Homestead Act In Missouri In Minnesota

Description

Form popularity

FAQ

Having a homestead classification means a person's property is his or her primary residence. This should be the address on your Minnesota driver's license, the address where you are registered to vote, or your primary mailing address.

Missouri homestead law allows for a $15,000 exemption, which is applicable to "a dwelling house and appurtenances, and the land used in connection therewith." In other words, the state's homestead law is limited to homes, corresponding buildings, and the land on which they stand.

This program has two main benefits for qualifying homeowners: It reduces the Taxable Market Value of the property (for properties valued under $414,000 only), thereby lowering taxes, and. It is one of the qualifying factors for homeowners to receive the State of Minnesota Property Tax Refund.

Its application was restricted after the passage of the Natural Resources Acts in 1930, and it was finally repealed in 1950.

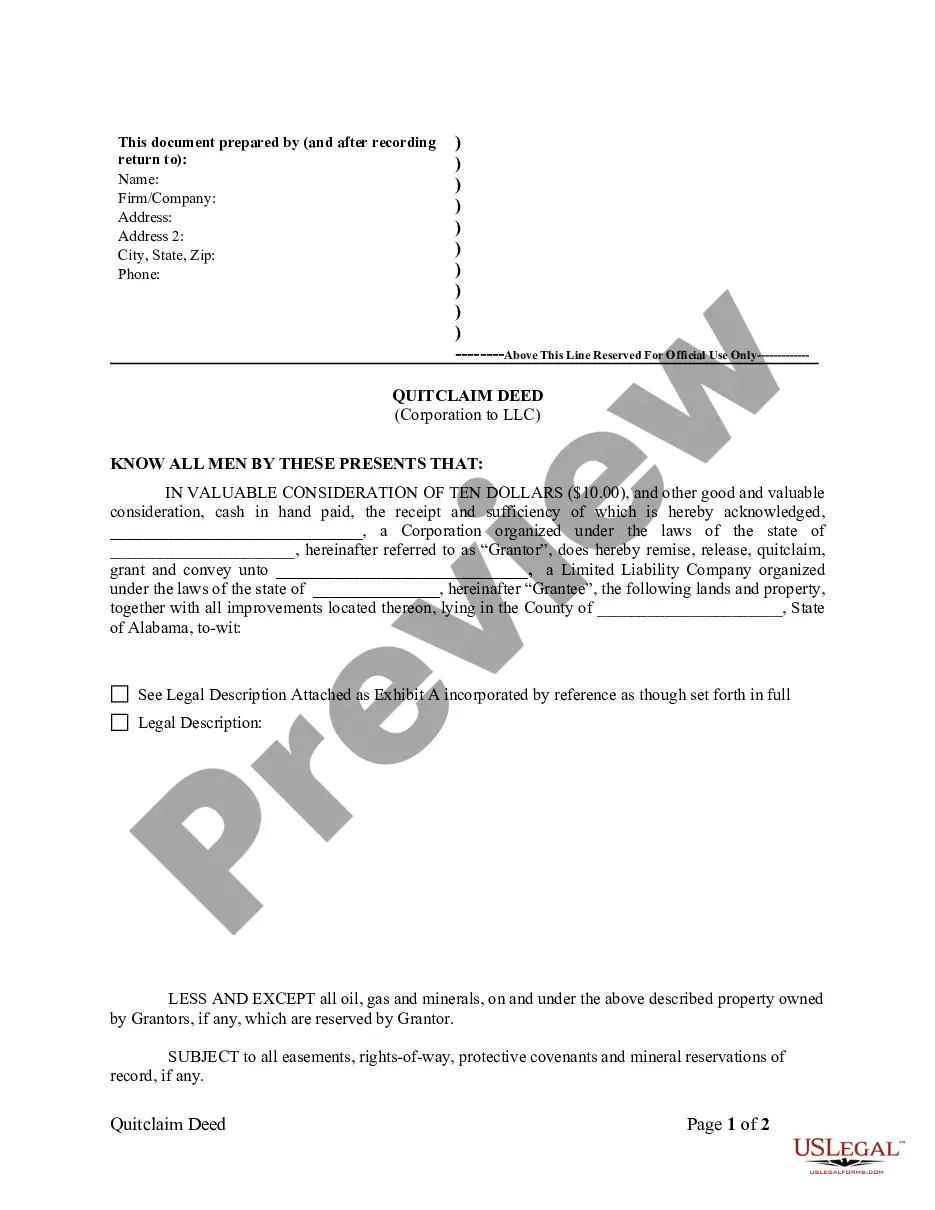

The new law established a three-fold homestead acquisition process: file an application, improve the land, and file for deed of title. Any U.S. citizen, or intended citizen, who had never borne arms against the U.S. Government could file an application and lay claim to 160 acres of surveyed Government land.

