Exemptions W-4 In Massachusetts

Description

Form popularity

FAQ

Summary. The Massachusetts Department of Revenue announced withholding tables for the fiscal year beginning January 1, 2024. The new withholding method includes a surtax on earnings of $1,053,750 or more. While income under $1,053,750 is taxed at 5%, annual income above $1,053,750 will be taxed at 9%.

How to fill out the Massachusetts Employee Withholding Exemption Certificate? Print your full name and home address. Provide your Social Security number. Claim personal and dependent exemptions as applicable. Sign and date the form. Submit this form to your employer.

You should claim the total number of exemptions to which you are entitled to prevent excessive over-withholding, unless you have a significant amount of other income. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or have additional amounts withheld.

Summary. The Massachusetts Department of Revenue announced withholding tables for the fiscal year beginning January 1, 2024. The new withholding method includes a surtax on earnings of $1,053,750 or more. While income under $1,053,750 is taxed at 5%, annual income above $1,053,750 will be taxed at 9%.

How to fill out the Massachusetts Employee Withholding Exemption Certificate? Print your full name and home address. Provide your Social Security number. Claim personal and dependent exemptions as applicable. Sign and date the form. Submit this form to your employer.

Massachusetts employs a graduated individual income tax system, meaning that tax rates vary based on your income. Currently, the range spans from 5% to 9%. If your gross income exceeds $8,000, whether from in-state or out-of-state sources, you must file a Massachusetts income tax return.

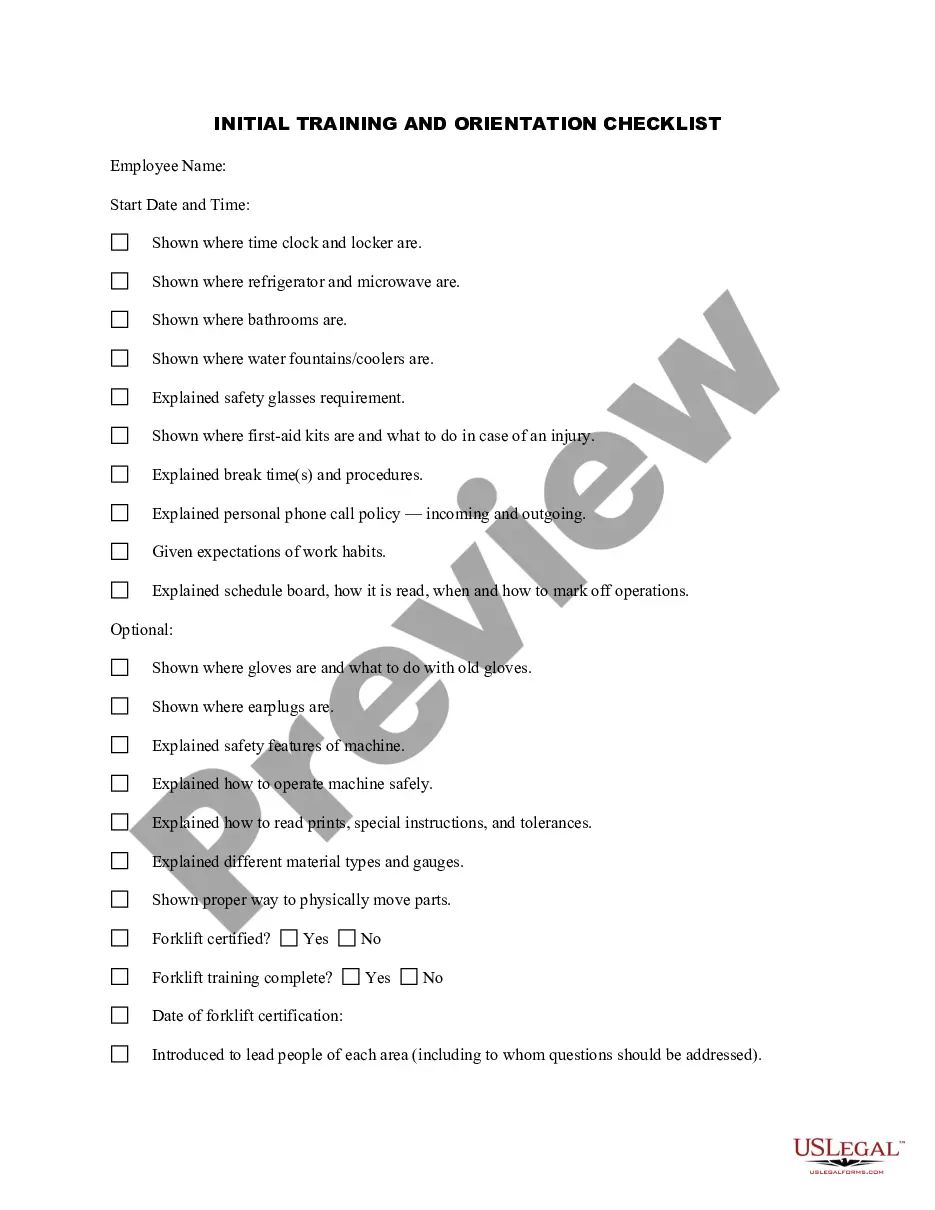

Employer Responsibilities Getting each employee's completed federal Employee's Withholding Allowance Certificate (Form W-4) and Massachusetts Employee's Withholding Exemption Certificate (Form M-4).