Tax Forms Exemptions In San Jose

Description

Form popularity

FAQ

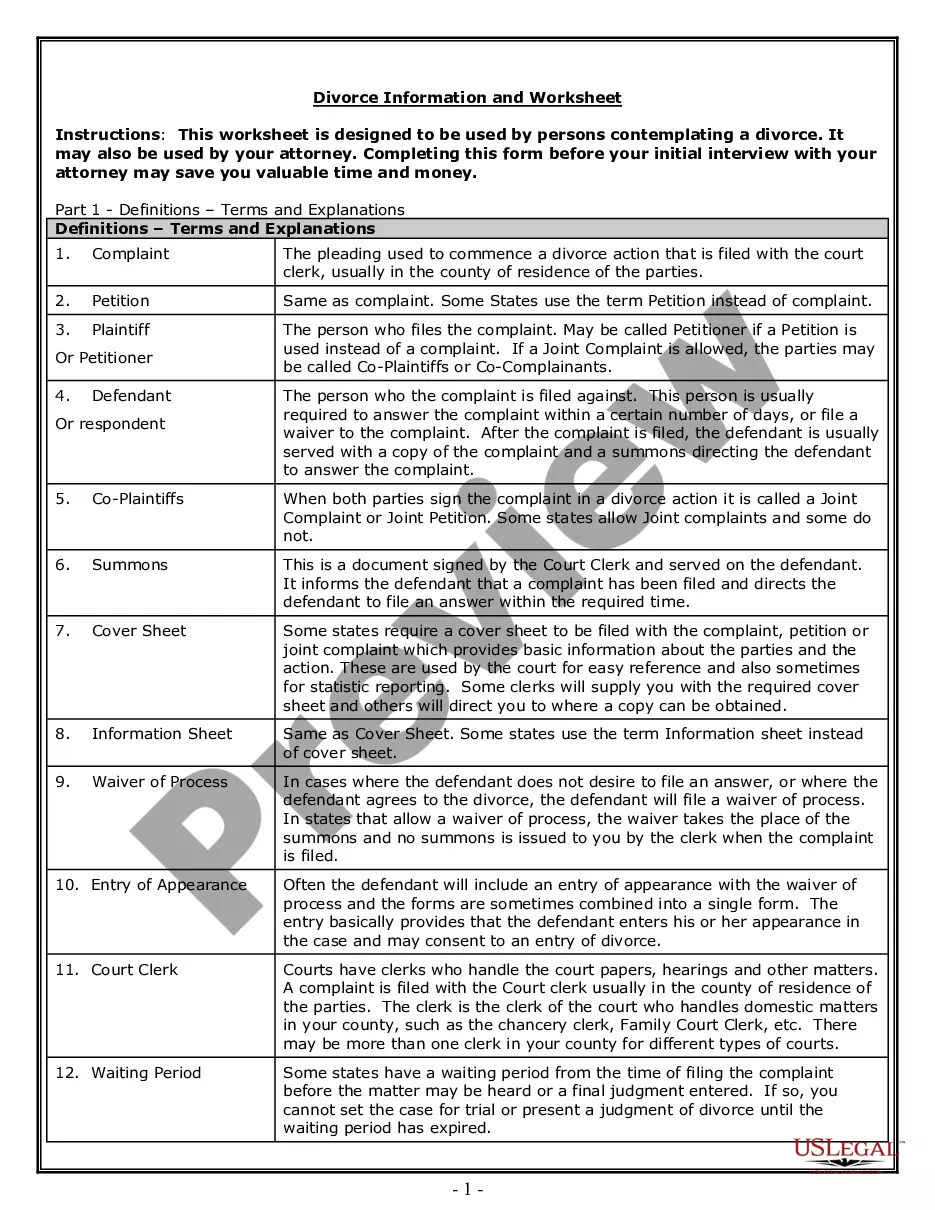

How to claim exempt status on a W-4. To claim an exemption, you must complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. (In Box 7, write “EXEMPT”.

Property owners who occupy their homes as their principal place of residence on the lien date (January 1st), and each year thereafter, are eligible for the exemption if they file a claim. Once filed, the exemption is continuous until the homeowner becomes ineligible.

TO RECEIVE A CLAIM FORM: Homeowners can call the Assessor's Exemption Unit at (408) 299-6460 or e-mail the Assessor's Office at Exemptions@asr.sccgov . When contacting or e-mailing the Assessor's Office please provide the property address and assessor's parcel number.

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

Eligibility Requirements: Homeowners must be age 55 or better (For married couples, only one spouse must be 55 or better to qualify.) Homeowners must have sold their former residence within 2 years of purchasing the replacement property. Both the former and replacement properties must be the owner's primary residence.

There are 2 ways to get tax-exempt status in California: Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application. Submission of Exemption Request (Form 3500A) If you have a federal determination letter:

There are 2 ways to get tax-exempt status in California: Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application. Submission of Exemption Request (Form 3500A) If you have a federal determination letter: