Homestead Exemption Without Drivers License In Middlesex

Description

Form popularity

FAQ

The new Home Renovation Savings Program will launch on January 28, 2025, and offer rebates of up to 30 per cent for home energy efficiency renovations and improvements, including new windows, doors, insulation, air sealing, smart thermostats, and heat pumps, as well as rooftop solar panels and battery storage systems ...

This program is made possible through funding by the federal and provincial governments and offers financial assistance to low to moderate-income households who own a home in the City of London and County of Middlesex to repair their home to bring to acceptable standards and to increase accessibility in their home ...

The Ontario Renovates program aims to increase the supply of affordable and accessible housing units by providing qualifying private landlords with funding to make accessibility modifications to their existing rental units.

Ontario Renovates Program This program is made possible through funding by the Federal and Provincial governments and offers financial assistance to low to moderate-income households for seniors 60 years or older and persons with disabilities.

The program has limited funding available to assist qualified low to moderate-income households by providing funds to do home repairs and home modifications for persons with disabilities. To qualify for this program, the applicants must own the existing home and meet specific income and home value criteria.

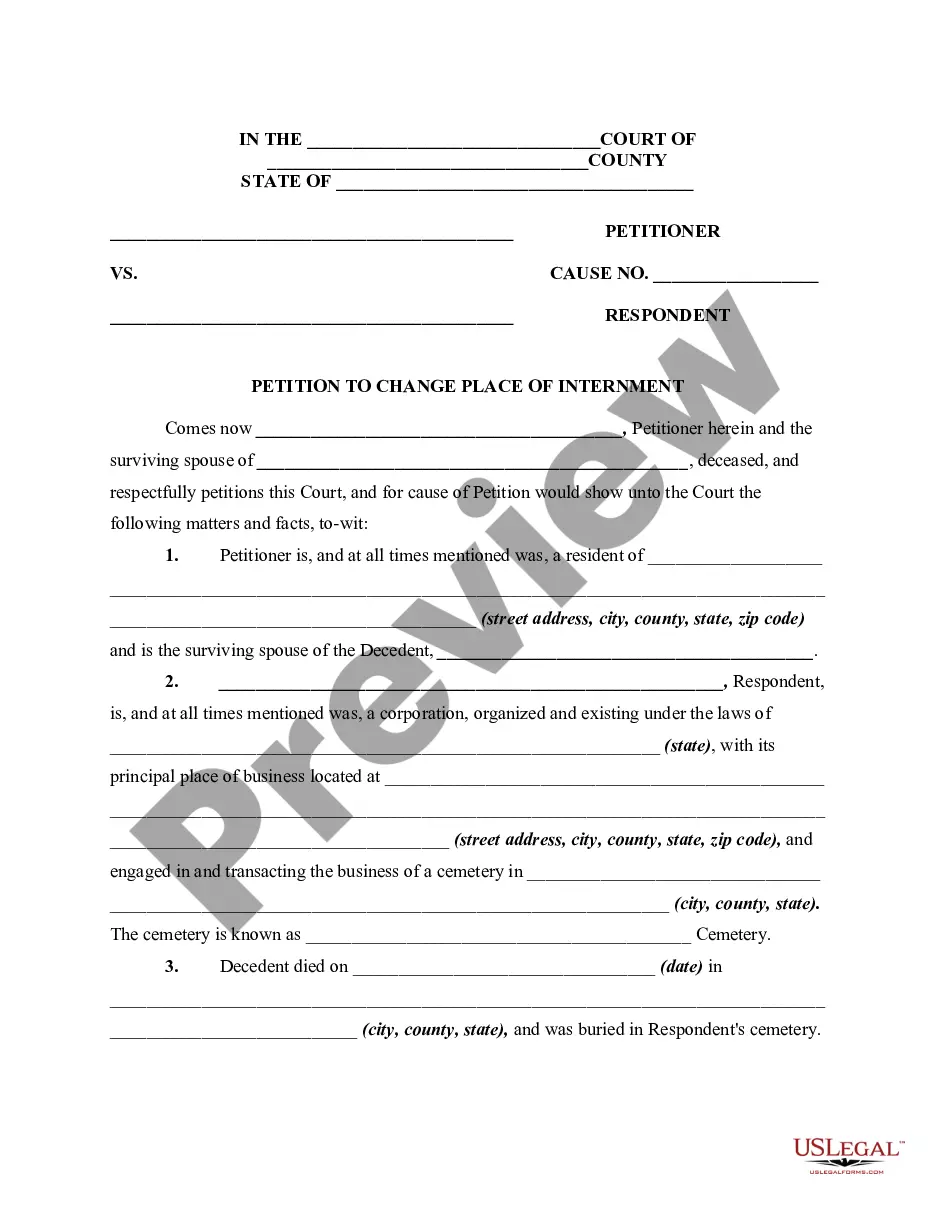

A lien can be placed on your home before and after you file a declaration of homestead, but no one can collect on the lien(s) that were placed on your home after you filed a declaration of homestead.

