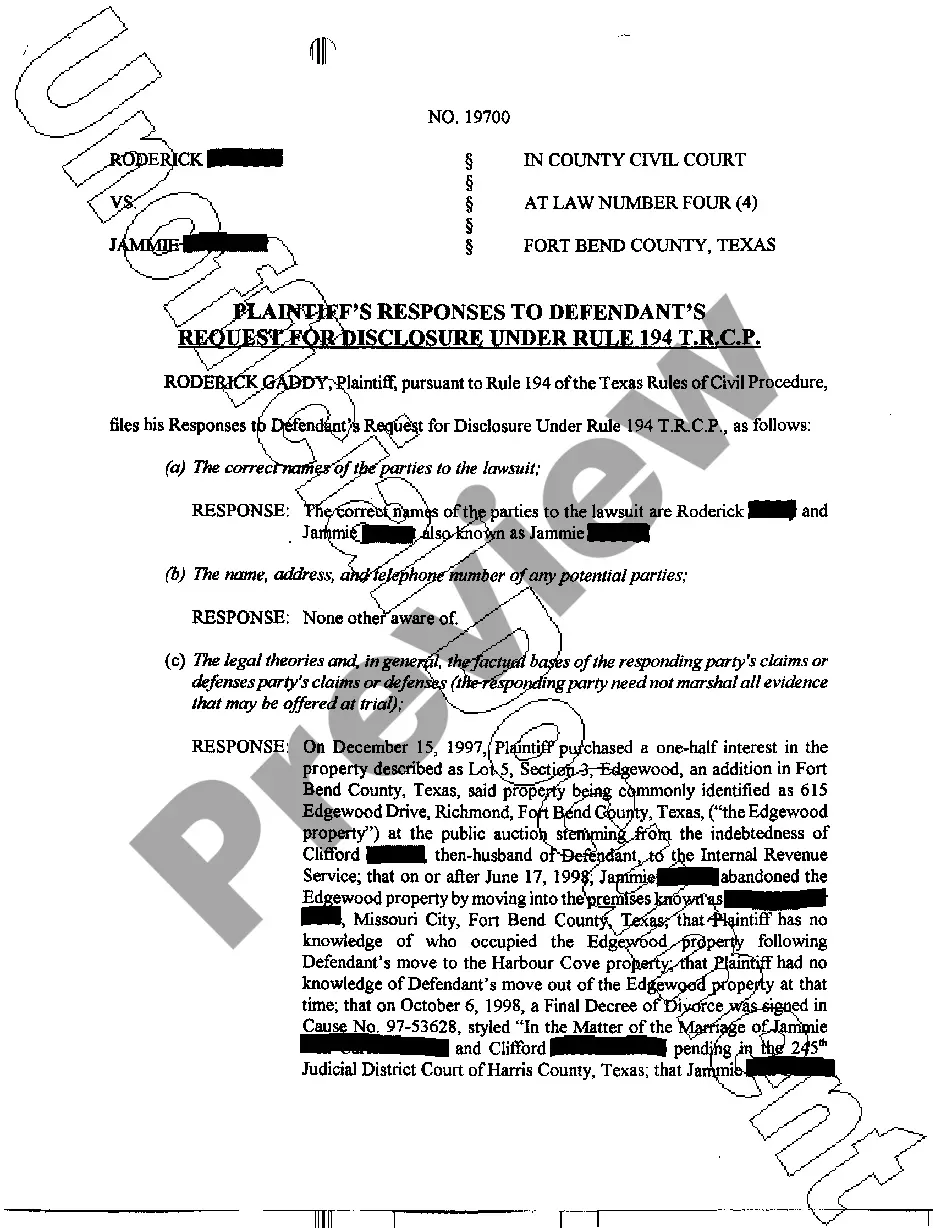

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

“A homestead exemption saved the average Travis County property owner $1,876 on their taxes in 2023,” added Mann. “Exemptions continue to be the easiest and fastest way to lower your property tax bill.”

A general residence homestead exempts a portion of your residence homestead's value from taxation, potentially lowering your taxes.