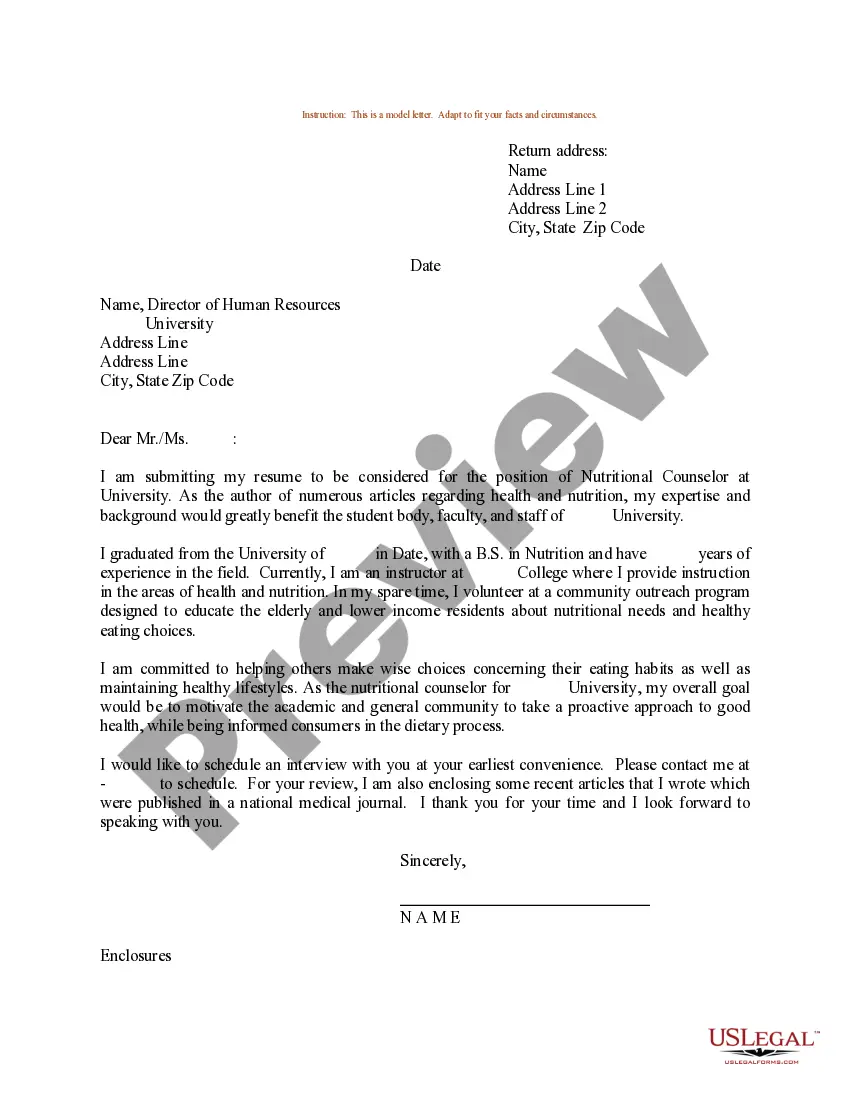

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption Form Pinellas County In Broward

Description

Form popularity

FAQ

You can file your Homestead Exemption online at .bcpa or at the Broward County Property Appraiser office (BCPA) located at 115 South Andrews Avenue, Room 111, Fort Lauderdale, FL 33301. If you have any question in regard to Homestead Exemption, please contact BCPA at 954-357-6830.

All legal Florida residents are eligible for a Homestead Exemption on their homes, iniums, co-op apartments, and certain mobile home lots if they qualify. The Florida Constitution provides this tax-saving exemption on the first and third $25,000 of the assessed value of an owner/occupied residence.

Filing for a homestead exemption in Florida can lead to substantial property tax savings. The exemption is designed to reduce the taxable value of a homeowner's primary residence, ultimately lowering the overall property tax bill. Florida law provides a generous exemption of up to $50,000 for eligible homesteads.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

To transfer the SOH benefit, you must establish a homestead exemption for the new home within three years of January 1 of the year you abandoned the old homestead (not three years after the sale). You must file the Transfer of Homestead Assessment Difference with the homestead exemption application.

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

A new application is required if your property has been sold or otherwise disposed of, or the ownership or use changes, or when the holder(s) of the Homestead Exemption ceases to reside on the property as a permanent resident.

You can file your Homestead Exemption online at .bcpa or at the Broward County Property Appraiser office (BCPA) located at 115 South Andrews Avenue, Room 111, Fort Lauderdale, FL 33301. If you have any question in regard to Homestead Exemption, please contact BCPA at 954-357-6830.

January 1st of each year is the date when permanent residency is determined, by law. Timely filing period for Homestead exemption starts September 19th through March 1 of the following year (by way of example) 2023. The absolute deadline to file a late file (in this example 2023) is September 19, 2023.

Please Note: We are currently accepting E-file applications for the tax year 2025 only. To be eligible for homestead exemption, you must be a permanent resident of Florida, who owns real property as of January 1 of the year in which you are applying.