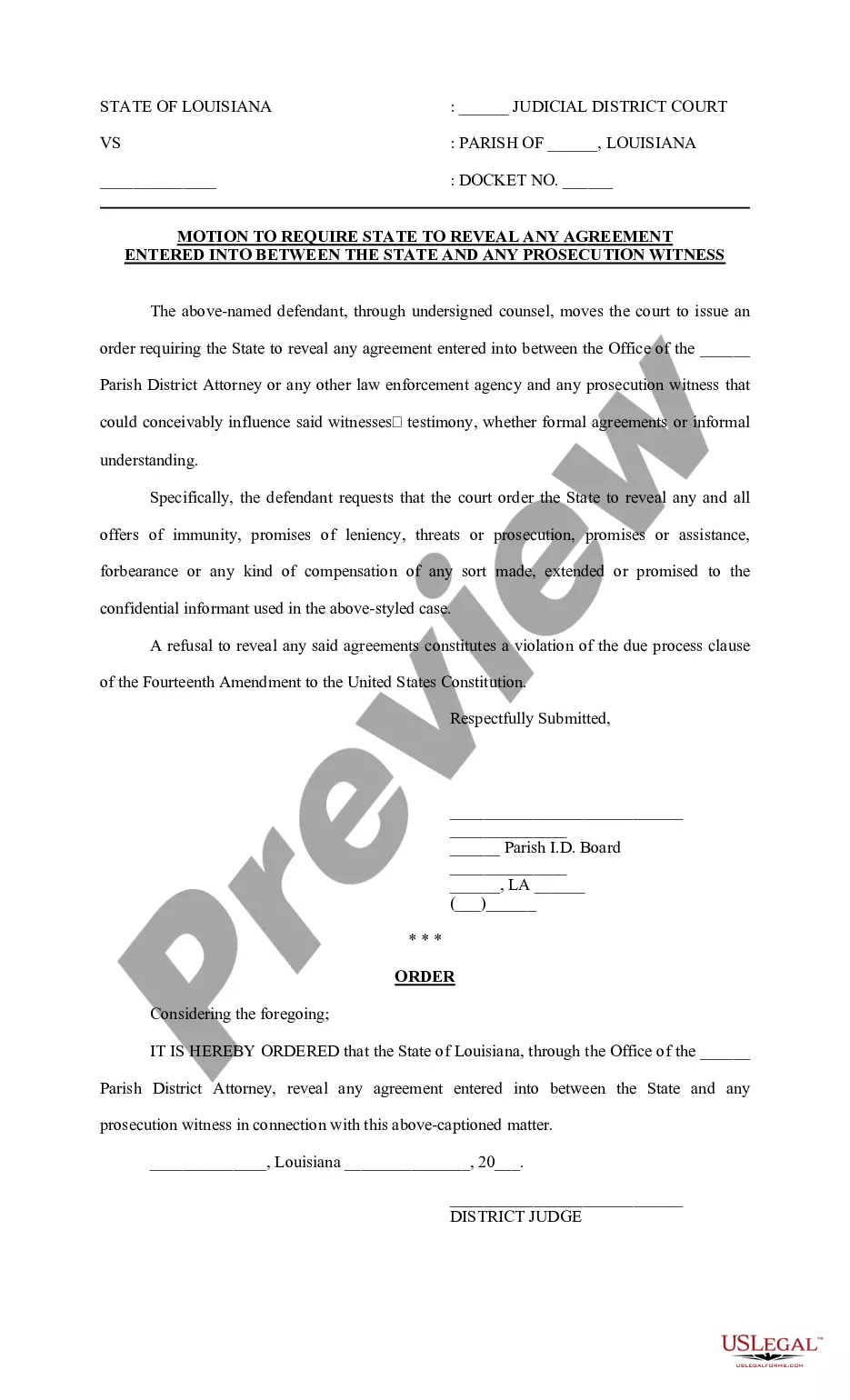

How Much Is New Jersey's Homestead Exemption? Federal Homestead Exemption Homestead exemption amount $27,900 Can spouses who file a joint bankruptcy double the exemption? $55,800 is available to spouses who co-own property. Homestead exemption law 11 U.S.C. § 522(d)(1) Other information Amounts will adjust on April 1, 2025.1 more row

If you own and occupy (or intend to occupy) your home as a principal residence, you can file a homestead protection.

The Massachusetts Homestead Act is a law under which a homeowner is protected by an Estate of Homestead. A homestead estate provides limited protection of the value of the home, up to $1,000,000, against unsecured creditor claims.

In August of 2024 the Governor approved an Act that amends the Massachusetts declared homestead exemption from $500,000.00 to $1,000,000.00.