Homestead Exemption Application On The Philadelphia Tax Center In Texas

Description

Form popularity

FAQ

You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don't need to create a username and password to submit your application online. If a previous owner is listed, call (215) 686-9200 or submit a paper application instead.

And how to apply for a homestead. Exemption. To learn more check out these links which you can clickMoreAnd how to apply for a homestead. Exemption. To learn more check out these links which you can click in the description.

Now, let's apply the standard Homestead Exemption of $100,000. Your new taxable value would be $150,000: $150,000 x 1.5% = $2,250 annually. In this example, the Homestead Exemption saves you $1,500 per year in property taxes.

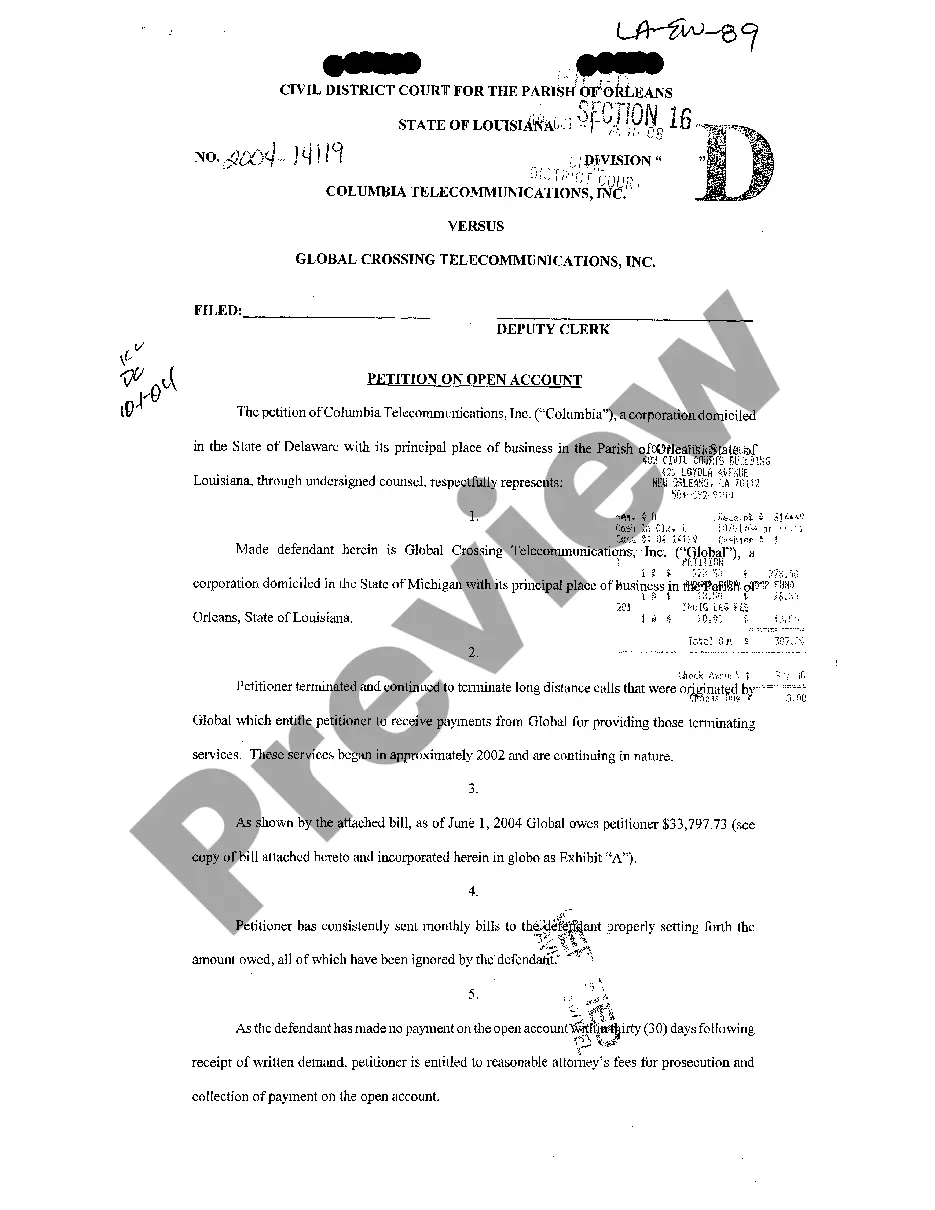

Check the Status of Your Application Note: Applications will be processed in the order they are received. We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45.