The State of Minnesota maintains the homestead program for residents who own and occupy their home or have a qualifying relative who occupies the home called the Homestead Market Value Exclusion.

Applicants must mail the application to the Department of Revenue (DOR) by September 30 of each year. By December 15th the DOR certifies to collectors those applicants who meet requirements of the homestead exemption credit.

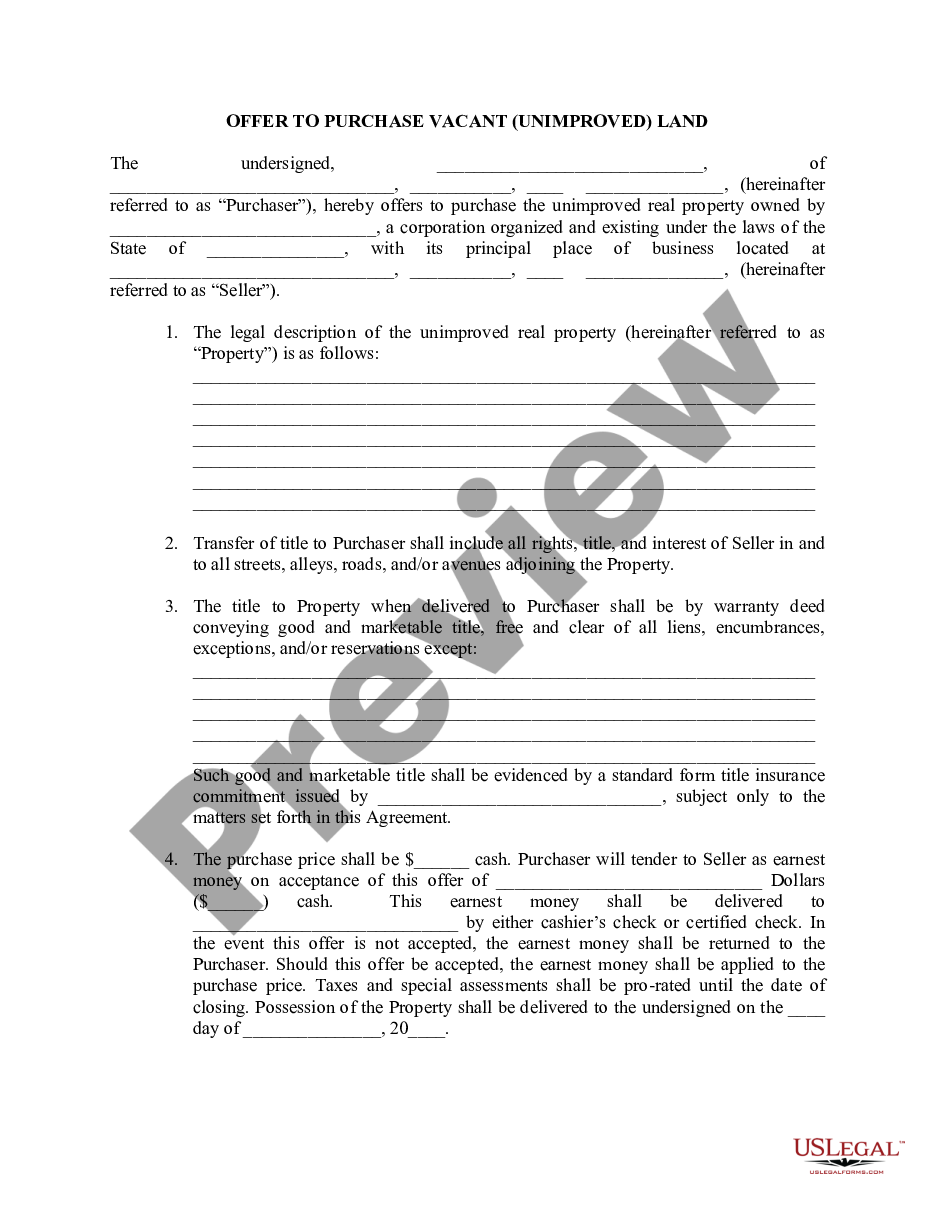

In Missouri, the homestead exemption applies to real property, including your home, inium, or co-op. You must own and occupy the property to protect it. The homestead exemption also applies to a manufactured home you have converted to real property by permanently affixing it to the land.

Corporations, partnerships, trusts and life estates may also be eligible for a homestead exclusion in certain situations. You must own and occupy the property as your primary place of residence by December 31st of the assessment year. You must be a Minnesota resident.

Missouri homestead law allows for a $15,000 exemption, which is applicable to "a dwelling house and appurtenances, and the land used in connection therewith." In other words, the state's homestead law is limited to homes, corresponding buildings, and the land on which they stand.