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan. 1 and April 30 of the year for which the exemption is requested. Do not file this document with the Texas Comptroller of Public Accounts.

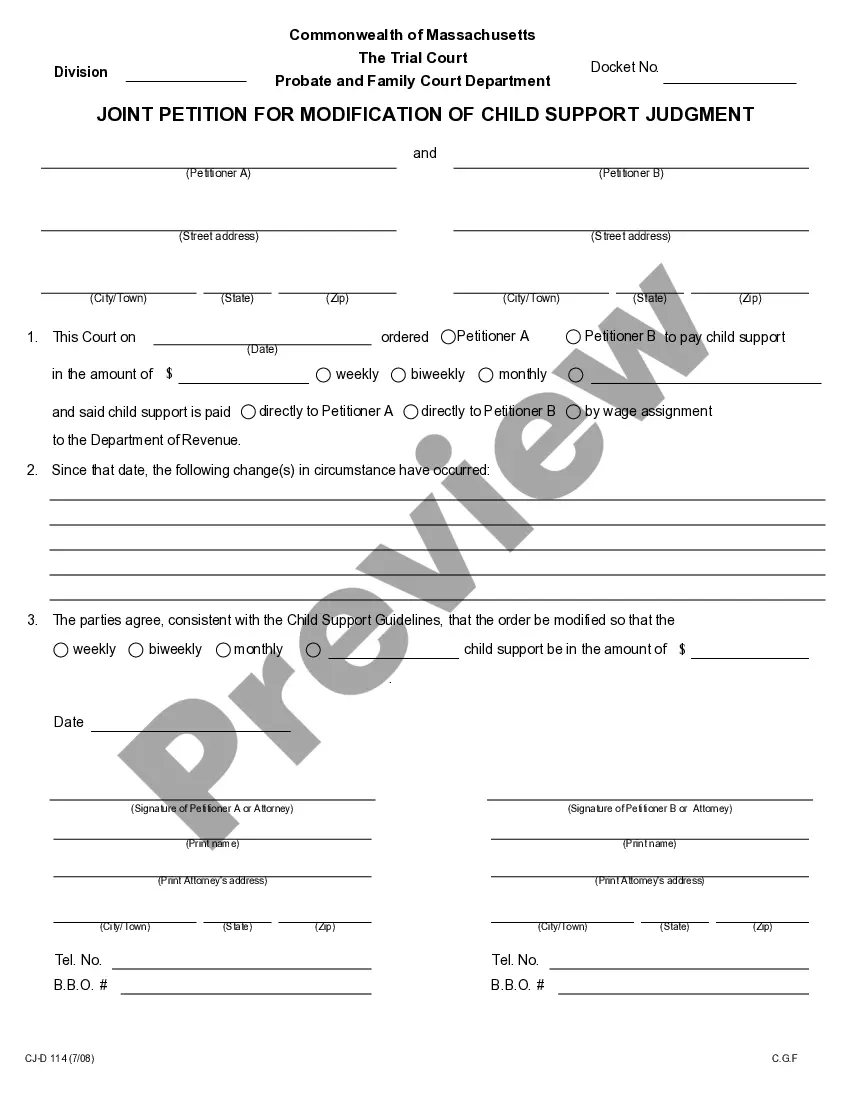

To receive a homestead or farmstead exclusion, a Pennsylvania resident must submit an application to the county assessor prior to March 1. School districts are required to send an application to all non approved, eligible property owners 60 days prior to the March 1 application deadline.

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don't need to create a username and password to submit your application online. If a previous owner is listed, call (215) 686-9200 or submit a paper application instead.

Get Real Estate Tax relief Get the Homestead Exemption. Real Estate Tax freezes. Set up an Owner-occupied Real Estate Tax payment agreement (OOPA) ... Get a property tax abatement. Apply for the Longtime Owner Occupants Program (LOOP) ... Active Duty Tax Credit. Enroll in the Real Estate Tax deferral program.

A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.